Pathward Financial Results Presentation Deck

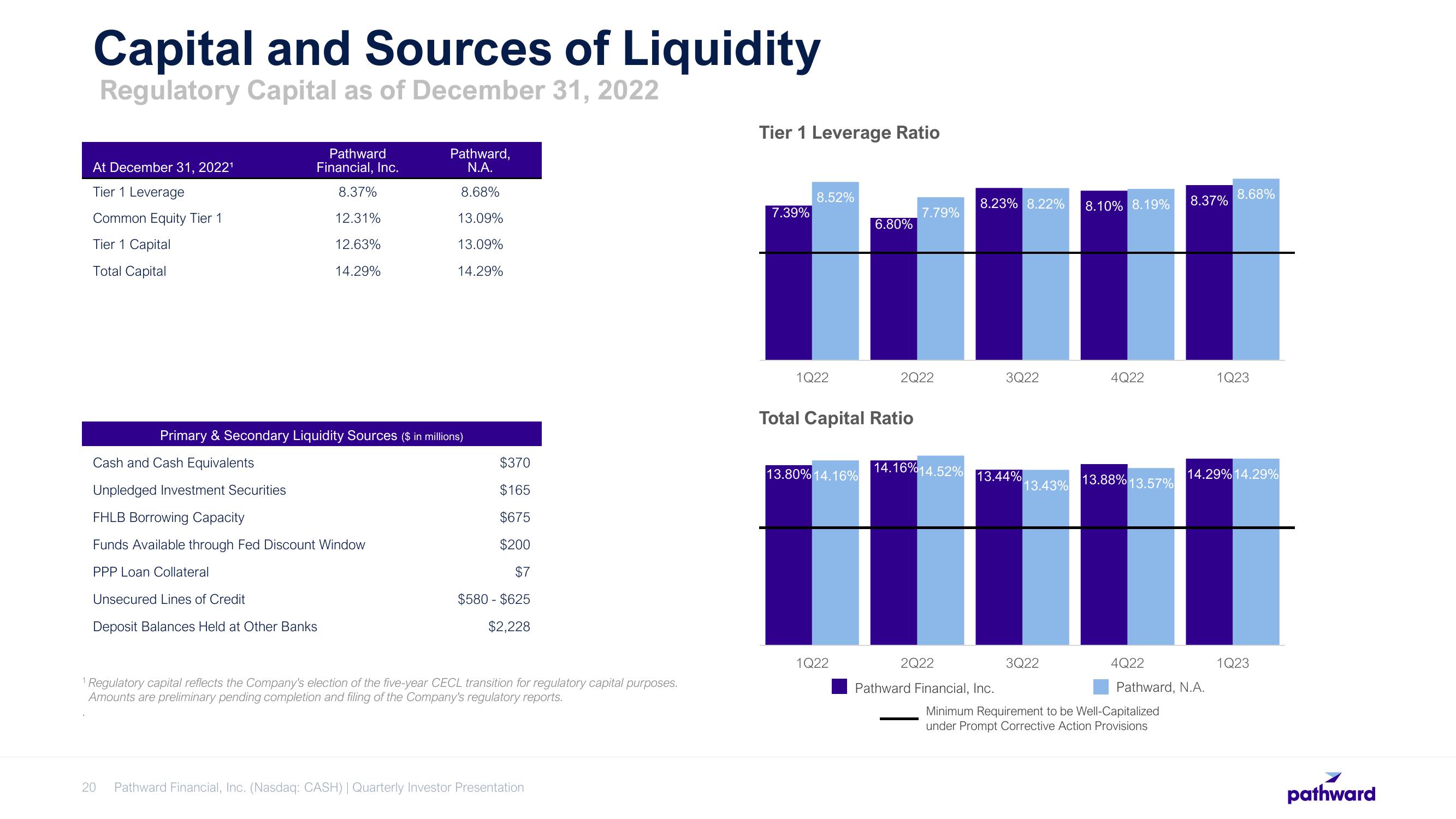

Capital and Sources of Liquidity

Regulatory Capital as of December 31, 2022

At December 31, 2022¹

Tier 1 Leverage

Common Equity Tier 1

Tier 1 Capital

Total Capital

Pathward

Financial, Inc.

8.37%

12.31%

12.63%

14.29%

Cash and Cash Equivalents

Unpledged Investment Securities

FHLB Borrowing Capacity

Funds Available through Fed Discount Window

PPP Loan Collateral

Unsecured Lines of Credit

Deposit Balances Held at Other Banks

20

Pathward,

N.A.

8.68%

13.09%

13.09%

14.29%

Primary & Secondary Liquidity Sources ($ in millions)

$370

$165

$675

$200

$7

$580 - $625

$2,228

¹ Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes.

Amounts are preliminary pending completion and filing of the Company's regulatory reports.

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

Tier 1 Leverage Ratio

7.39%

8.52%

1Q22

13.80% 14.16%

6.80%

Total Capital Ratio

1Q22

7.79%

2Q22

14.16%14.52%

2Q22

8.23% 8.22%

3Q22

13.44%

Pathward Financial, Inc.

13.43%

3Q22

8.10% 8.19%

4Q22

13.88% 13.57%

8.37%

Minimum Requirement to be Well-Capitalized

under Prompt Corrective Action Provisions

4Q22

Pathward, N.A.

8.68%

1Q23

14.29% 14.29%

1Q23

pathwardView entire presentation