WeWork Restructuring Presentation Deck

Transaction Term Sheet (Cont'd)

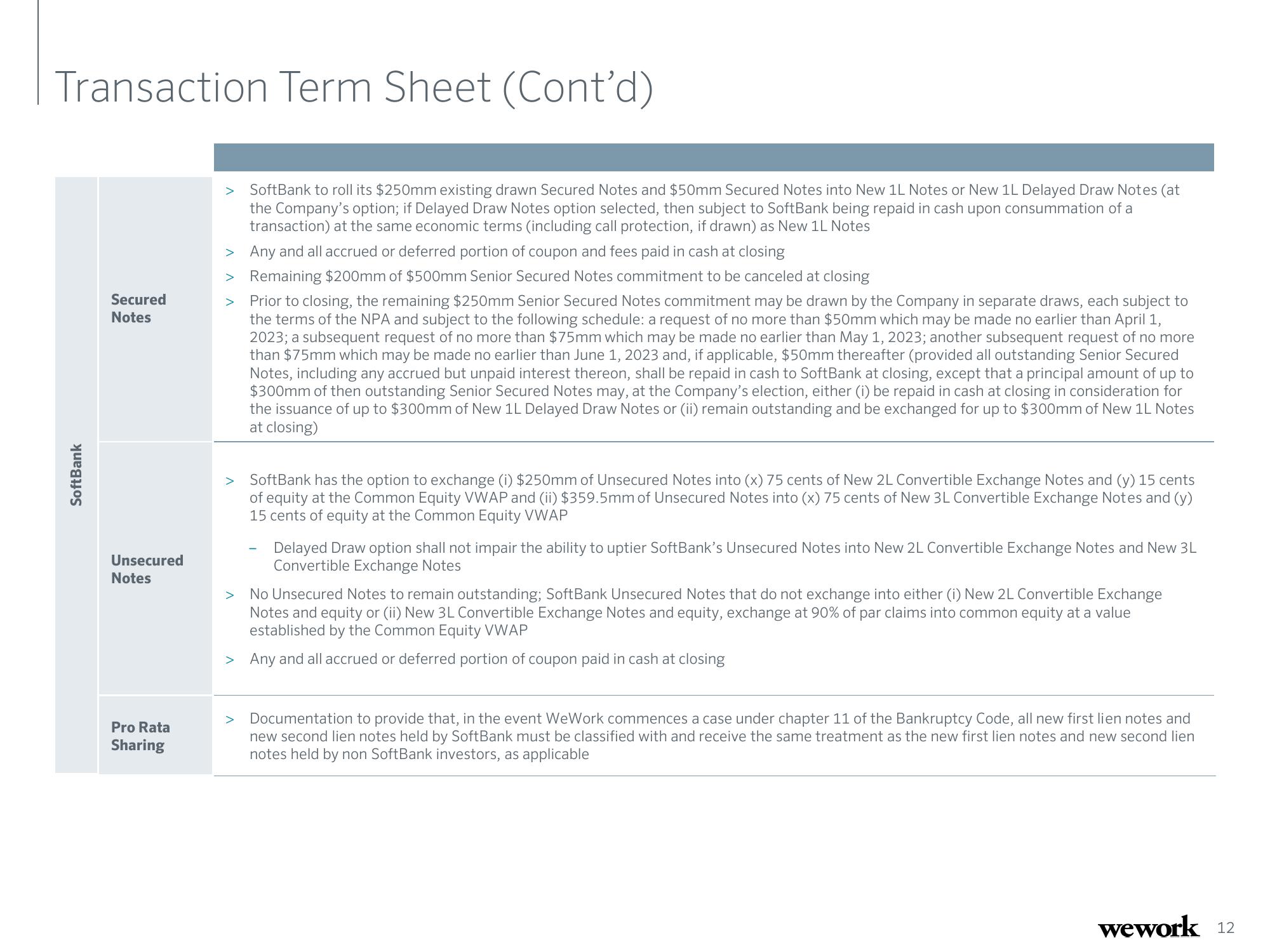

SoftBank

Secured

Notes

Unsecured

Notes

Pro Rata

Sharing

>

>

SoftBank to roll its $250mm existing drawn Secured Notes and $50mm Secured Notes into New 1L Notes or New 1L Delayed Draw Notes (at

the Company's option; if Delayed Draw Notes option selected, then subject to SoftBank being repaid in cash upon consummation of a

transaction) at the same economic terms (including call protection, if drawn) as New 1L Notes

Any and all accrued or deferred portion of coupon and fees paid in cash at closing

Remaining $200mm of $500mm Senior Secured Notes commitment to be canceled at closing

Prior to closing, the remaining $250mm Senior Secured Notes commitment may be drawn by the Company in separate draws, each subject to

the terms of the NPA and subject to the following schedule: a request of no more than $50mm which may be made no earlier than April 1,

2023; a subsequent request of no more than $75mm which may be made no earlier than May 1, 2023; another subsequent request of no more

than $75mm which may be made no earlier than June 1, 2023 and, if applicable, $50mm thereafter (provided all outstanding Senior Secured

Notes, including any accrued but unpaid interest thereon, shall be repaid in cash to SoftBank at closing, except that a principal amount of up to

$300mm of then outstanding Senior Secured Notes may, at the Company's election, either (i) be repaid in cash at closing in consideration for

the issuance of up to $300mm of New 1L Delayed Draw Notes or (ii) remain outstanding and be exchanged for up to $300mm of New 1L Notes

at closing)

> SoftBank has the option to exchange (i) $250mm of Unsecured Notes into (x) 75 cents of New 2L Convertible Exchange Notes and (y) 15 cents

of equity at the Common Equity VWAP and (ii) $359.5mm of Unsecured Notes into (x) 75 cents of New 3L Convertible Exchange Notes and (y)

15 cents of equity at the Common Equity VWAP

Delayed Draw option shall not impair the ability to uptier SoftBank's Unsecured Notes into New 2L Convertible Exchange Notes and New 3L

Convertible Exchange Notes

No Unsecured Notes to remain outstanding; SoftBank Unsecured Notes that do not exchange into either (i) New 2L Convertible Exchange

Notes and equity or (ii) New 3L Convertible Exchange Notes and equity, exchange at 90% of par claims into common equity at a value

established by the Common Equity VWAP

> Any and all accrued or deferred portion of coupon paid in cash at closing

Documentation to provide that, in the event WeWork commences a case under chapter 11 of the Bankruptcy Code, all new first lien notes and

new second lien notes held by SoftBank must be classified with and receive the same treatment as the new first lien notes and new second lien

notes held by non SoftBank investors, as applicable

wework 12View entire presentation