jetBlue Results Presentation Deck

Focused on Maintaining Strong Balance Sheet

jetBlue

48%

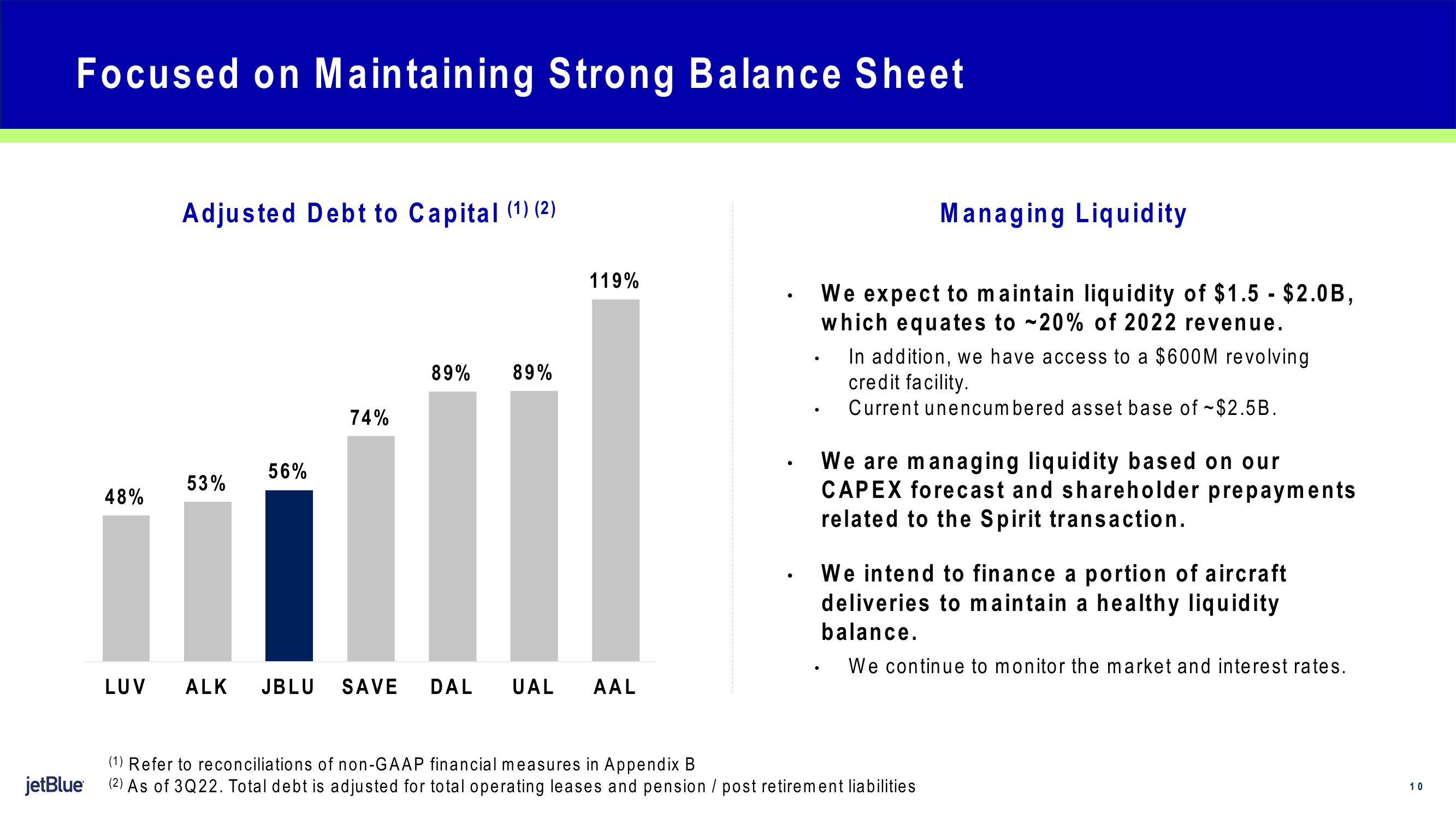

Adjusted Debt to Capital (1) (2)

53%

56%

74%

89% 89%

119%

LUV ALK JBLU SAVE DAL UAL AAL

●

●

Managing Liquidity

We expect to maintain liquidity of $1.5- $2.0B,

which equates to ~20% of 2022 revenue.

In addition, we have access to a $600M revolving

credit facility.

Current unencumbered asset base of ~$2.5B.

We are managing liquidity based on our

CAPEX forecast and shareholder prepayments

related to the Spirit transaction.

We intend to finance a portion of aircraft

deliveries to maintain a healthy liquidity

balance.

We continue to monitor the market and interest rates.

(1) Refer to reconciliations of non-GAAP financial measures in Appendix B

(2) As of 3Q22. Total debt is adjusted for total operating leases and pension / post retirement liabilities

10View entire presentation