Citi Investment Banking Pitch Book

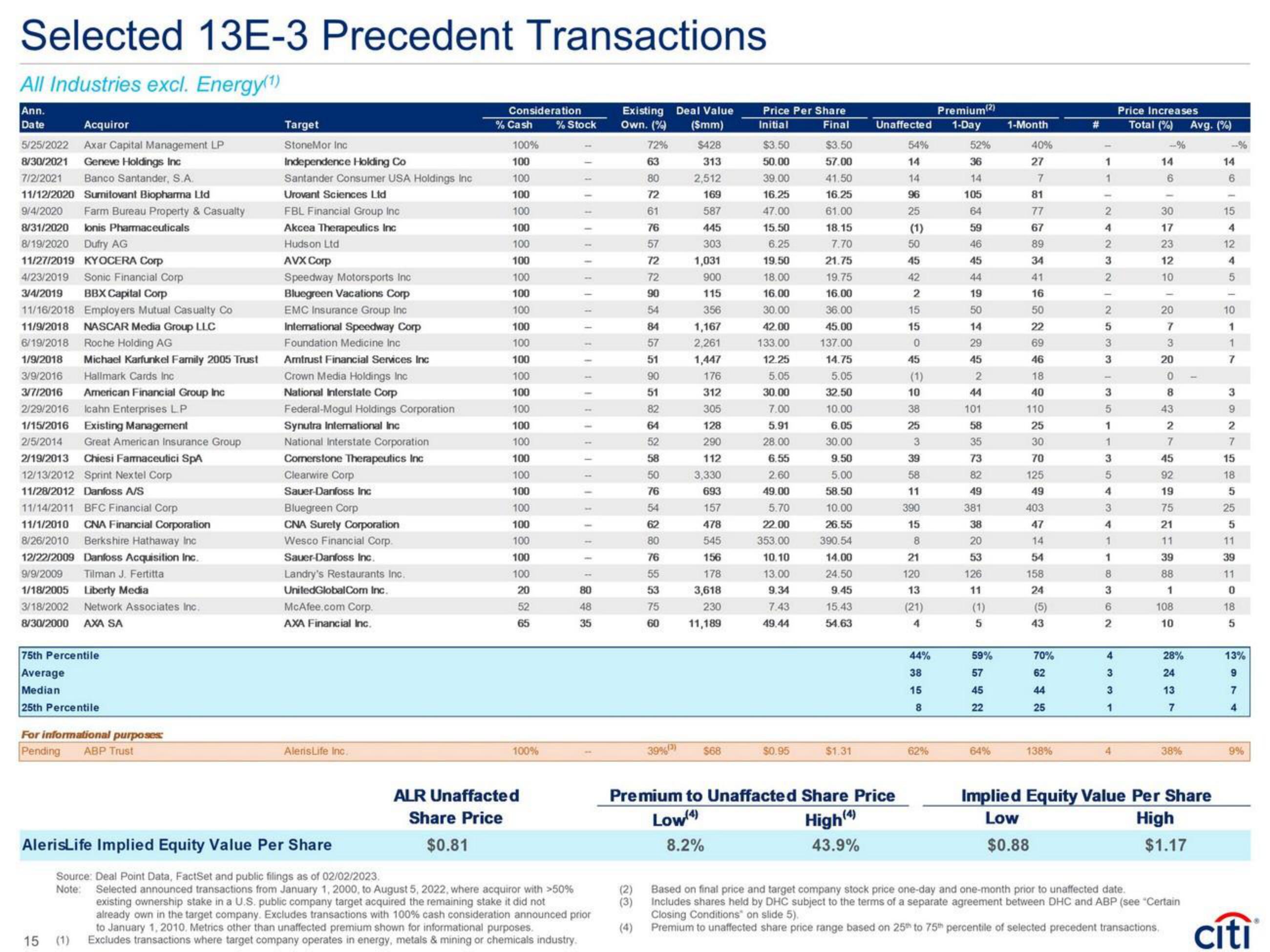

Selected 13E-3 Precedent Transactions

All Industries excl. Energy(¹)

Ann.

Date

Acquiror

5/25/2022 Axar Capital Management LP

8/30/2021 Geneve Holdings Inc

7/2/2021 Banco Santander, S.A.

11/12/2020 Sumitovant Biopharma Ltd

9/4/2020 Farm Bureau Property & Casualty

8/31/2020 konis Pharmaceuticals

8/19/2020 Dufry AG

11/27/2019 KYOCERA Corp

4/23/2019 Sonic Financial Corp

3/4/2019 BBX Capital Corp

11/16/2018 Employers Mutual Casualty Co

11/9/2018 NASCAR Media Group LLC

6/19/2018 Roche Holding AG

1/9/2018 Michael Karfunkel Family 2005 Trust

3/9/2016 Hallmark Cards Inc

3/7/2016 American Financial Group Inc

2/29/2016 Icahn Enterprises LP

1/15/2016 Existing Management

2/5/2014 Great American Insurance Group

2/19/2013 Chiesi Farmaceutici SpA

12/13/2012 Sprint Nextel Corp

11/28/2012 Danfoss A/S

11/14/2011 BFC Financial Corp

11/1/2010 CNA Financial Corporation

8/26/2010 Berkshire Hathaway Inc

12/22/2009 Danfoss Acquisition Inc.

9/9/2009 Tilman J. Fertitta

1/18/2005 Liberty Media

3/18/2002 Network Associates Inc.

8/30/2000 AXA SA

75th Percentile

Average

Median

25th Percentile

For informational purposes:

Pending ABP Trust

15

Target

StoneMor Inc

Independence Holding Co

Santander Consumer USA Holdings Inc

Urovant Sciences Ltd

FBL Financial Group Inc

Akcea Therapeutics Inc

Hudson Ltd

AVX Corp

(1)

Speedway Motorsports Inc

Bluegreen Vacations Corp

EMC Insurance Group Inc

International Speedway Corp

Foundation Medicine Inc

Amtrust Financial Services Inc

Crown Media Holdings Inc

National Interstate Corp

Federal-Mogul Holdings Corporation

Synutra International Inc

National Interstate Corporation

Cornerstone Therapeutics Inc

Clearwire Corp

Sauer-Danfoss Inc

Bluegreen Corp

CNA Surety Corporation

Wesco Financial Corp.

Sauer-Danfoss Inc.

Landry's Restaurants Inc.

UnitedGlobalCom Inc.

McAfee.com Corp.

AXA Financial Inc.

AlerisLife Inc.

Consideration

% Cash

100%

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

100

20

52

65

100%

ALR Unaffacted

Share Price

$0.81

% Stock

AlerisLife Implied Equity Value Per Share

Source: Deal Point Data, FactSet and public filings as of 02/02/2023.

Note: Selected announced transactions from January 1, 2000, to August 5, 2022, where acquiror with > 50%

existing ownership stake in a U.S. public company target acquired the remaining stake it did not

already own in the target company. Excludes transactions with 100% cash consideration announced prior

to January 1, 2010, Metrics other than unaffected premium shown for informational purposes.

Excludes transactions where target company operates in energy, metals & mining or chemicals industry.

80

48

35

Existing Deal Value

Own. (%) (Smm)

72%

63

80

72

61

76

57

72

72

90

54

84

57

51

90

51

82

64

52

58

50

76

54

62

80

76

55

53

75

60

39%(3)

$428

313

2,512

169

587

445

303

1,031

900

115

356

1,167

2,261

1,447

176

312

305

128

290

112

3,330

693

157

478

545

156

178

3,618

230

11,189

$68

Price Per Share

Initial Final

$3.50

57.00

41.50

16.25

61.00

18.15

7.70

$3.50

50.00

39.00

16.25

47.00

15.50

6.25

19.50

18.00

16.00

30.00

42.00

133.00

12.25

5.05

30.00

7.00

5.91

28.00

6.55

2.60

49.00

5.70

22.00

353.00

10.10

13.00

9.34

7.43

49.44

$0.95

21.75

19.75

16.00

36.00

45.00

137.00

14.75

5.05

32.50

10.00

6.05

30.00

9.50

5.00

58.50

10.00

26.55

390.54

14.00

24.50

9.45

15.43

54.63

$1.31

Premium(2)

Unaffected 1-Day 1-Month

Premium to Unaffacted Share Price

Low(4)

8.2%

High (4)

43.9%

54%

14

14

96

25

(1)

50

45

42

2

15

15

0

45

(1)

10

38

25

3

39

58

11

390

15

8

21

120

13

(21)

4

44%

38

15

8

62%

52%

36

14

105

64

59

46

45

44

19

50

14

29

45

2

44

101

58

35

73

82

49

381

38

20

53

126

11

(1)

5

59%

57

45

22

64%

40%

27

7

81

77

67

89

34

16

50

22

69

46

18

40

110

25

30

70

125

49

403

47

14

54

158

24

(5)

43

70%

62

44

25

138%

1

2

4

2

3

2

2

5

3

3

3

5

1

1

3

5

4

3

1

1

8

3

6

2

43

3

1

Price Increases

Total (%) Avg. (%)

14

6

30

17

23

12

10

20

7

3

8

20

0

8

43

2

7

45

92

19

75

21

11

39

88

1

108

10

28%

24

13

7

38%

Implied Equity Value Per Share

Low

High

$1.17

$0.88

Based on final price and target company stock price one-day and one-month prior to unaffected date.

Includes shares held by DHC subject to the terms of a separate agreement between DHC and ABP (see "Certain

Closing Conditions on slide 5).

Premium to unaffected share price range based on 25th to 75th percentile of selected precedent transactions.

14

6

15

4

12

4

5

-

10

1

1

7

392

7

15

18

5

25

5

11

39

11

0

18

5

13%

9

7

4

9%

cítiView entire presentation