3Q24 Investor Update

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

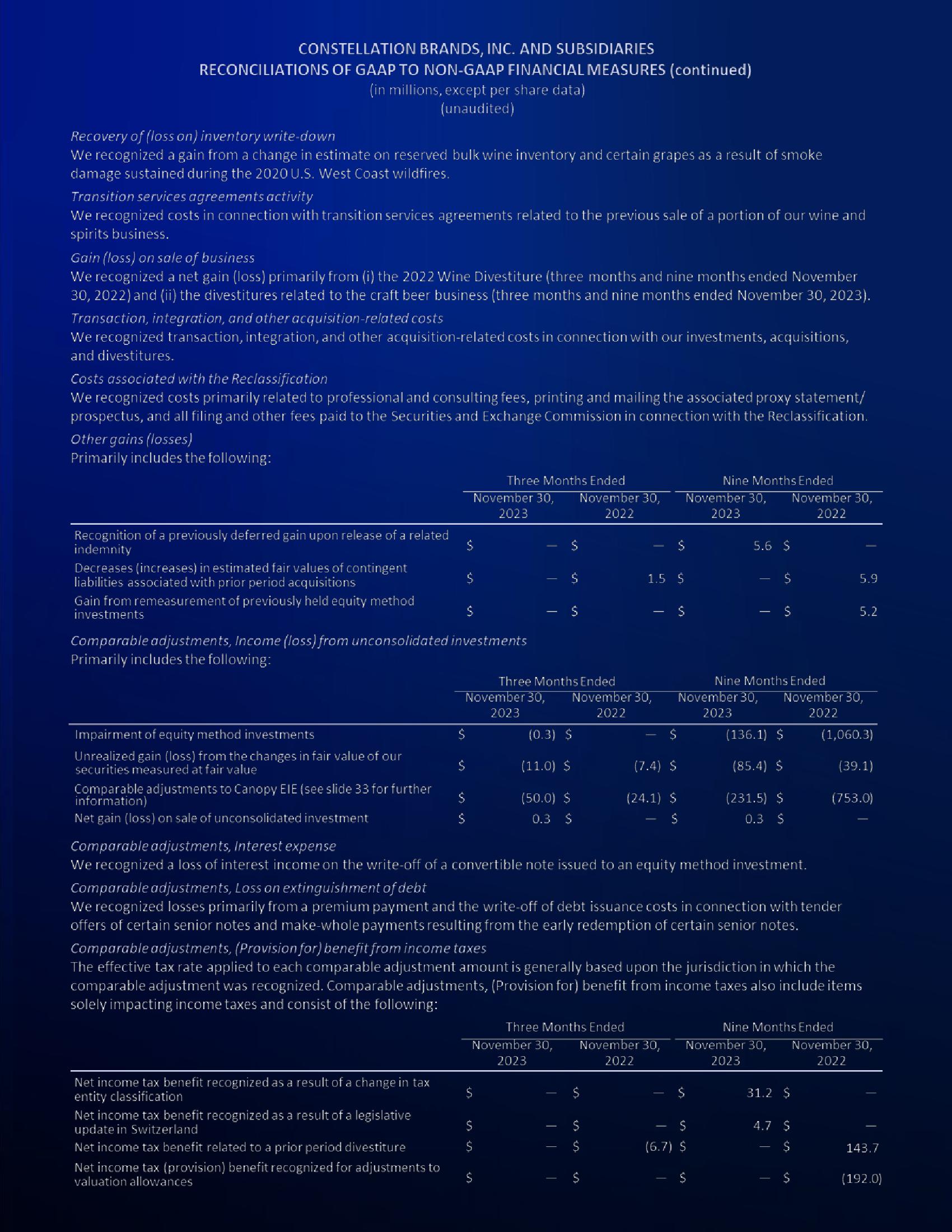

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

Recovery of (loss on) inventory write-down

We recognized a gain from a change in estimate on reserved bulk wine inventory and certain grapes as a result of smoke

damage sustained during the 2020 U.S. West Coast wildfires.

Transition services agreements activity

We recognized costs in connection with transition services agreements related to the previous sale of a portion of our wine and

spirits business.

Gain (loss) on sale of business

We recognized a net gain (loss) primarily from (i) the 2022 Wine Divestiture (three months and nine months ended November

30, 2022) and (ii) the divestitures related to the craft beer business (three months and nine months ended November 30, 2023).

Transaction, integration, and other acquisition-related costs

We recognized transaction, integration, and other acquisition-related costs in connection with our investments, acquisitions,

and divestitures.

Costs associated with the Reclassification

We recognized costs primarily related to professional and consulting fees, printing and mailing the associated proxy statement/

prospectus, and all filing and other fees paid to the Securities and Exchange Commission in connection with the Reclassification.

Other gains (losses)

Primarily includes the following:

Recognition of a previously deferred gain upon release of a related

indemnity

Decreases (increases) in estimated fair values of contingent

liabilities associated with prior period acquisitions

Gain from remeasurement of previously held equity method

investments

Impairment of equity method investments

Unrealized gain (loss) from the changes in fair value of our

securities measured at fair value

Comparable adjustments to Canopy EIE (see slide 33 for further

information)

Net gain (loss) on sale of unconsolidated investment

Comparable adjustments, Income (loss) from unconsolidated investments

Primarily includes the following:

Net income tax benefit recognized as a result of a change in tax

entity classification

Net income tax benefit recognized as a result of a legislative

update in Switzerland

Net income tax benefit related to a prior period divestiture

S

$

Net income tax (provision) benefit recognized for adjustments to

valuation allowances

Three Months Ended

November 30, November 30,

2023

2022

$

Ś

$

I

$

I

$

S

$

$

Three Months Ended

November 30, November 30,

2023

2022

$

$

(0.3) $

(11.0) $

(50.0) $

0.3 $

T

Three Months Ended

November 30, November 30,

2023

2022

$

ins

1.5 S

$

$

$

$

$

(7.4) S

(24.1) S

$

Nine Months Ended

November 30, November 30,

2023

2022

$

Comparable adjustments, Interest expense

We recognized a loss of interest income on the write-off of a convertible note issued to an equity method investment.

Comparable adjustments, Loss on extinguishment of debt

We recognized losses primarily from a premium payment and the write-off of debt issuance costs in connection with tender

offers of certain senior notes and make-whole payments resulting from the early redemption of certain senior notes.

Comparable adjustments, (Provision for) benefit from income taxes

The effective tax rate applied to each comparable adjustment amount is generally based upon the jurisdiction in which the

comparable adjustment was recognized. Comparable adjustments, (Provision for) benefit from income taxes also include items

solely impacting income taxes and consist of the following:

I

5.6 $

November 30,

2023

S

$

(6.7) $

I

$

S

Nine Months Ended

(136.1) $

(85.4) $

(231.5) $

0.3 $

S

I

November 30,

2022

Nine Months Ended

November 30, November 30,

2023

2022

31.2 S

4.7 $

$

5.9

I

5.2

$

(1,060.3)

(39.1)

(753.0)

143.7

(192.0)View entire presentation