Tudor, Pickering, Holt & Co Investment Banking

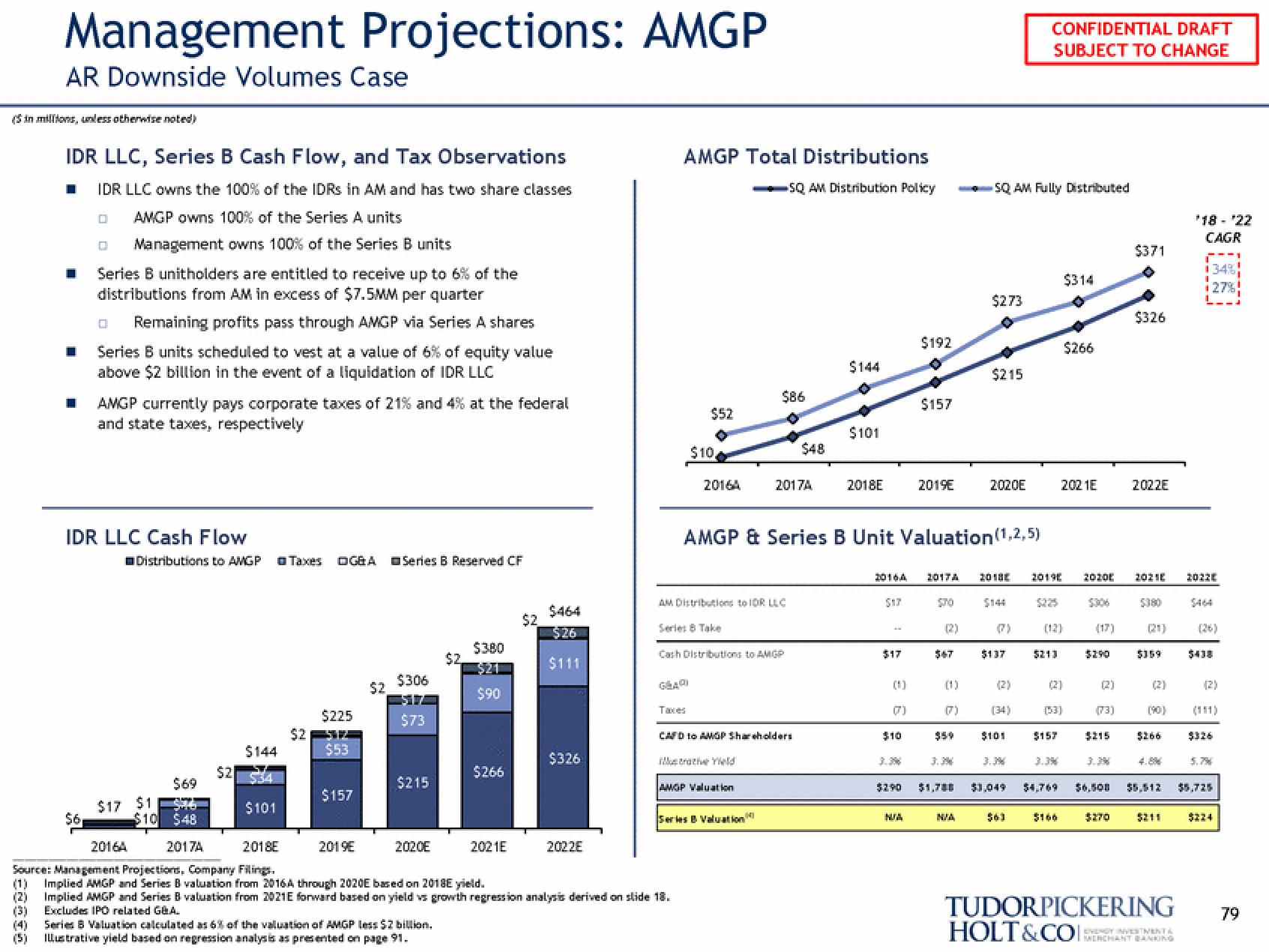

Management Projections: AMGP

AR Downside Volumes Case

(in millions, unless otherwise noted)

IDR LLC, Series B Cash Flow, and Tax Observations

IDR LLC owns the 100% of the IDRS in AM and has two share classes

AMGP owns 100% of the Series A units

Management owns 100% of the Series B units

■

☐

■

Series B unitholders are entitled to receive up to 6% of the

distributions from AM in excess of $7.5MM per quarter

Remaining profits pass through AMGP via Series A shares

Series B units scheduled to vest at a value of 6% of equity value

above $2 billion in the event of a liquidation of IDR LLC

AMGP currently pays corporate taxes of 21% and 4% at the federal

and state taxes, respectively

IDR LLC Cash Flow

Distributions to AMGP □ Taxes DGBA Series B Reserved CF

$69

$17 $1 5316

$10 $48

2016A

2017A

$2

$144

$101

$2

$225

$53

$157

2019E

$2

$306

$73

$215

2020E

$2

(3)

(4)

(5) Illustrative yield based on regression analysis as presented on page 91.

$380

$90

$266

2021E

$2

$464

$26

$111

$326

2022E

AMGP Total Distributions

SQ AM Distribution Policy

2018E

Source: Management Projections, Company Filings.

(1)

Implied AMGP and Series B valuation from 2016A through 2020E based on 2018E yield.

Implied AMGP and Series B valuation from 2021E forward based on yield vs growth regression analysis derived on slide 18.

Excludes IPO related GEA.

Series & Valuation calculated as 6% of the valuation of AMGP less $2 billion.

$52

$10

GRADI

2016A

Serie: B Take

Taxes

AM Distributions to IDR LLC

Cash Distributions to AMGP

$86

CAFD to AMGP Shareholders

rathe Yeld

AMGP Valuation

2017A

Series B Valuation

$48

$144

$101

AMGP & Series B Unit Valuation (1,2,5)

2018E

$17

(7)

$192

$10

$157

NUW

2019E

2016A 2017A 2018

(7)

$59

$1,700

SQ AM Fully Distributed

$273

N/A

$215

2020E

$137

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

$101

3.3%

$213

(2)

(53)

$157

3.3%

$3,049 54.769

$314

202 1E

$166

$266

2019E 2020E 2021E 2022E

$290

(2)

(73)

$215

$371

$270

$326

2022E

(2)

(90)

$266

$5,512

TUDORPICKERING

HOLT&COI:

*18 - '22

CAGR

EVERGY INVESTMENT &

MERCHANT BANKING

34%

27%!

$438

(2)

$326

5.7%

$224

79View entire presentation