Comcast Results Presentation Deck

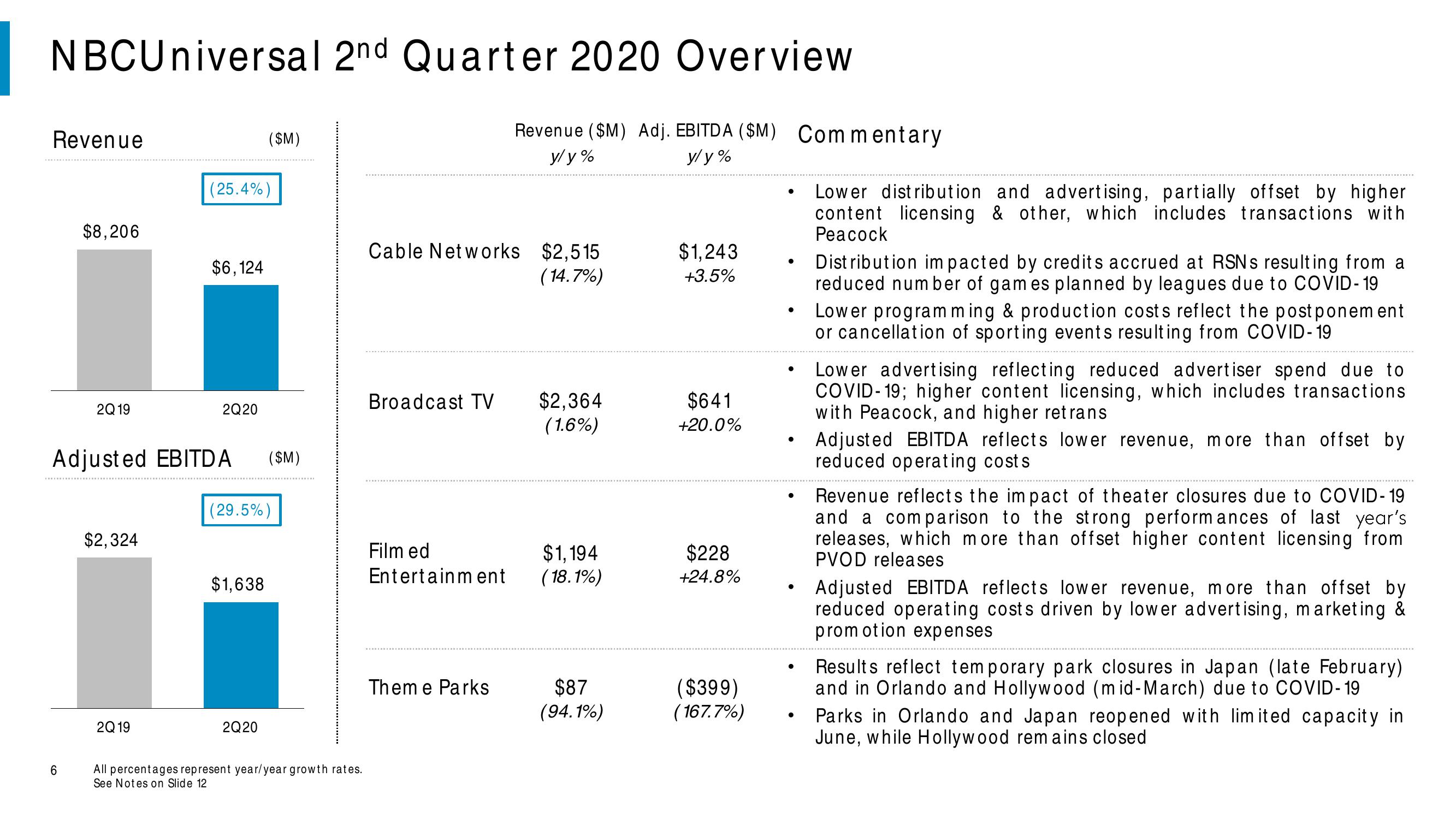

NBCUniversal 2nd Quarter 2020 Overview

Revenue

$8,206

6

2Q 19

$2,324

2Q19

(25.4%)

$6,124

Adjusted EBITDA ($M)

2Q20

($M)

(29.5%)

$1,638

2Q20

All percentages represent year/year growth rates.

See Notes on Slide 12

Cable Networks $2,515

(14.7%)

Revenue ($M) Adj. EBITDA ($M) Commentary

y/y%

y/y%

Broadcast TV $2,364

(1.6%)

Film ed

Entertainment

Theme Parks

$1,194

(18.1%)

$87

(94.1%)

$1,243

+3.5%

$641

+20.0%

$228

+24.8%

($399)

(167.7%)

●

●

●

●

Lower distribution and advertising, partially offset by higher

content licensing & other, which includes transactions with

Peacock

Distribution impacted by credits accrued at RSNs resulting from a

reduced number of games planned by leagues due to COVID-19

Lower programming & production costs reflect the postponement

or cancellation of sporting events resulting from COVID-19

Lower advertising reflecting reduced advertiser spend due to

COVID-19; higher content licensing, which includes transactions

with Peacock, and higher retrans

Adjusted EBITDA reflects lower revenue, more than offset by

reduced operating costs

Revenue reflects the impact of theater closures due to COVID-19

and a comparison to the strong performances of last year's

releases, which more than offset higher content licensing from

PVOD releases

Adjusted EBITDA reflects lower revenue, more than offset by

reduced operating costs driven by lower advertising, marketing &

promotion expenses

Results reflect temporary park closures in Japan (late February)

and in Orlando and Hollywood (mid-March) due to COVID-19

Parks in Orlando and Japan reopened with limited capacity in

June, while Hollywood remains closedView entire presentation