Eos Energy Investor Presentation Deck

Financial Results

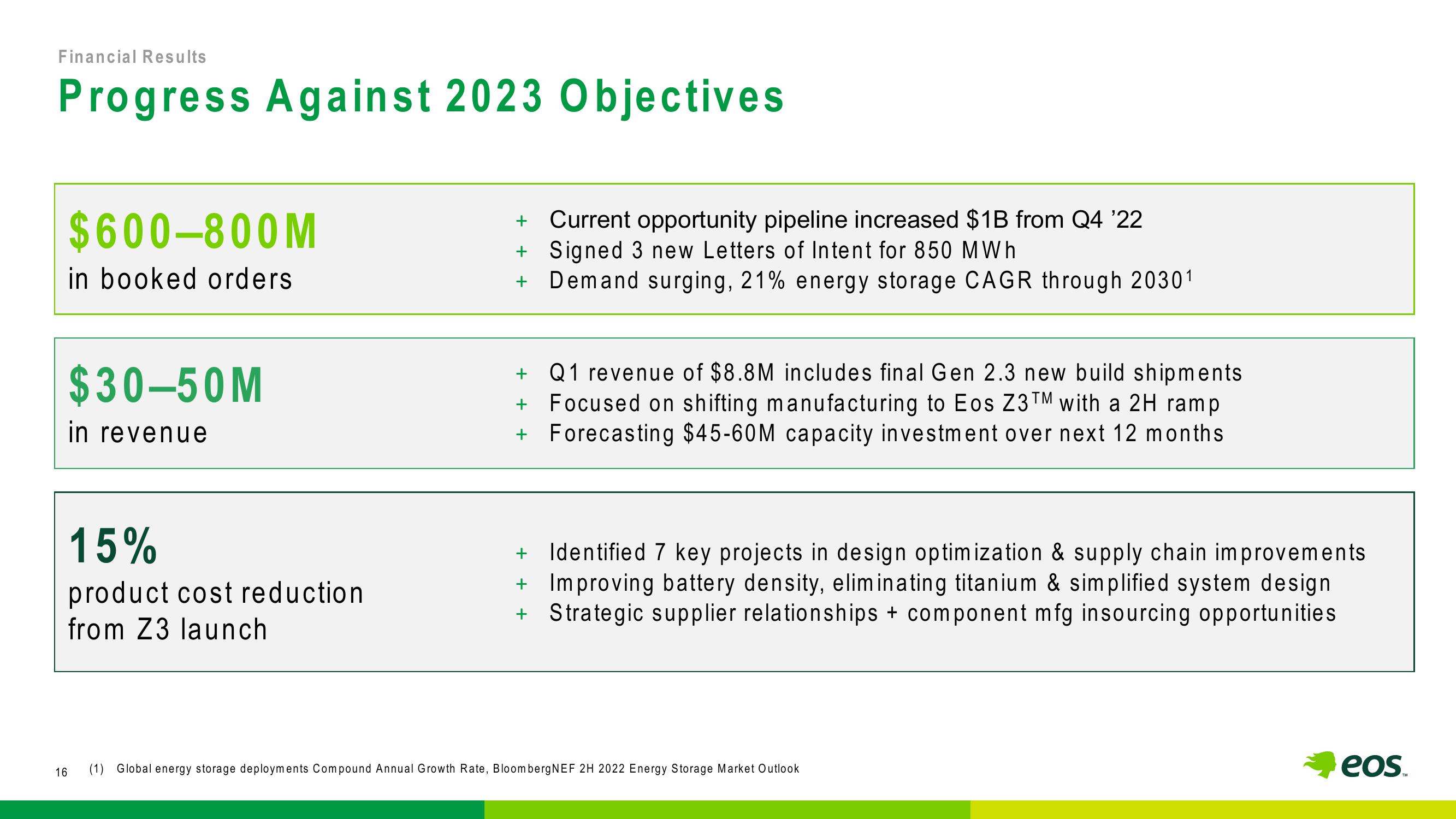

Progress Against 2023 Objectives

$600-800M

in booked orders

16

$30-50M

in revenue

15%

product cost reduction

from Z3 launch

+

Current opportunity pipeline increased $1B from Q4 '22

+ Signed 3 new Letters of Intent for 850 MWh

Demand surging, 21% energy storage CAGR through 20301

+ Q1 revenue of $8.8M includes final Gen 2.3 new build shipments

+ Focused on shifting manufacturing to Eos Z3TM with a 2H ramp

+ Forecasting $45-60M capacity investment over next 12 months

+ Identified 7 key projects in design optimization & supply chain improvements

+ Improving battery density, eliminating titanium & simplified system design

+ Strategic supplier relationships + component mfg insourcing opportunities

(1) Global energy storage deployments Compound Annual Growth Rate, Bloomberg NEF 2H 2022 Energy Storage Market Outlook

eos.View entire presentation