Oatly Results Presentation Deck

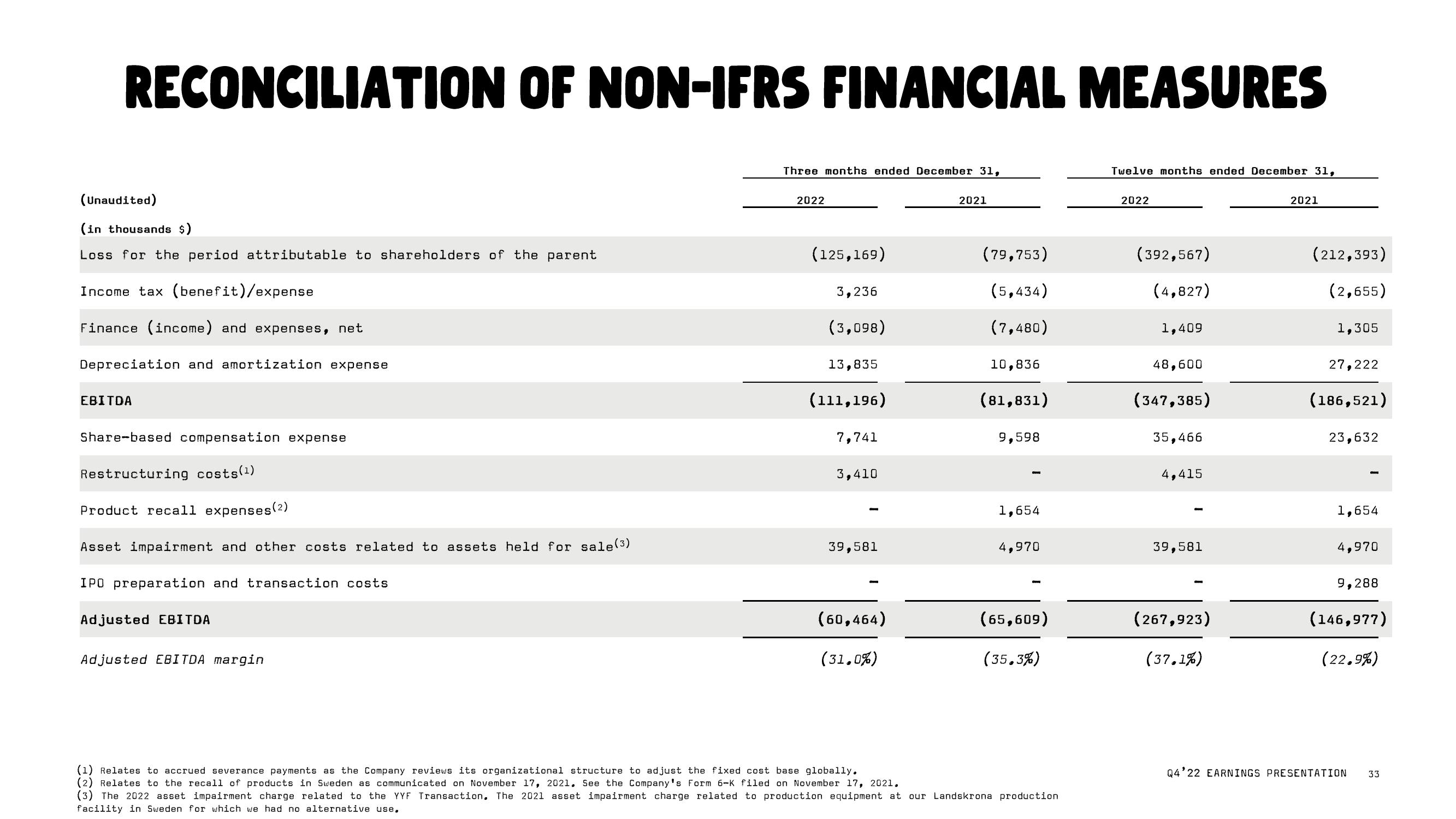

RECONCILIATION OF NON-IFRS FINANCIAL MEASURES

(Unaudited)

(in thousands $)

Loss for the period attributable to shareholders of the parent

Income tax (benefit)/expense

Finance (income) and expenses, net

Depreciation and amortization expense

EBITDA

Share-based compensation expense

Restructuring costs(¹)

Product recall expenses (2)

Asset impairment and other costs related to assets held for sale (³)

IPO preparation and transaction costs

Adjusted EBITDA

Adjusted EBITDA margin

Three months ended December 31,

2022

(125,169)

3,236

(3,098)

13,835

(111,196)

7,741

3,410

39,581

(60,464)

(31.0%)

2021

(79,753)

(5,434)

(7,480)

10,836

(81,831)

9,598

1,654

4,970

(65,609)

(35.3%)

(1) Relates to accrued severance payments as the Company reviews its organizational structure to adjust the fixed cost base globally.

(2) Relates to the recall of products in Sweden as communicated on November 17, 2021. See the Company's Form 6-K filed on November 17, 2021.

(3) The 2022 asset impairment charge related to the YYF Transaction. The 2021 asset impairment charge related to production equipment at our Landskrona production

facility in Sweden for which had no alternative use.

Twelve months ended December 31,

2022

(392,567)

(4,827)

1,409

48,600

(347,385)

35,466

4,415

39,581

(267,923)

(37.1%)

2021

(212,393)

(2,655)

1,305

27,222

(186,521)

23,632

1,654

4,970

9,288

(146,977)

(22.9%)

Q4'22 EARNINGS PRESENTATION 33View entire presentation