AG Direct Lending SMA

ANGELO

GORDON

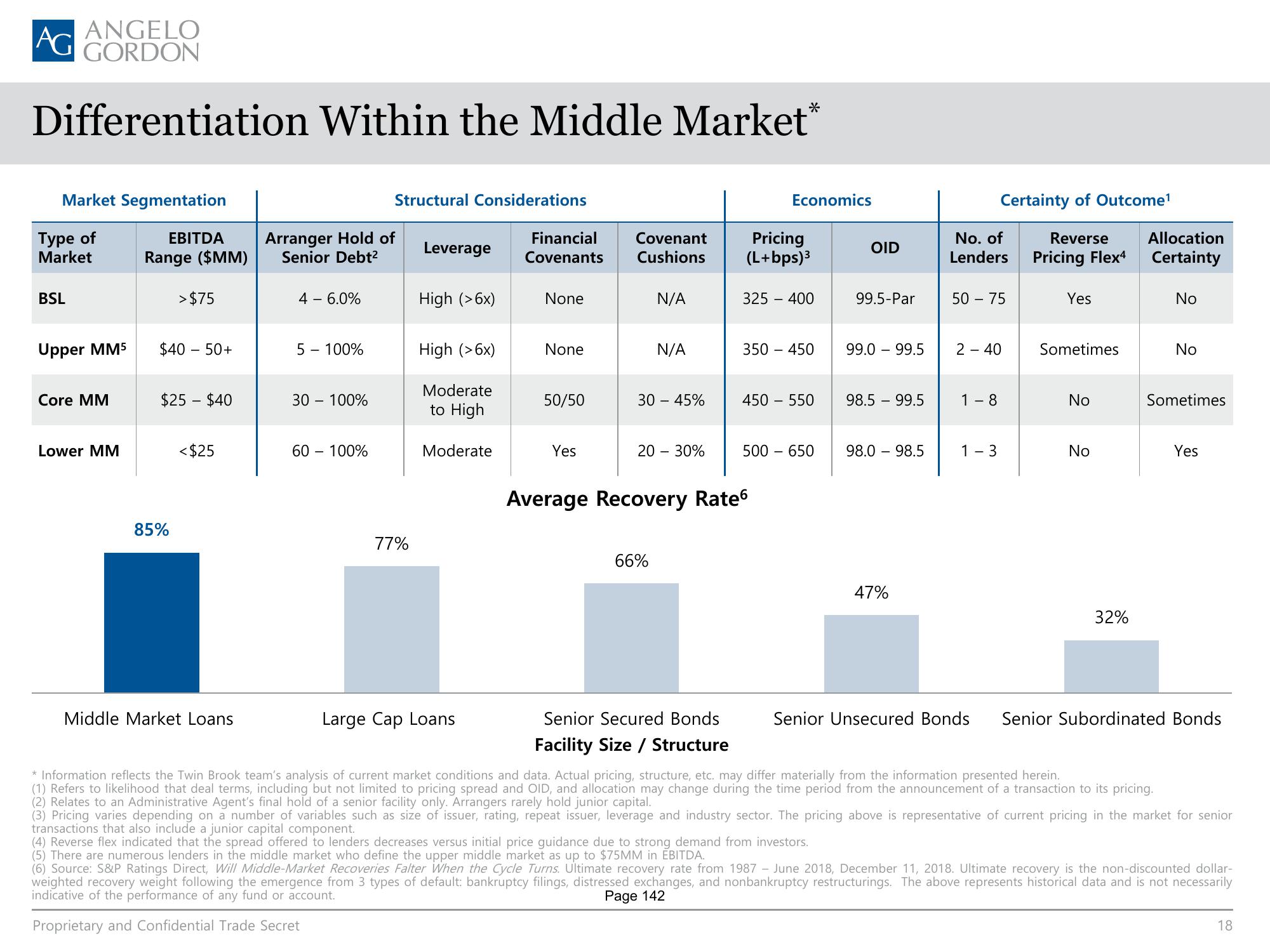

Differentiation Within the Middle Market*

Market Segmentation

Type of

Market

BSL

Upper MM5

Core MM

Lower MM

EBITDA

Range ($MM)

>$75

$40 - 50+

$25 - $40

85%

<$25

Middle Market Loans

Arranger Hold of

Senior Debt²

4 - 6.0%

5 - 100%

30 - 100%

Structural Considerations

60 - 100%

77%

Leverage

High (>6x)

High (>6x)

Moderate

to High

Moderate

Large Cap Loans

Financial

Covenants

None

None

50/50

Yes

Covenant

Cushions

N/A

N/A

30-45%

20 - 30%

66%

Average Recovery Rate

Senior Secured Bonds

Facility Size / Structure

Economics

Pricing

(L+bps) ³

325 - 400

350 - 450

450-550

500 - 650

OID

99.5-Par

99.0 - 99.5

98.5 - 99.5

98.0 - 98.5

47%

No. of

Lenders

Certainty of Outcome¹

Reverse

Pricing Flex4

50 - 75

2 - 40

1-8

1-3

Yes

Sometimes

No

No

32%

Allocation

Certainty

No

No

Sometimes

Yes

Senior Unsecured Bonds Senior Subordinated Bonds

* Information reflects the Twin Brook team's analysis of current market conditions and data. Actual pricing, structure, etc. may differ materially from the information presented herein.

(1) Refers to likelihood that deal terms, including but not limited to pricing spread and OID, and allocation may change during the time period from the announcement of a transaction to its pricing.

(2) Relates to an Administrative Agent's final hold of a senior facility only. Arrangers rarely hold junior capital.

(3)

varies depending on a number of variables such as size of issuer, rating, repeat issuer, leverage and ind sector. The pricing above is representative of current pricing in the market for senior

transactions that also include a junior capital component.

(4) Reverse flex indicated that the spread offered to lenders decreases versus initial price guidance due to strong demand from investors.

(5) There are numerous lenders in the middle market who define the upper middle market as up to $75MM in EBITDA.

(6) Source: S&P Ratings Direct, Will Middle-Market Recoveries Falter When the Cycle Turns. Ultimate recovery rate from 1987 - June 2018, December 11, 2018. Ultimate recovery is the non-discounted dollar-

weighted recovery weight following the emergence from 3 types of default: bankruptcy filings, distressed exchanges, and nonbankruptcy restructurings. The above represents historical data and is not necessarily

indicative of the performance of any fund or account.

Page 142

Proprietary and Confidential Trade Secret

18View entire presentation