Summit Hotel Properties Investor Presentation Deck

25

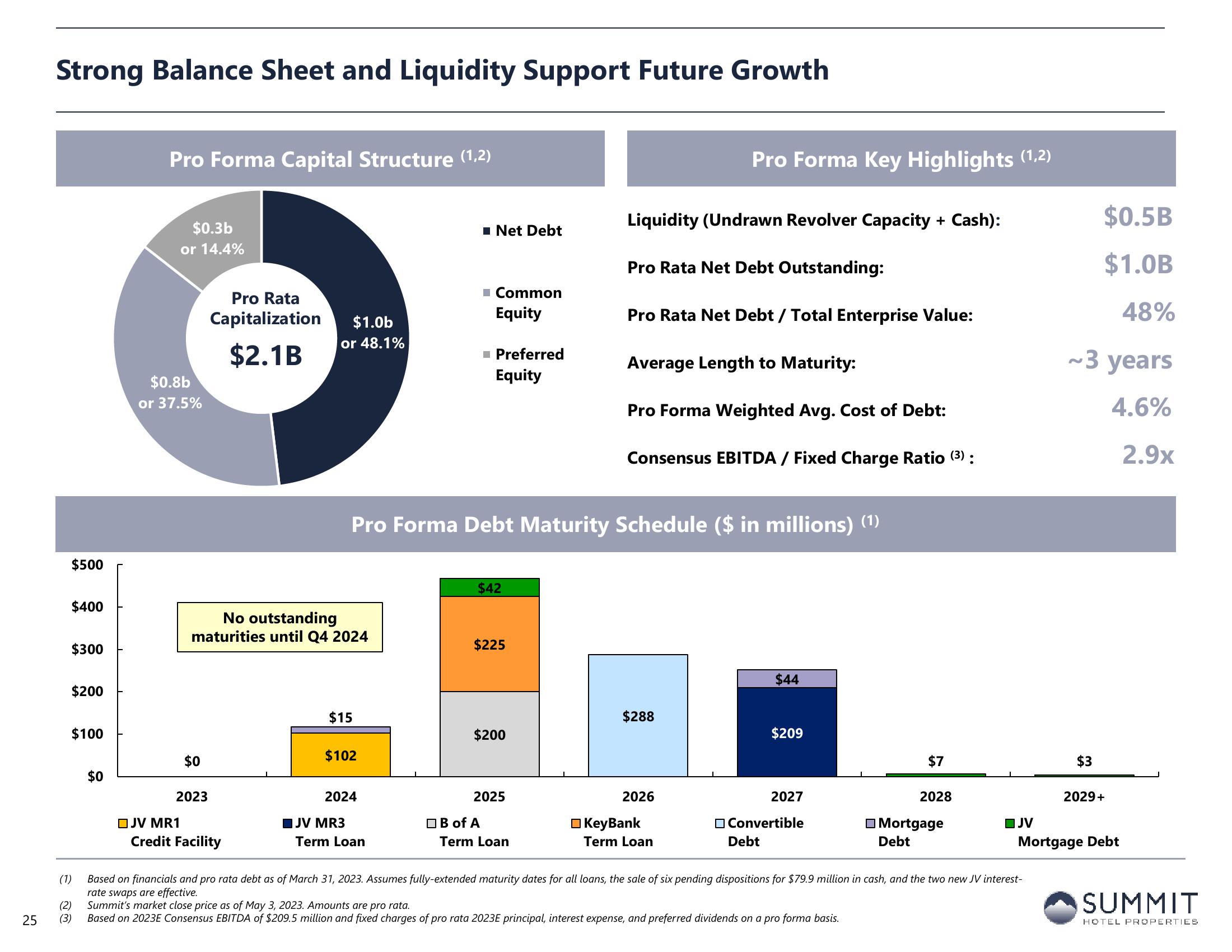

Strong Balance Sheet and Liquidity Support Future Growth

$500

$400

$300

$200

$100

$0

Pro Forma Capital Structure (1,2)

$0.3b

or 14.4%

$0.8b

or 37.5%

☐JV MR1

$0

2023

Pro Rata

Capitalization

$2.1B

No outstanding

maturities until Q4 2024

$1.0b

or 48.1%

Credit Facility

$15

$102

■ Net Debt

2024

JV MR3

Term Loan

■ Common

Equity

■ Preferred

Equity

Pro Forma Debt Maturity Schedule ($ in millions) (1)

$42

$225

$200

2025

B of A

Term Loan

Liquidity (Undrawn Revolver Capacity + Cash):

Pro Rata Net Debt Outstanding:

Pro Rata Net Debt / Total Enterprise Value:

Average Length to Maturity:

Pro Forma Key Highlights (1,2)

Pro Forma Weighted Avg. Cost of Debt:

Consensus EBITDA / Fixed Charge Ratio (³) :

$288

2026

KeyBank

Term Loan

$44

$209

2027

Convertible

Debt

$7

2028

Mortgage

Debt

JV

(1) Based on financials and pro rata debt as of March 31, 2023. Assumes fully-extended maturity dates for all loans, the sale of six pending dispositions for $79.9 million in cash, and the two new JV interest-

rate swaps are effective.

(2)

Summit's market close price as of May 3, 2023. Amounts are pro rata.

(3) Based on 2023E Consensus EBITDA of $209.5 million and fixed charges of pro rata 2023E principal, interest expense, and preferred dividends on a pro forma basis.

$0.5B

$1.0B

48%

~3 years

4.6%

2.9x

$3

2029+

Mortgage Debt

SUMMIT

HOTEL PROPERTIESView entire presentation