Dragonfly Energy SPAC Presentation Deck

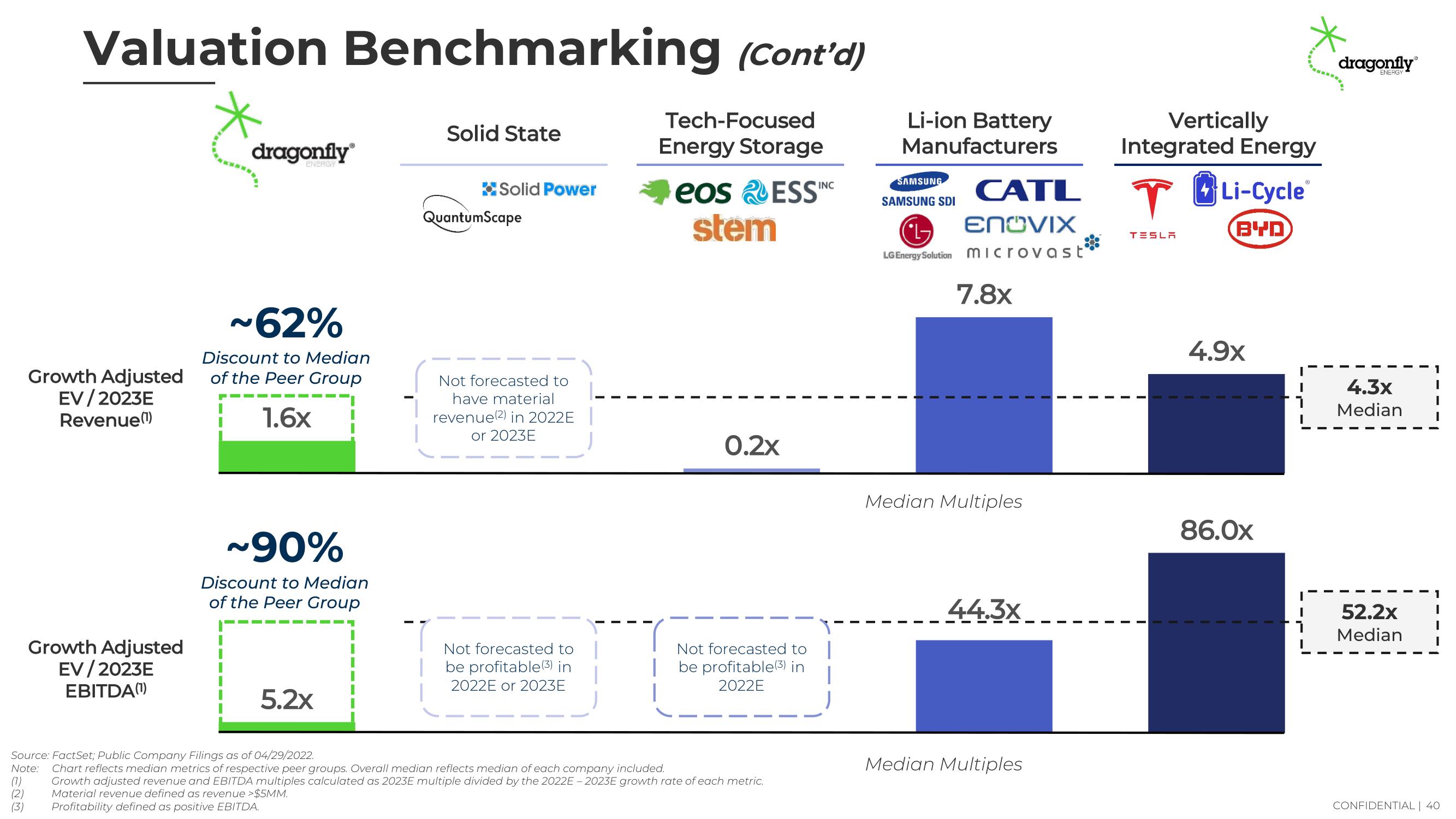

Valuation Benchmarking (Cont'd)

(7)

(2)

(3)

Growth Adjusted

EV/2023E

Revenue(¹)

Growth Adjusted

EV/2023E

EBITDA (¹)

dragonfly

ENERGY

~62%

Discount to Median

of the Peer Group

1.6x

~90%

Discount to Median

of the Peer Group

5.2x

Solid State

Solid Power

QuantumScape

Not forecasted to

have material

revenue(2) in 2022E

or 2023E

Not forecasted to

be profitable (³) in

2022E or 2023E

Tech-Focused

Energy Storage

eos ESS

stem

0.2x

Not forecasted to

be profitable(3) in

2022E

Source: FactSet; Public Company Filings as of 04/29/2022.

Note: Chart reflects median metrics of respective peer groups. Overall median reflects median of each company included.

Growth adjusted revenue and EBITDA multiples calculated as 2023E multiple divided by the 2022E-2023E growth rate of each metric.

Material revenue defined as revenue >$5MM.

Profitability defined as positive EBITDA.

INC

Li-ion Battery

Manufacturers

SAMSUNG

SAMSUNG SDI

CATL

L

ENOVIX

LG Energy Solution microvast

7.8x

Median Multiples

44.3x

Median Multiples

Vertically

Integrated Energy

Li-Cycle

(BYD)

T

TESLA

4.9x

86.0x

dragonfly

4.3x

Median

52.2x

Median

CONFIDENTIAL | 40View entire presentation