IBM Results Presentation Deck

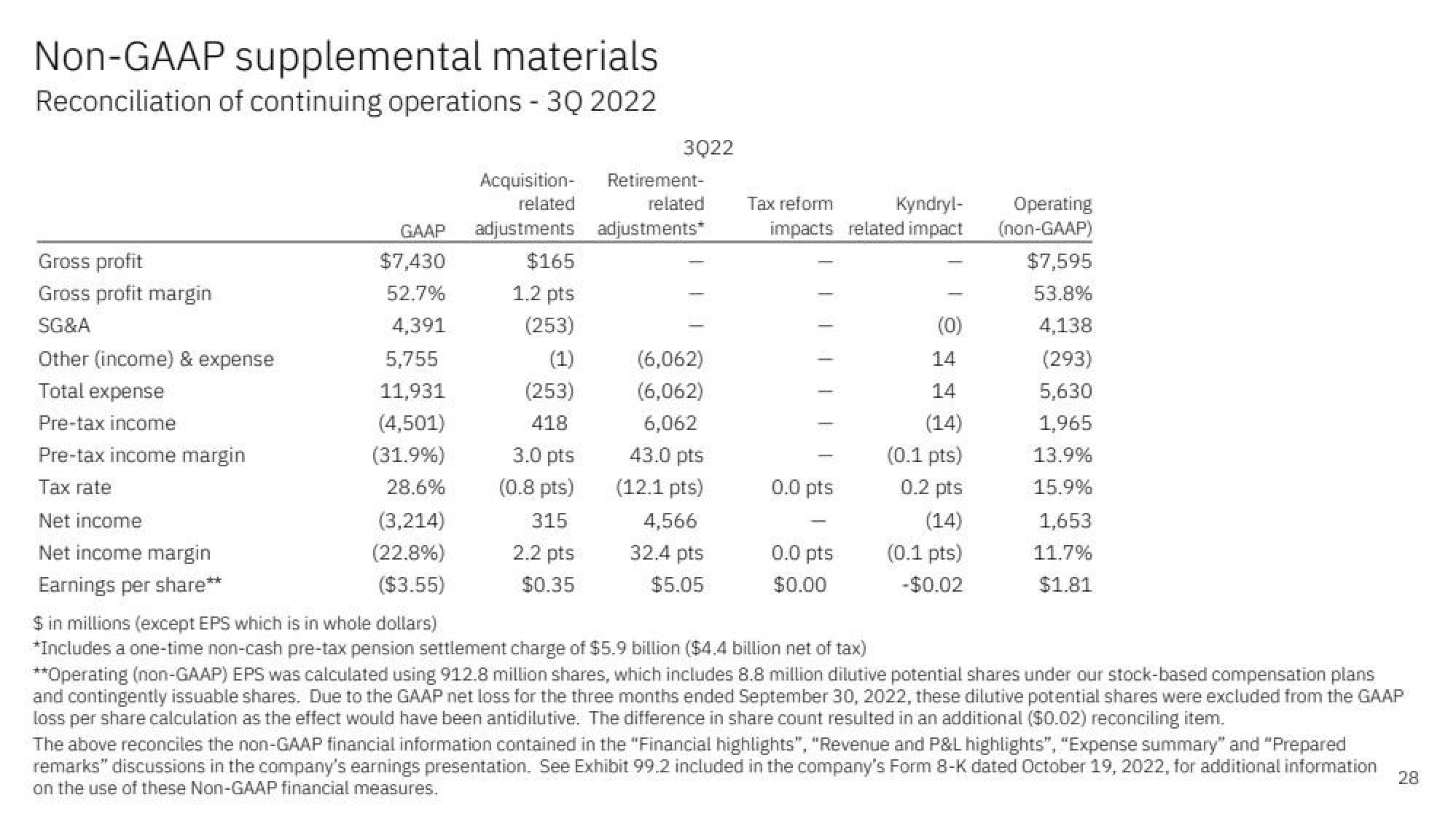

Non-GAAP supplemental materials

Reconciliation of continuing operations - 3Q 2022

Gross profit

Gross profit margin

SG&A

Other (income) & expense

Total expense

Pre-tax income

Pre-tax income margin

Tax rate

Net income

Net income margin

Earnings per share**

GAAP adjustments

$7,430

52.7%

4,391

Acquisition-

related

5,755

11,931

(4,501)

(31.9%)

28.6%

(3,214)

(22.8%)

($3.55)

$165

1.2 pts

(253)

(1)

(253)

418

3.0 pts

(0.8 pts)

315

2.2 pts

$0.35

3022

Retirement-

related

adjustments*

(6,062)

(6,062)

6,062

43.0 pts

(12.1 pts)

4,566

32.4 pts

$5.05

Kyndryl-

impacts related impact

Tax reform

0.0 pts

0.0 pts

$0.00

(0)

14

14

(14)

(0.1 pts)

0.2 pts

(14)

(0.1 pts)

-$0.02

Operating

(non-GAAP)

$7,595

53.8%

4,138

(293)

5,630

1,965

13.9%

15.9%

1,653

11.7%

$1.81

$ in millions (except EPS which is in whole dollars)

*Includes a one-time non-cash pre-tax pension settlement charge of $5.9 billion ($4.4 billion net of tax)

**Operating (non-GAAP) EPS was calculated using 912.8 million shares, which includes 8.8 million dilutive potential shares under our stock-based compensation plans

and contingently issuable shares. Due to the GAAP net loss for the three months ended September 30, 2022, these dilutive potential shares were excluded from the GAAP

loss per share calculation as the effect would have been antidilutive. The difference in share count resulted in an additional ($0.02) reconciling item.

The above reconciles the non-GAAP financial information contained in the "Financial highlights", "Revenue and P&L highlights", "Expense summary" and "Prepared

remarks" discussions in the company's earnings presentation. See Exhibit 99.2 included in the company's Form 8-K dated October 19, 2022, for additional information

on the use of these Non-GAAP financial measures.

28View entire presentation