TPG Results Presentation Deck

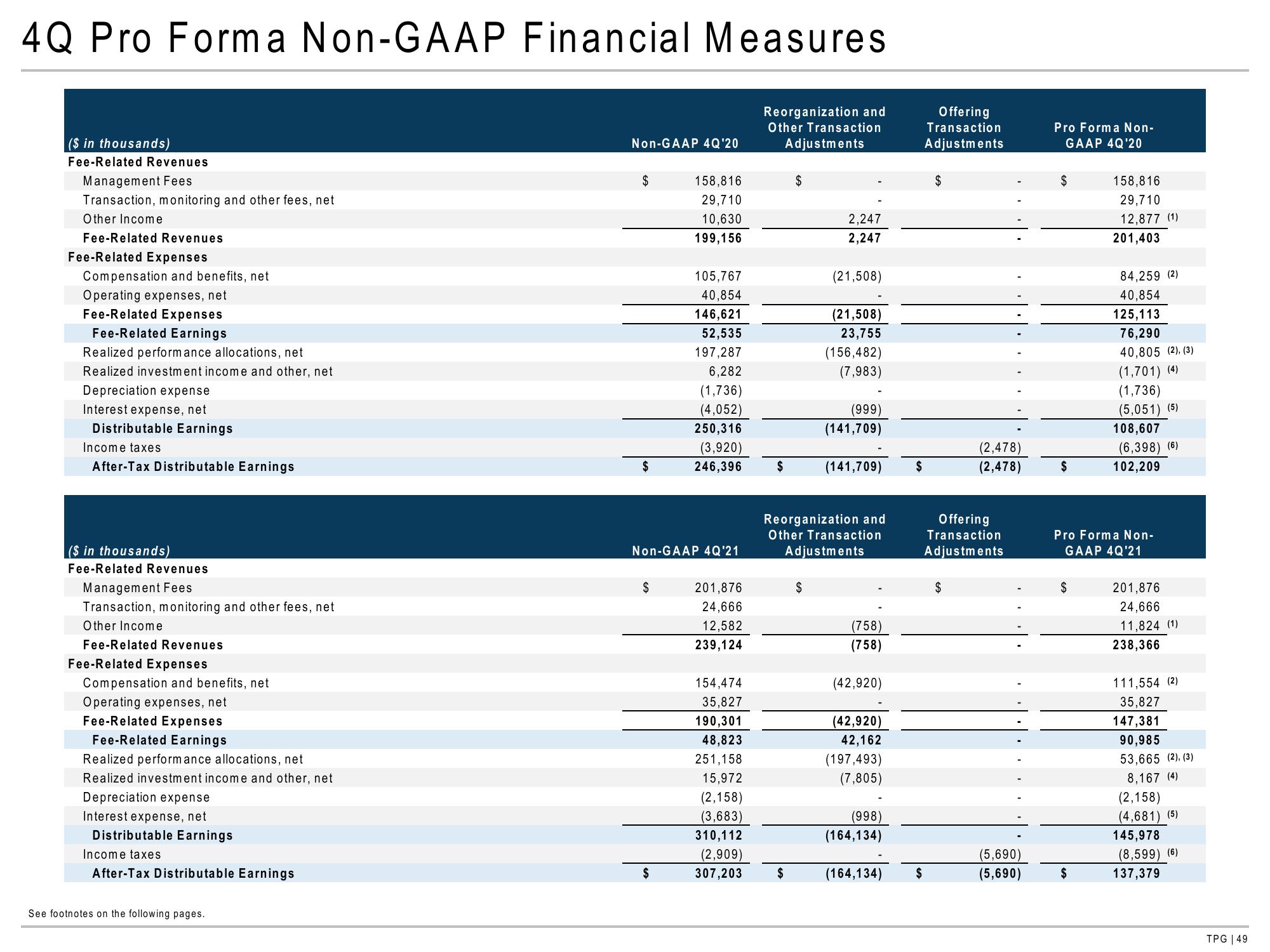

4Q Pro Forma Non-GAAP Financial Measures

Reorganization and

Other Transaction

Adjustments

($ in thousands)

Fee-Related Revenues

Management Fees

Transaction, monitoring and other fees, net

Other Income

Fee-Related Revenues

Fee-Related Expenses

Compensation and benefits, net

Operating expenses, net

Fee-Related Expenses

Fee-Related Earnings

Realized performance allocations, net

Realized investment income and other, net

Depreciation expense

Interest expense, net

Distributable Earnings

Income taxes

After-Tax Distributable Earnings

($ in thousands)

Fee-Related Revenues

Management Fees

Transaction, monitoring and other fees, net

Other Income

Fee-Related Revenues

Fee-Related Expenses

Compensation and benefits, net

Operating expenses, net

Fee-Related Expenses

Fee-Related Earnings

Realized performance allocations, net

Realized investment income and other, net

Depreciation expense

Interest expense,

Distributable Earnings

Income taxes

After-Tax Distributable Earnings

See footnotes on the following pages.

Non-GAAP 4Q'20

$

$

$

158,816

29,710

10,630

199,156

$

105,767

40,854

146,621

52,535

197,287

6,282

(1,736)

(4,052)

250,316

Non-GAAP 4Q'21

(3,920)

246,396

201,876

24,666

12,582

239,124

154,474

35,827

190,301

48,823

251,158

15,972

(2,158)

3,683)

310,112

(2,909)

307,203

$

$

$

2,247

2,247

$

(21,508)

(21,508)

23,755

(156,482)

(7,983)

(999)

(141,709)

Reorganization and

Other Transaction

Adjustments

(141,709)

(758)

(758)

(42,920)

(42,920)

42,162

(197,493)

(7,805)

(998)

(164,134)

(164,134)

$

$

Offering

Transaction

Adjustments

$

(2,478)

(2,478)

Offering

Transaction

Adjustments

$

(5,690)

(5,690)

Pro Forma Non-

GAAP 4Q'20

$

$

$

158,816

29,710

12,877 (1)

201,403

$

84,259 (2)

40,854

125,113

76,290

40,805 (2), (3)

Pro Forma Non-

GAAP 4Q'21

(1,701) (4)

(1,736)

(5,051) (5)

108,607

(6,398) (6)

102,209

201,876

24,666

11,824 (1)

238,366

111,554 (2)

35,827

147,381

90,985

53,665 (2), (3)

8,167 (4)

(2,158)

(4,681) (5)

145,978

(8,599) (6)

137,379

TPG | 49View entire presentation