Yelp Investor Presentation Deck

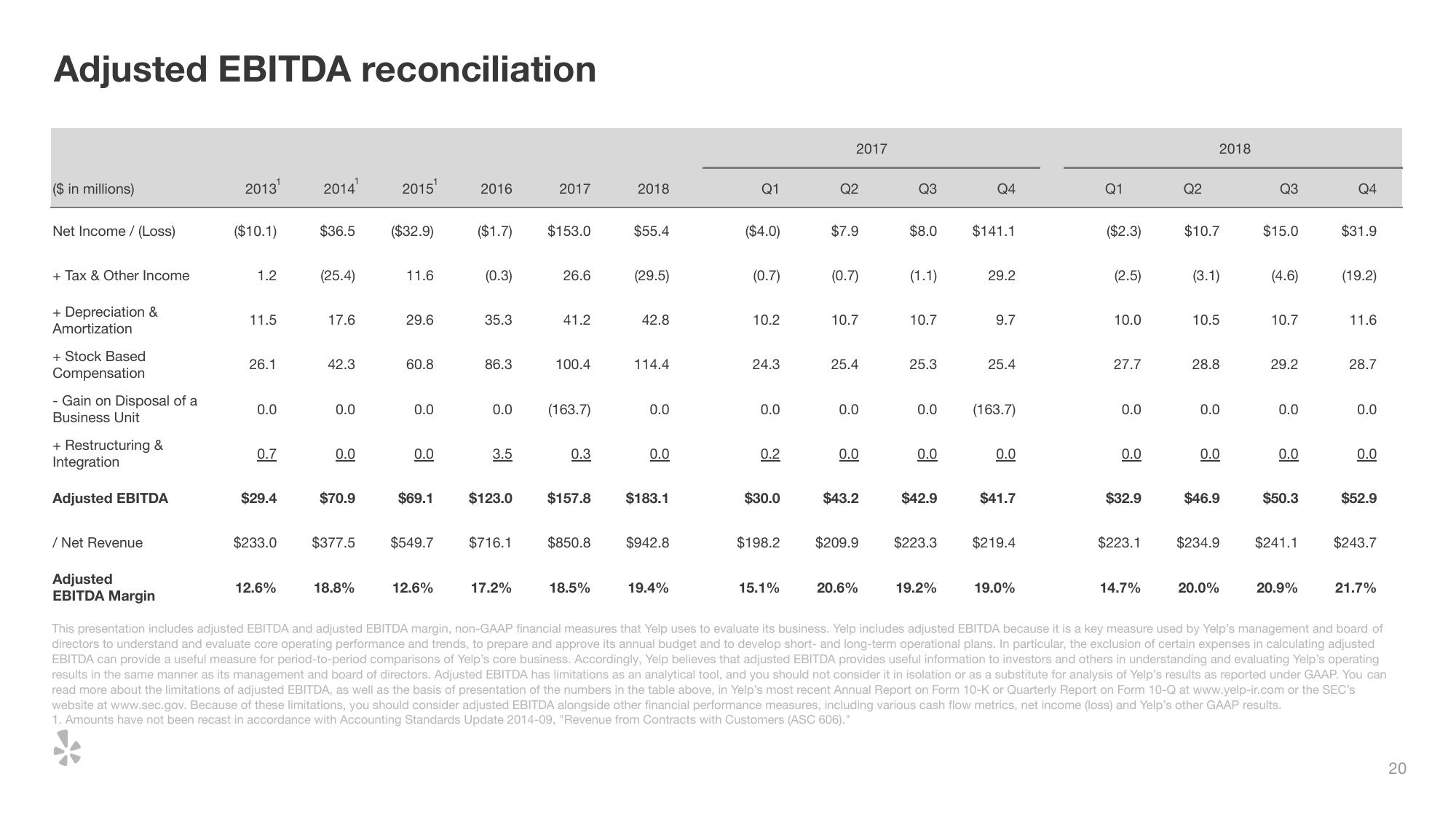

Adjusted EBITDA reconciliation

($ in millions)

Net Income / (Loss)

+ Tax & Other Income

+ Depreciation &

Amortization

+ Stock Based

Compensation

- Gain on Disposal of a

Business Unit

+ Restructuring &

Integration

Adjusted EBITDA

/ Net Revenue

Adjusted

EBITDA Margin

2013¹

($10.1)

1.2

11.5

26.1

0.0

0.7

$29.4

$233.0

12.6%

2014¹ 2015¹

$36.5 ($32.9)

(25.4)

17.6

42.3

0.0

0.0

$70.9

$377.5

18.8%

11.6

29.6

60.8

0.0

0.0

$69.1

$549.7

12.6%

2016

($1.7) $153.0

(0.3)

35.3

86.3

0.0

3.5

2017

$716.1

17.2%

26.6

41.2

100.4

(163.7)

0.3

$850.8

2018

18.5%

$55.4

(29.5)

42.8

$123.0 $157.8 $183.1

114.4

0.0

0.0

$942.8

19.4%

Q1

($4.0)

(0.7)

10.2

24.3

0.0

0.2

$30.0

$198.2

15.1%

2017

Q2

$7.9

(0.7)

10.7

25.4

0.0

0.0

$43.2

$209.9

20.6%

Q3

$8.0

(1.1)

10.7

25.3

0.0

0.0

$42.9

$223.3

19.2%

Q4

$141.1

29.2

9.7

25.4

(163.7)

0.0

$41.7

$219.4

19.0%

Q1

($2.3)

(2.5)

10.0

27.7

0.0

0.0

$32.9

$223.1

14.7%

Q2

2018

$10.7

(3.1)

10.5

28.8

0.0

0.0

$46.9

$234.9

20.0%

Q3

$15.0

(4.6)

10.7

29.2

0.0

0.0

$50.3

$241.1

20.9%

Q4

$31.9

(19.2)

11.6

28.7

0.0

0.0

$52.9

$243.7

21.7%

This presentation includes adjusted EBITDA and adjusted EBITDA margin, non-GAAP financial measures that Yelp uses to evaluate its business. Yelp includes adjusted EBITDA because it is a key measure used by Yelp's management and board of

directors to understand and evaluate core operating performance and trends, to prepare and approve its annual budget and to develop short- and long-term operational plans. In particular, the exclusion of certain expenses in calculating adjusted

EBITDA can provide a useful measure for period-to-period comparisons of Yelp's core business. Accordingly, Yelp believes that adjusted EBITDA provides useful information to investors and others in understanding and evaluating Yelp's operating

results in the same manner as its management and board of directors. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of Yelp's results as reported under GAAP. You can

read more about the limitations of adjusted EBITDA, as well as the basis of presentation of the numbers in the table above, in Yelp's most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q at www.yelp-ir.com or the SEC's

website at www.sec.gov. Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net income (loss) and Yelp's other GAAP results.

1. Amounts have not been recast in accordance with Accounting Standards Update 2014-09, "Revenue from Contracts with Customers (ASC 606)."

20View entire presentation