KKR Real Estate Finance Trust Results Presentation Deck

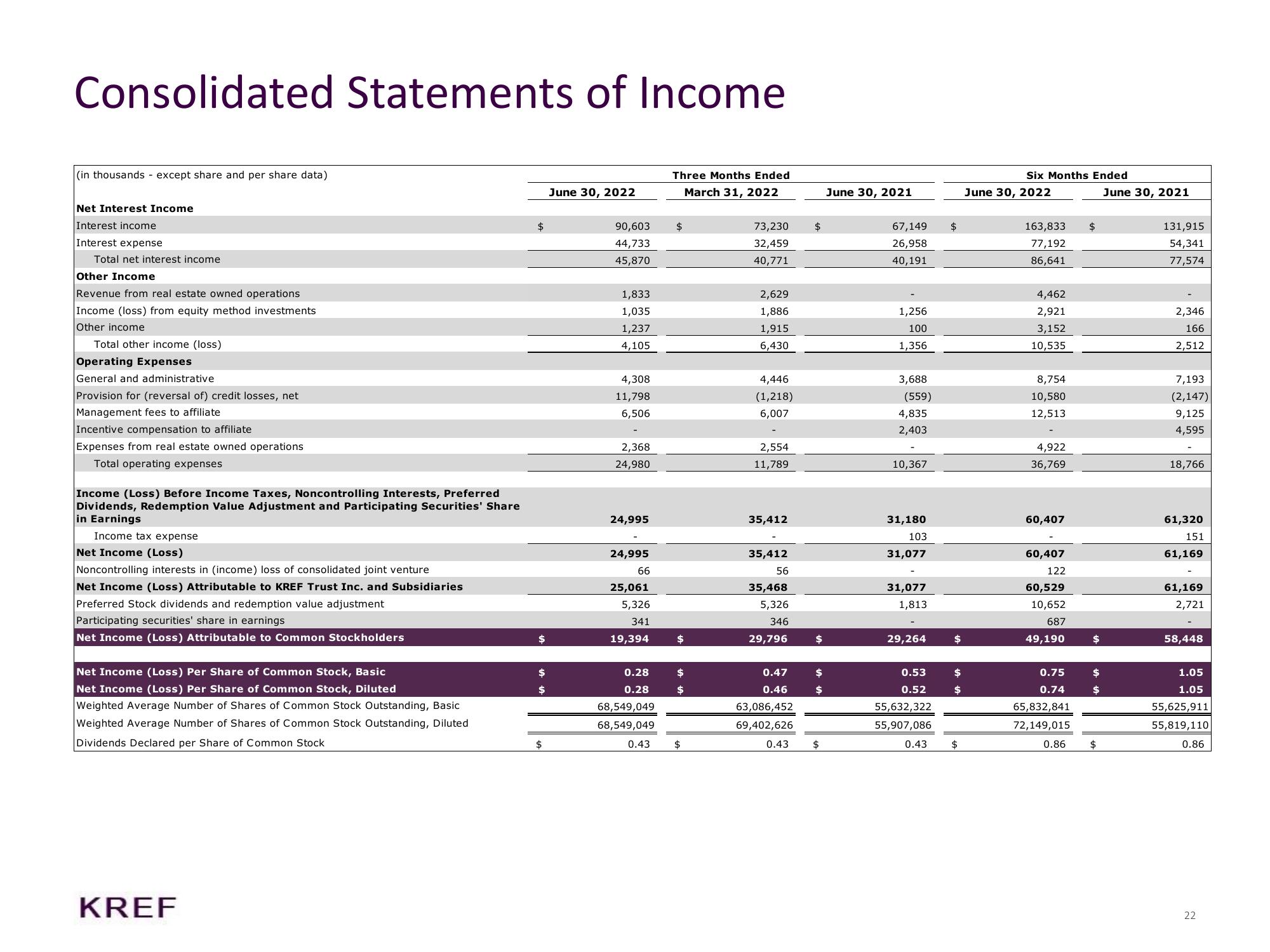

Consolidated Statements of Income

(in thousands except share and per share data)

Net Interest Income

Interest income

Interest expense

Total net interest income

Other Income

nue from real state owned operations

Income (loss) from equity method investments

Other income

Total other income (loss)

Operating Expenses

General and administrative

Provision for (reversal of) credit losses, net

Management fees to affiliate

Incentive compensation to affiliate

Expenses from real estate owned operations

Total operating expenses

Income (Loss) Before Income Taxes, Noncontrolling Interests, Preferred

Dividends, Redemption Value Adjustment and Participating Securities' Share

in Earnings

Income tax expense

Net Income (Loss)

Noncontrolling interests in (income) loss of consolidated joint venture

Net Income (Loss) Attributable to KREF Trust Inc. and Subsidiaries

Preferred Stock dividends and redemption value adjustment

Participating securities' share in earnings

Net Income (Loss) Attributable to Common Stockholders

Net Income (Loss) Per Share of Common Stock, Basic

Net Income (Loss) Per Share of Common Stock, Diluted

Weighted Average Number of Shares of Common Stock Outstanding, Basic

Weighted Average Number of Shares of Common Stock Outstanding, Diluted

Dividends Declared per Share of Common Stock

KREF

$

$

June 30, 2022

90,603

44,733

45,870

1,833

1,035

1,237

4,105

4,308

11,798

6,506

2,368

24,980

24,995

24,995

66

25,061

5,326

341

19,394

0.28

0.28

68,549,049

68,549,049

Three Months Ended

March 31, 2022

$

$

$

$

0.43 $

73,230

32,459

40,771

2,629

1,886

1,915

6,430

4,446

(1,218)

6,007

2,554

11,789

35,412

35,412

56

35,468

5,326

346

29,796

0.47

0.46

63,086,452

69,402,626

0.43

$

$

$

$

$

June 30, 2021

67,149

26,958

40,191

1,256

100

1,356

3,688

(559)

4,835

2,403

10,367

31,180

103

31,077

31,077

1,813

29,264

0.53

0.52

55,632,322

55,907,086

$

$

$

$

0.43 $

Six Months Ended

June 30, 2022

163,833

77,192

86,641

4,462

2,921

3,152

10,535

8,754

10,580

12,513

4,922

36,769

60,407

60,407

122

60,529

10,652

687

49,190

$

$

0.75

0.74

65,832,841

72,149,015

0.86 $

$

$

June 30, 2021

131,915

54,341

77,574

2,346

166

2,512

7,193

(2,147)

9,125

4,595

18,766

61,320

151

61,169

61,169

2,721

58,448

1.05

1.05

55,625,911

55,819,110

0.86

22View entire presentation