Kering Investor Presentation Deck

576

●

H1 22 Kering

Eyewear

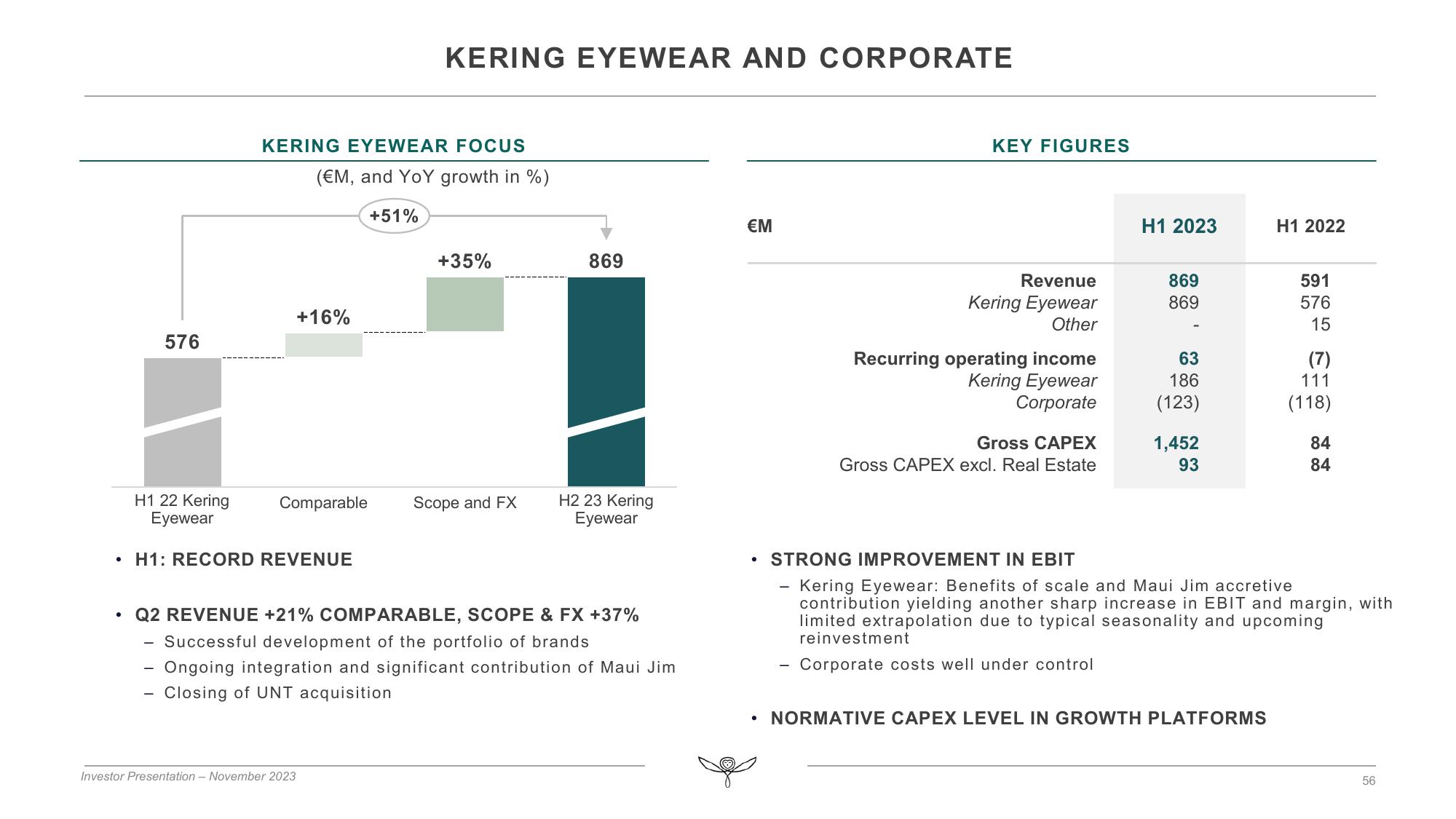

KERING EYEWEAR FOCUS

(€M, and YoY growth in %)

+51%

+16%

Comparable

• H1: RECORD REVENUE

KERING EYEWEAR AND CORPORATE

Investor Presentation - November 2023

+35%

Scope and FX

869

H2 23 Kering

Eyewear

Q2 REVENUE +21% COMPARABLE, SCOPE & FX +37%

Successful development of the portfolio of brands

- Ongoing integration and significant contribution of Maui Jim

Closing of UNT acquisition

€M

KEY FIGURES

●

Revenue

Kering Eyewear

Other

Recurring operating income

Kering Eyewear

Corporate

Gross CAPEX

Gross CAPEX excl. Real Estate

H1 2023

869

869

63

186

(123)

1,452

93

H1 2022

NORMATIVE CAPEX LEVEL IN GROWTH PLATFORMS

591

576

15

(7)

111

(118)

• STRONG IMPROVEMENT IN EBIT

Kering Eyewear: Benefits of scale and Maui Jim accretive

contribution yielding another sharp increase in EBIT and margin, with

limited extrapolation due to typical seasonality and upcoming

reinvestment

Corporate costs well under control

84

84

56View entire presentation