Antero Midstream Partners Mergers and Acquisitions Presentation Deck

AMGP / AM Transaction

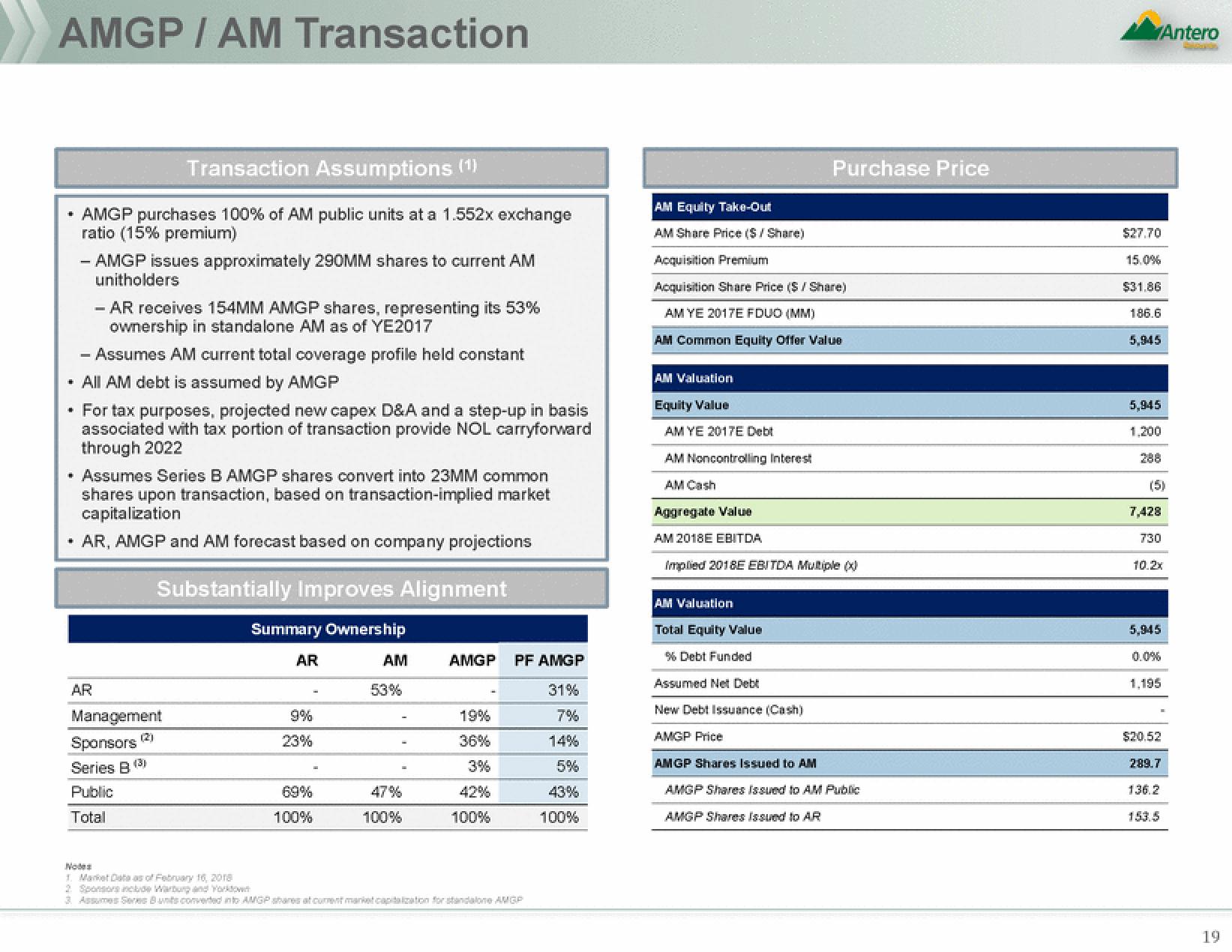

Transaction Assumptions (1)

• AMGP purchases 100% of AM public units at a 1.552x exchange

ratio (15% premium)

- AMGP issues approximately 290MM shares to current AM

unitholders

☐

- Assumes AM current total coverage profile held constant

• All AM debt is assumed by AMGP

* For tax purposes, projected new capex D&A and a step-up in basis

associated with tax portion of transaction provide NOL carryforward

through 2022

- AR receives 154MM AMGP shares, representing its 53%

ownership in standalone AM as of YE2017

Assumes Series B AMGP shares convert into 23MM common

shares upon transaction, based on transaction-implied market

capitalization

AR, AMGP and AM forecast based on company projections

AR

Substantially Improves Alignment

Summary Ownership

AR

Management

Sponsors

Series B (³)

Public

Total

(2)

9%

23%

69%

100%

AM

53%

47%

100%

AMGP PF AMGP

31%

7%

14%

5%

43%

100%

19%

36%

3%

42%

100%

Notes

1. Market Data as of February 16, 2018

3 Assumes Seres Bunts converted into AMGP shares at current market capitalization for standalone AMGP

Purchase Price

AM Equity Take-Out

AM Share Price ($ / Share)

Acquisition Premium

Acquisition Share Price ($ / Share)

AM YE 2017E FDUO (MM)

AM Common Equity Offer Value

AM Valuation

Equity Value

AM YE 2017E Debt

AM Noncontrolling Interest

AM Cash

Aggregate Value

AM 2018E EBITDA

Implied 2018E EBITDA Multiple (X)

AM Valuation

Total Equity Value

% Debt Funded

Assumed Net Debt

New Debt Issuance (Cash)

AMGP Price

AMGP Shares Issued to AM

AMGP Shares Issued to AM Public

AMGP Shares issued to AR

Antero

$27.70

15.0%

$31,86

186.6

5,945

5,945

1,200

(5)

7,428

730

10.2x

5,945

0.0%

1,195

$20.52

289.7

136.2

153.5

19View entire presentation