First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

1

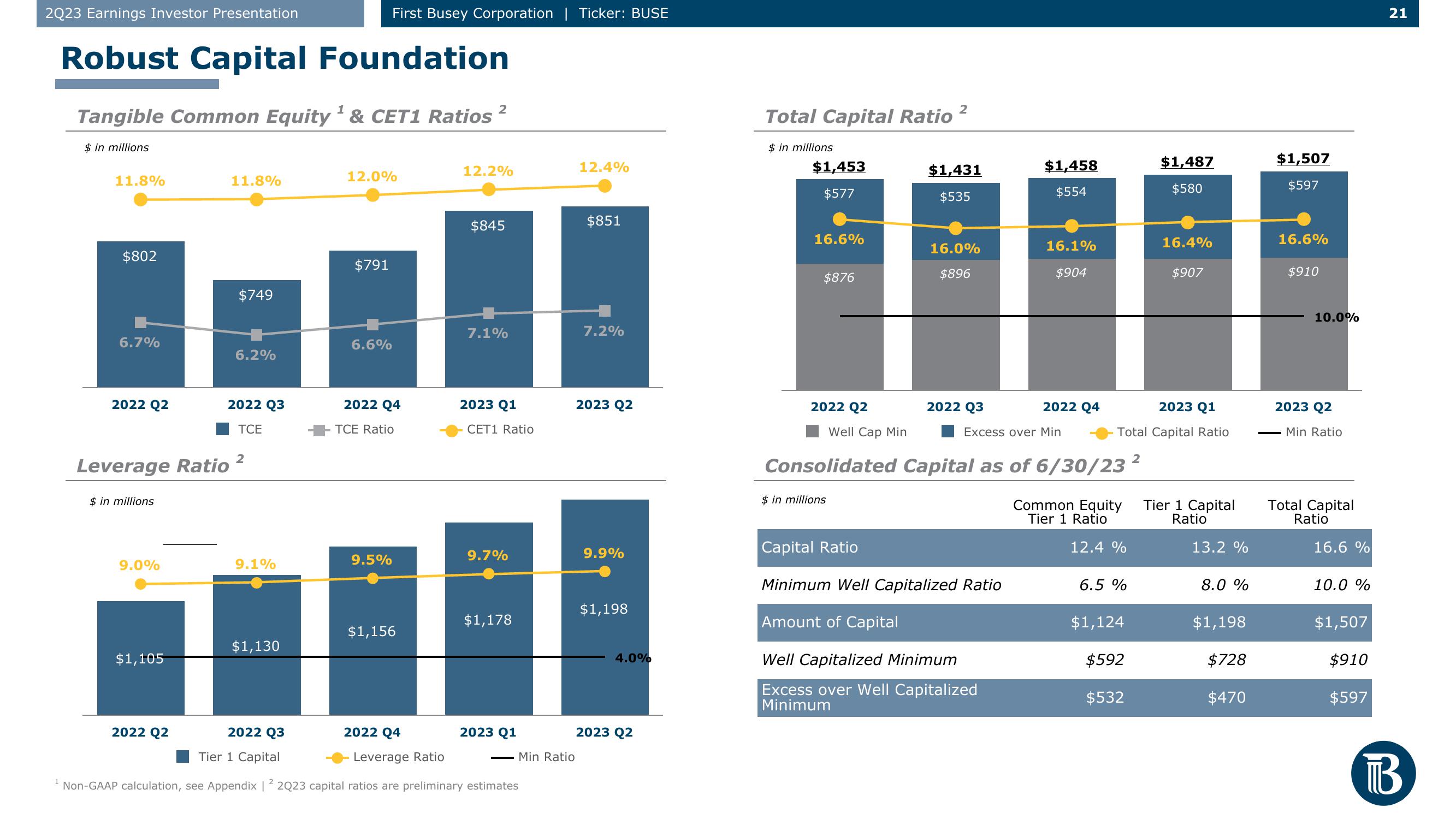

Robust Capital Foundation

Tangible Common Equity & CET1 Ratios

$ in millions

11.8%

$802

6.7%

2022 Q2

Leverage Ratio

$ in millions

9.0%

$1,105

11.8%

2022 Q2

$749

6.2%

2022 Q3

TCE

2

9.1%

$1,130

First Busey Corporation | Ticker: BUSE

12.0%

$791

6.6%

2022 Q4

TCE Ratio

9.5%

$1,156

2

12.2%

$845

7.1%

2023 Q1

CET1 Ratio

9.7%

$1,178

2022 Q3

2022 Q4

Leverage Ratio

Tier 1 Capital

Non-GAAP calculation, see Appendix | 2 2023 capital ratios are preliminary estimates

2023 Q1

- Min Ratio

12.4%

$851

7.2%

2023 Q2

9.9%

$1,198

4.0%

2023 Q2

Total Capital Ratio ²

$ in millions

$1,453

$577

16.6%

$876

2022 Q2

$1,431

$535

$ in millions

16.0%

$896

2022 Q3

Capital Ratio

Minimum Well Capitalized Ratio

Amount of Capital

$1,458

$554

Well Capitalized Minimum

Excess over Well Capitalized

Minimum

16.1%

$904

Well Cap Min

Excess over Min

Consolidated Capital as of 6/30/23²

2022 Q4

2023 Q1

Total Capital Ratio

Common Equity

Tier 1 Ratio

12.4 %

6.5 %

$1,487

$580

$1,124

$592

$532

16.4%

$907

Tier 1 Capital

Ratio

13.2 %

8.0 %

$1,198

$728

$470

$1,507

$597

16.6%

$910

10.0%

2023 Q2

Min Ratio

Total Capital

Ratio

16.6 %

10.0 %

$1,507

$910

$597

21

ТВView entire presentation