Playboy SPAC Presentation Deck

PLAYBOY 2020

36

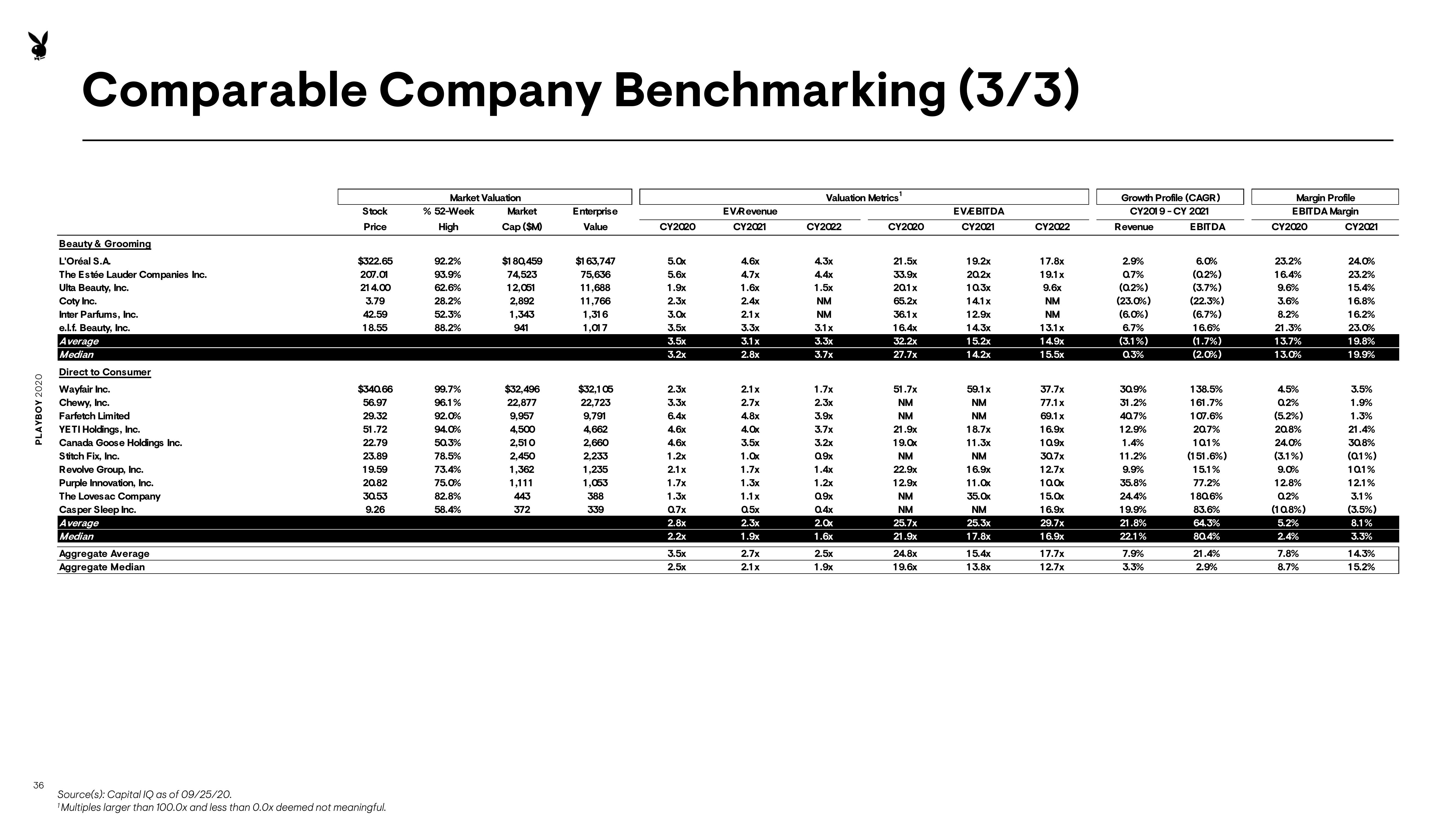

Comparable Company Benchmarking (3/3)

Beauty & Grooming

L'Oréal S.A.

The Estée Lauder Companies Inc.

Ulta Beauty, Inc.

Coty Inc.

Inter Parfums, Inc.

e.l.f. Beauty, Inc.

Average

Median

Direct to Consumer

Wayfair Inc.

Chewy, Inc.

Farfetch Limited

YETI Holdings, Inc.

Canada Goose Holdings Inc.

Stitch Fix, Inc.

Revolve Group, Inc.

Purple Innovation, Inc.

The Loves ac Company

Casper Sleep Inc.

Average

Median

Aggregate Average

Aggregate Median

Stock

Price

$322.65

207.01

214.00

3.79

42.59

18.55

$340.66

56.97

29.32

51.72

22.79

23.89

19.59

20.82

30.53

9.26

Source(s): Capital IQ as of 09/25/20.

¹Multiples larger than 100.0x and less than 0.0x deemed not meaningful.

Market Valuation

% 52-Week

High

92.2%

93.9%

62.6%

28.2%

52.3%

88.2%

99.7%

96.1%

92.0%

94.0%

50.3%

78.5%

73.4%

75.0%

82.8%

58.4%

Market

Cap ($M)

$180,459

74,523

12.051

2,892

1,343

941

$32,496

22,877

9,957

4,500

2.510

2,450

1,362

1,111

443

372

Enterprise

Value

$1 63,747

75,636

11,688

11,766

1,316

1,017

$32,105

22,723

9,791

4,662

2.660

2,233

1,235

1,053

388

339

CY2020

5.0x

5.6x

1.9x

2.3x

3.0x

3.5x

3.5x

3.2x

2.3x

3.3x

6.4x

4.6x

4.6x

1.2x

2.1x

1.7x

1.3x

0.7x

2.8x

2,2x

3.5x

2.5x

EV/Revenue

CY2021

4,6x

4.7x

1.6x

2.4x

2.1x

3.3x

3.1x

2.8x

2.1x

2.7x

4.8x

4.0x

3.5x

1.0x

1.7x

1.3x

1.1x

Q.5x

2.3x

1.9x

2.7x

2.1x

Valuation Metrics¹

CY2022

4.3x

4,4x

1.5x

NM

NM

3.1x

3.3x

3.7x

1.7x

2.3x

3.9x

3.7x

3.2x

09x

1.4x

1.2x

09x

04x

2.0x

1.6x

2.5x

1.9x

CY2020

21.5x

33.9x

201x

65.2x

36.1 x

16.4x

32.2x

27.7x

51.7x

NM

NM

21.9x

19.0x

NM

22.9x

12.9x

NM

NM

25.7x

21.9x

24.8x

19.6x

EVÆEBITDA

CY2021

19.2x

20,2x

10.3x

14.1x

12.9x

14.3x

15.2x

14.2x

59.1 x

NM

NM

18.7x

11.3x

NM

16.9x

11.0x

35.0x

NM

25.3x

17.8x

15.4x

13.8x

CY2022

17.8x

19.1x

9.6x

NM

NM

13.1x

14.9x

155x

37.7x

77.1x

69.1 x

16.9x

10.9x

30.7x

12.7x

100x

15.0x

16.9x

29.7x

16.9x

17.7x

12.7x

Growth Profile (CAGR)

CY2019-CY 2021

EBITDA

Revenue

2.9%

0.7%

(0.2%)

(23.0%)

(6.0%)

6.7%

(3.1%)

0.3%

30.9%

31.2%

40.7%

12.9%

1.4%

11.2%

9.9%

35.8%

24.4%

19.9%

21.8%

22.1%

7.9%

3.3%

6.0%

(0.2%)

(3.7%)

(22.3%)

(6.7%)

16.6%

(1.7%)

(2.0%)

138.5%

161.7%

107.6%

20.7%

101%

(151.6%)

15.1%

77.2%

180.6%

83.6%

64.3%

80.4%

21.4%

2.9%

Margin Profile

EBITDA Margin

CY2020

23.2%

16.4%

9.6%

3.6%

8.2%

21.3%

13.7%

13.0%

4.5%

0.2%

(5.2%)

20.8%

24.0%

(3.1%)

9.0%

12.8%

0.2%

(10.8%)

5.2%

2.4%

7.8%

8.7%

CY2021

24.0%

23.2%

15.4%

16.8%

16.2%

23.0%

19.8%

19.9%

3.5%

1.9%

1.3%

21.4%

30.8%

(0.1%)

101%

12.1%

3.1%

(3.5%)

8.1%

3.3%

14.3%

15.2%View entire presentation