Lazard Investor Presentation Deck

INVESTOR PRESENTATION

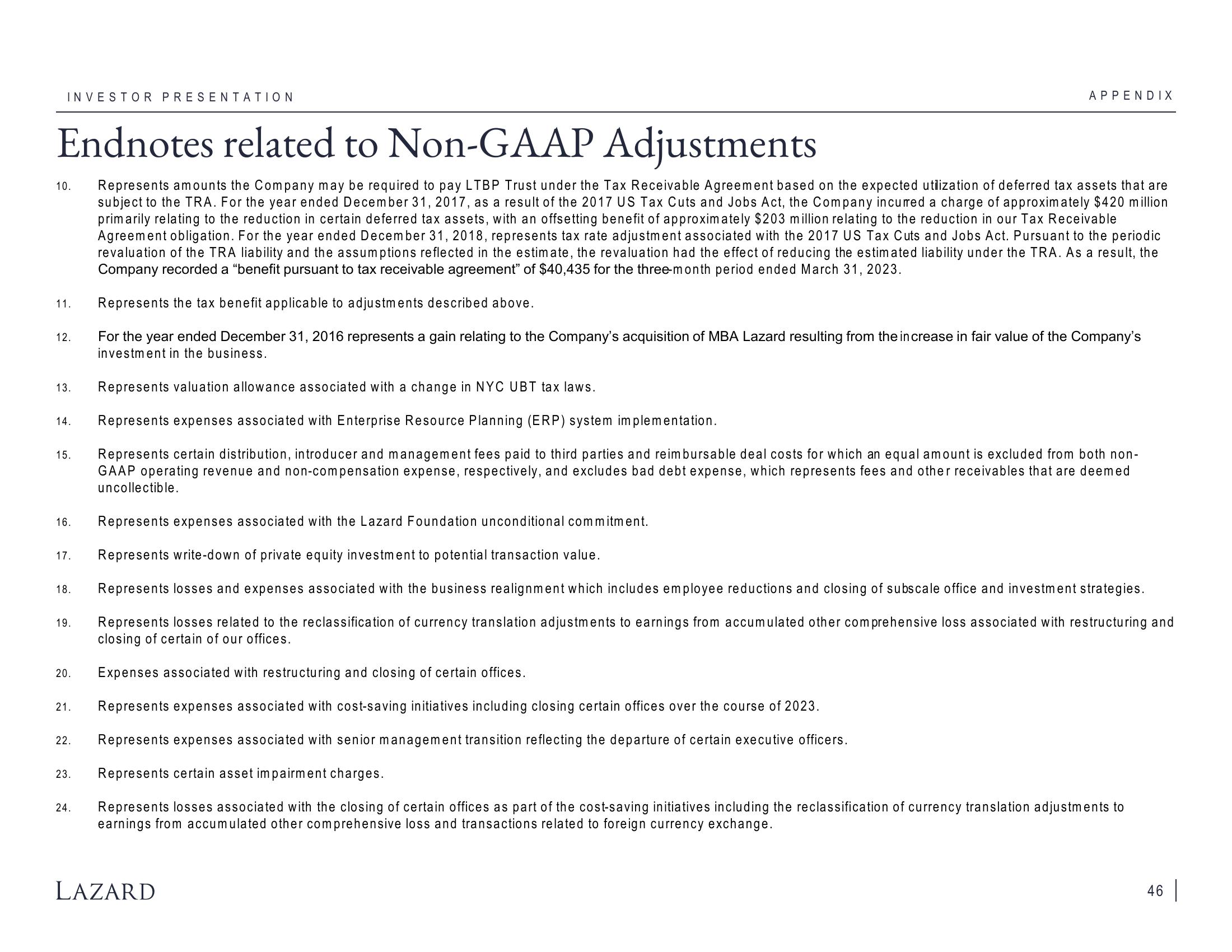

Endnotes related to Non-GAAP Adjustments

Represents amounts the Company may be required to pay LTBP Trust under the Tax Receivable Agreement based on the expected utilization of deferred tax assets that are

subject to the TRA. For the year ended December 31, 2017, as a result of the 2017 US Tax Cuts and Jobs Act, the Company incurred a charge of approximately $420 million

primarily relating to the reduction in certain deferred tax assets, with an offsetting benefit of approximately $203 million relating to the reduction in our Tax Receivable

Agreement obligation. For the year ended December 31, 2018, represents tax rate adjustment associated with the 2017 US Tax Cuts and Jobs Act. Pursuant to the periodic

revaluation of the TRA liability and the assumptions reflected in the estimate, the revaluation had the effect of reducing the estimated liability under the TRA. As a result, the

Company recorded a "benefit pursuant to tax receivable agreement" of $40,435 for the three-month period ended March 31, 2023.

Represents the tax benefit applicable to adjustments described above.

For the year ended December 31, 2016 represents a gain relating to the Company's acquisition of MBA Lazard resulting from the increase in fair value of the Company's

investment in the business.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

APPENDIX

Represents valuation allowance associated with a change in NYC UBT tax laws.

Represents expenses associated with Enterprise Resource Planning (ERP) system implementation.

Represents certain distribution, introducer and management fees paid to third parties and reimbursable deal costs for which an equal amount is excluded from both non-

GAAP operating revenue and non-compensation expense, respectively, and excludes bad debt expense, which represents fees and other receivables that are deemed

uncollectible.

Represents expenses associated with the Lazard Foundation unconditional commitment.

Represents write-down of private equity investment to potential transaction value.

Represents losses and expenses associated with the business realignment which includes employee reductions and closing of subscale office and investment strategies.

Represents losses related to the reclassification of currency translation adjustments to earnings from accumulated other comprehensive loss associated with restructuring and

closing of certain of our offices.

Expenses associated with restructuring and closing of certain offices.

Represents expenses associated with cost-saving initiatives including closing certain offices over the course of 2023.

Represents expenses associated with senior management transition reflecting the departure of certain executive officers.

Represents certain asset impairment charges.

Represents losses associated with the closing of certain offices as part of the cost-saving initiatives including the reclassification of currency translation adjustments to

earnings from accumulated other comprehensive loss and transactions related to foreign currency exchange.

LAZARD

46 |View entire presentation