Credit Suisse Investment Banking Pitch Book

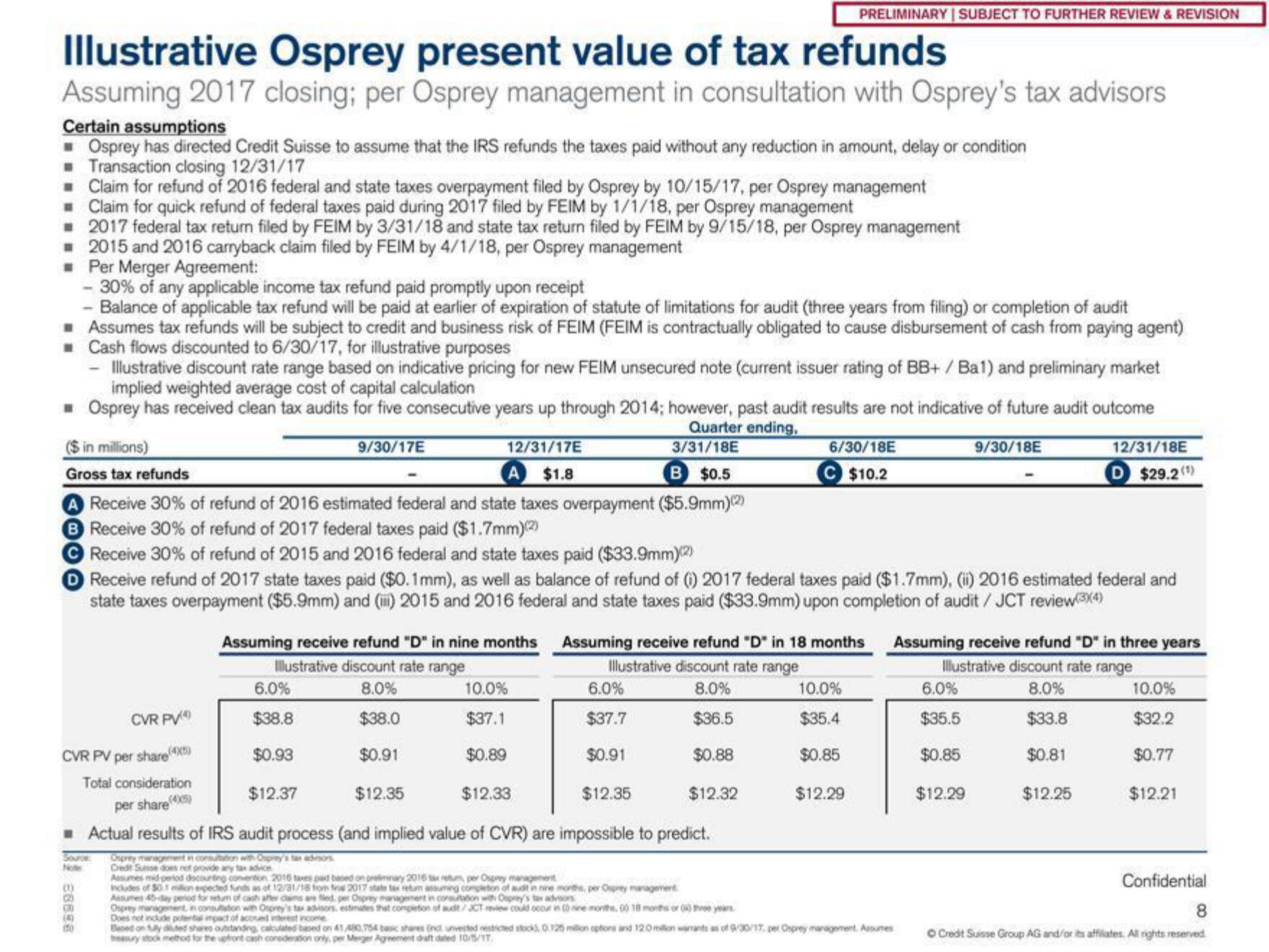

Illustrative Osprey present value of tax refunds

Assuming 2017 closing; per Osprey management in consultation with Osprey's tax advisors

Certain assumptions

Osprey has directed Credit Suisse to assume that the IRS refunds the taxes paid without any reduction in amount, delay or condition

Transaction closing 12/31/17

■ Claim for refund of 2016 federal and state taxes overpayment filed by Osprey by 10/15/17, per Osprey management

Claim for quick refund of federal taxes paid during 2017 filed by FEIM by 1/1/18, per Osprey management

☐ 2017 federal tax return filed by FEIM by 3/31/18 and state tax return filed by FEIM by 9/15/18, per Osprey management

☐ 2015 and 2016 carryback claim filed by FEIM by 4/1/18, per Osprey management

■ Per Merger Agreement:

- 30% of any applicable income tax refund paid promptly upon receipt

- Balance of applicable tax refund will be paid at earlier of expiration of statute of limitations for audit (three years from filing) or completion of audit

■ Assumes tax refunds will be subject to credit and business risk of FEIM (FEIM is contractually obligated to cause disbursement of cash from paying agent)

■ Cash flows discounted to 6/30/17, for illustrative purposes

- Illustrative discount rate range based on indicative pricing for new FEIM unsecured note (current issuer rating of BB+ / Ba1) and preliminary market

implied weighted average cost of capital calculation

■ Osprey has received clean tax audits for five consecutive years up through 2014; however, past audit results are not indicative of future audit outcome

9/30/17E

Quarter ending,

3/31/18E

B $0.5

9/30/18E

12/31/17E

A $1.8

A Receive 30% of refund of 2016 estimated federal and state taxes overpayment ($5.9mm)(2)

8 Receive 30% of refund of 2017 federal taxes paid ($1.7mm)2)

($ in millions)

Gross tax refunds

CVR PV

CVR PV per share (4x)

Total consideration

per share (45)

Receive 30% of refund of 2015 and 2016 federal and state taxes paid ($33.9mm)(2)

O Receive refund of 2017 state taxes paid ($0.1mm), as well as balance of refund of (1) 2017 federal taxes paid ($1.7mm), (ii) 2016 estimated federal and

state taxes overpayment ($5.9mm) and (iii) 2015 and 2016 federal and state taxes paid ($33.9mm) upon completion of audit / JCT review(304)

| 88088

6.0%

6.0%

$38.8

$37.7

$0.93

$0.91

$12.37

$12.33

$12.35

■ Actual results of IRS audit process (and implied value of CVR) are impossible to predict.

Assuming receive refund "D" in nine months

Illustrative discount rate range

8.0%

$38.0

$0.91

Source: Osprey management in consultation with Osprey's tax advisors

Note

(1)

(4)

10.0%

$37.1

$0.89

$12.35

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Assuming receive refund "D" in 18 months

Illustrative discount rate range

8.0%

$36.5

$0.88

6/30/18E

C $10.2

$12.32

10.0%

$35.4

$0.85

$12.29

Assuming receive refund "D" in three years

Illustrative discount rate range

8.0%

$33.8

$0.81

Credit Suisse does not provide any tax advice

Assumes mid-period discourting convention 2016 taxes paid based on preliminary 2016 tax return per Osprey management

Includes of 501 milion expected funds as of 12/31/16 from final 2017 state tax retum assuming completion of audit in nine months, per Osprey management

Assumes 45-day period for retum of cash after claims are fled, per Osprey management in consultation with Osprey's tax advisors

Osprey management, in consultation with Osprey's tax advisors, estimates that completion of audit/CT review could occur in to see months. 00 18 months or (4) three years.

Does not include potential impact of acoued interest income

Based on fully died shares outstanding, calculated based on 41/480,754 basic shares inct unverted restricted stock), 0.125 million options and 120 million wants as of 9/30/17, per Osprey management Assumes

treasury stock method for the uptront cash consideration only, per Merger Agreement draft dated 10/5/17

6.0%

$35.5

$0.85

12/31/18E

D $29.2(1)

$12.29

$12.25

10.0%

$32.2

$0.77

$12.21

Confidential

8

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation