Nikola Results Presentation Deck

1 2

PAGE

NIKOLA

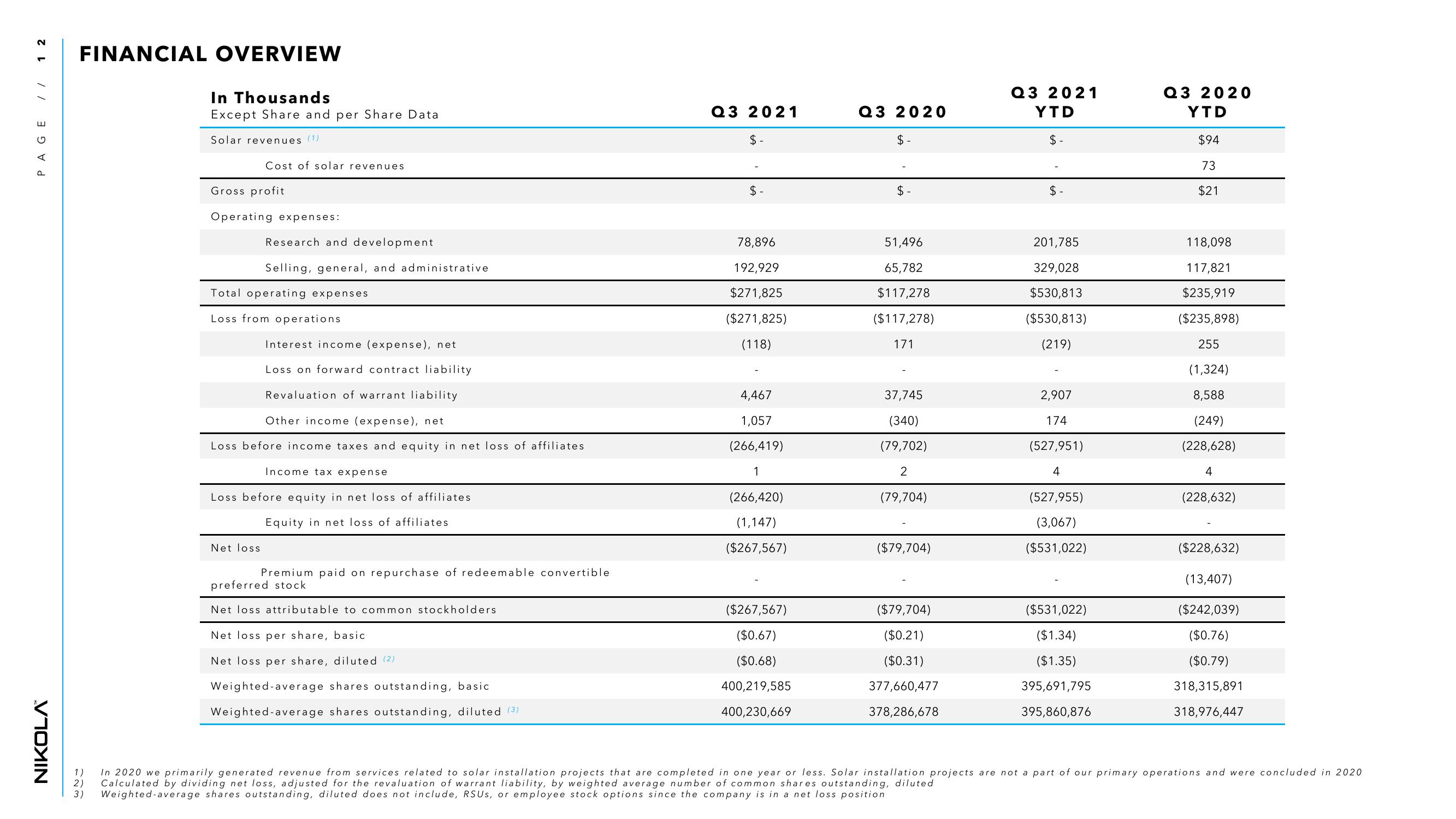

FINANCIAL OVERVIEW

In Thousands

Except Share and per Share Data

Solar revenues (¹)

Cost of solar revenues

Gross profit

Operating expenses:

Research and development

Selling, general, and administrative

Total operating expenses

Loss from operations

Interest income (expense), net

Loss on forward contract liability

Revaluation of warrant liability

Other income (expense), net

Loss before income taxes and equity in net loss of affiliates

Net loss

Income tax expense

Loss before equity in net loss of affiliates

Equity in net loss of affiliates

Premium paid on repurchase of redeemable convertible

preferred stock

Net loss attributable to common stockholders

Net loss per share, basic

Net loss per share, diluted (2)

Weighted-average shares outstanding, basic

Weighted-average shares outstanding, diluted (3)

Q3 2021

$-

$-

78,896

192,929

$271,825

($271,825)

(118)

4,467

1,057

(266,419)

1

(266,420)

(1,147)

($267,567)

($267,567)

($0.67)

($0.68)

400,219,585

400,230,669

Q3 2020

$-

$

51,496

65,782

$117,278

($117,278)

171

37,745

(340)

(79,702)

2

(79,704)

($79,704)

($79,704)

($0.21)

($0.31)

377,660,477

378,286,678

Q3 2021

YTD

$-

$-

201,785

329,028

$530,813

($530,813)

(219)

2,907

174

(527,951)

4

(527,955)

(3,067)

($531,022)

($531,022)

($1.34)

($1.35)

395,691,795

395,860,876

Q3 2020

YTD

$94

73

$21

118,098

117,821

$235,919

($235,898)

255

(1,324)

8,588

(249)

(228,628)

4

(228,632)

($228,632)

(13,407)

($242,039)

($0.76)

($0.79)

318,315,891

318,976,447

1) In 2020 we primarily generated revenue from services related to solar installation projects that are completed in one year or less. Solar installation projects are not a part of our primary operations and were concluded in 2020

2) Calculated by dividing net loss, adjusted for the revaluation of warrant liability, by weighted average number of common shares outstanding, diluted

3)

Weighted-average shares outstanding, diluted does not include, RSUS, or employee stock options since the company is in a net loss positionView entire presentation