2Q 2023 Earnings Conference Call

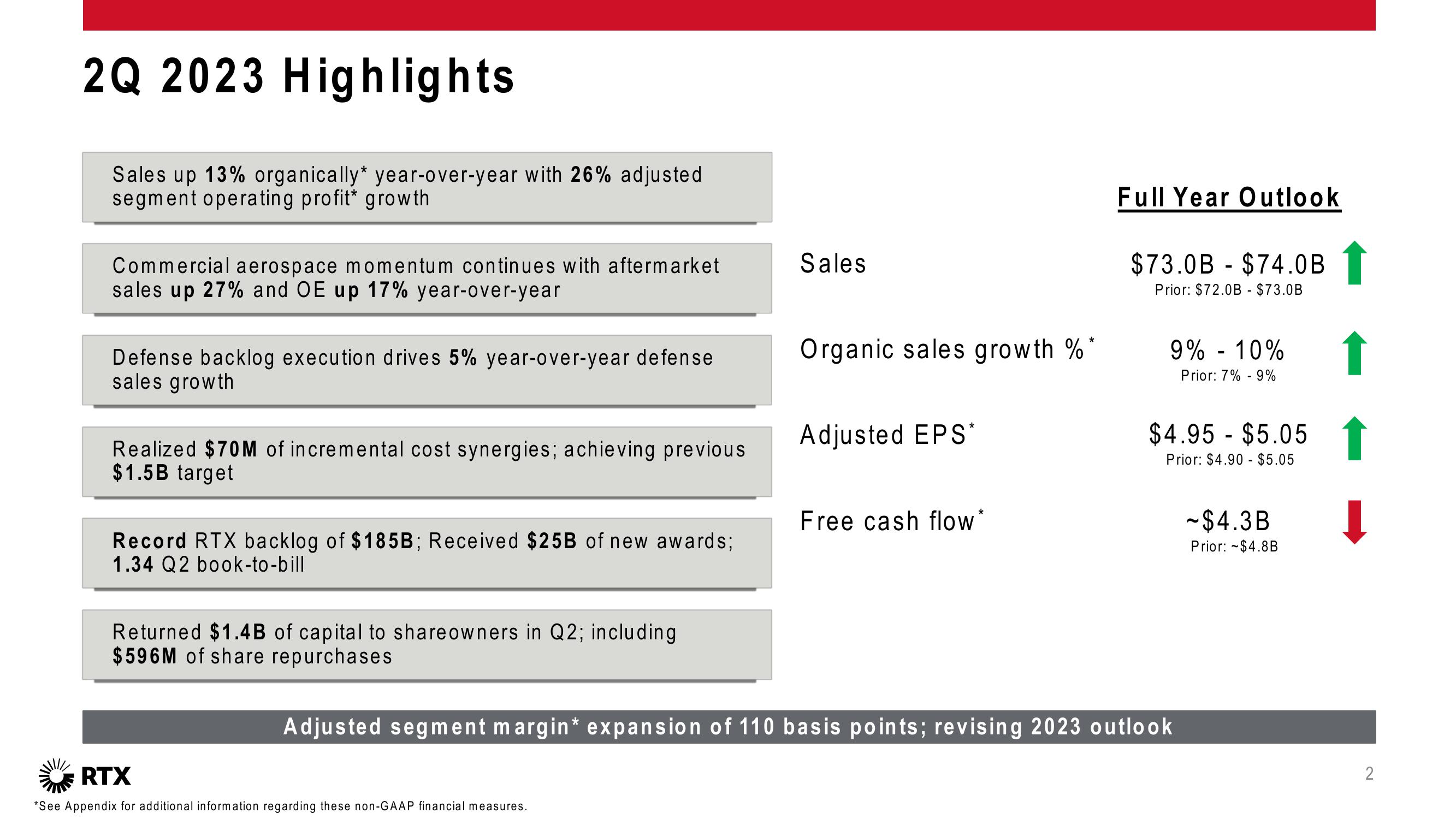

2Q 2023 Highlights

Sales up 13% organically* year-over-year with 26% adjusted

segment operating profit* growth

Commercial aerospace momentum continues with aftermarket

sales up 27% and OE up 17% year-over-year

Defense backlog execution drives 5% year-over-year defense

sales growth

Realized $70M of incremental cost synergies; achieving previous

$1.5B target

Record RTX backlog of $185B; Received $25B of new awards;

1.34 Q2 book-to-bill

Returned $1.4B of capital to shareowners in Q2; including

$596M of share repurchases

Sales

RTX

*See Appendix for additional information regarding these non-GAAP financial measures.

Organic sales growth %*

Adjusted EPS*

Free cash flow*

Full Year Outlook

$73.0B - $74.0B

Prior: $72.0B - $73.0B

9% - 10%

Prior: 7% - 9%

$4.95 - $5.05

Prior: $4.90 $5.05

Adjusted segment margin* expansion of 110 basis points; revising 2023 outlook

~$4.3B

Prior: $4.8B

↑

↓

2View entire presentation