Maersk Investor Presentation Deck

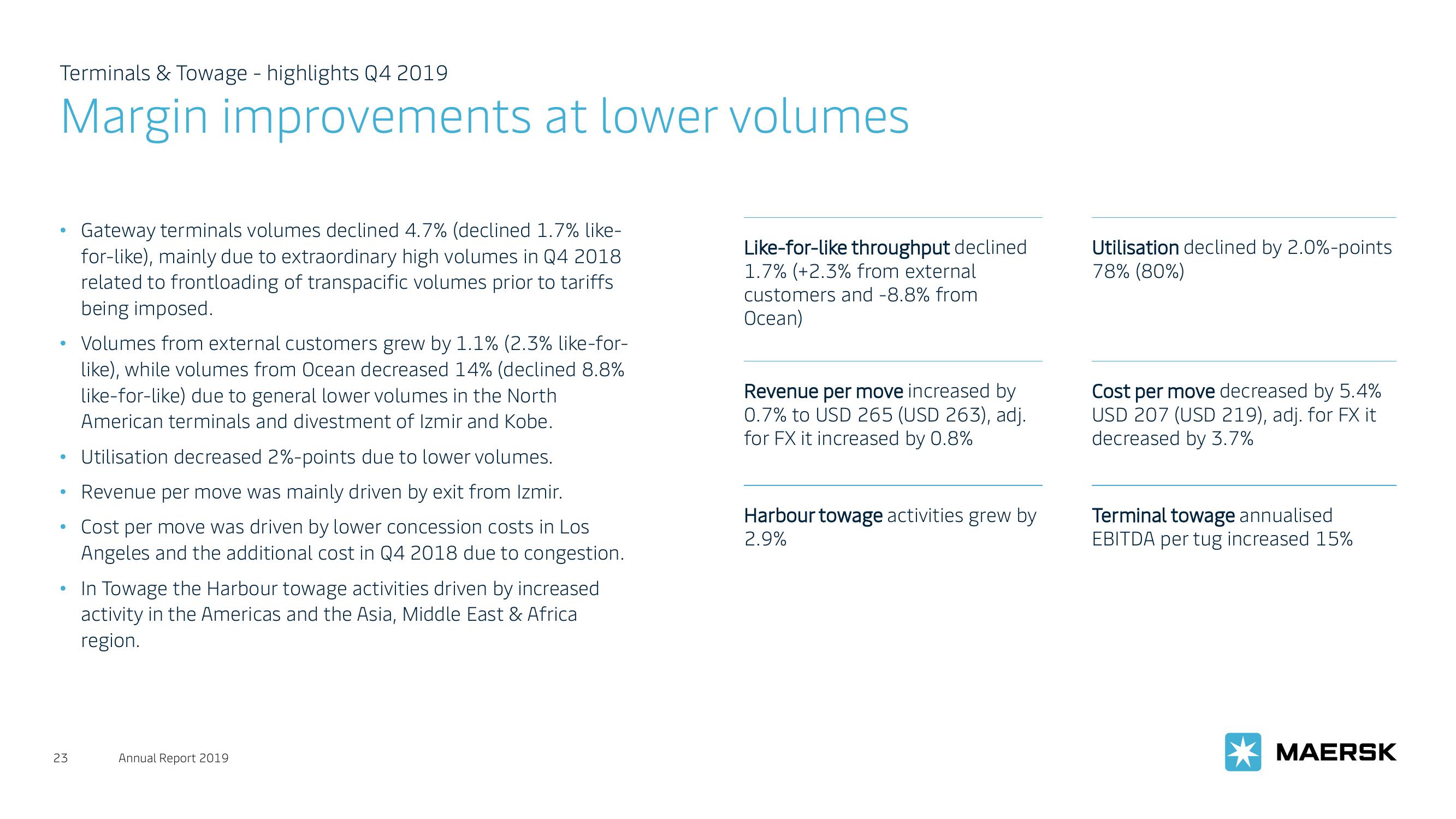

Terminals & Towage - highlights Q4 2019

Margin improvements at lower volumes

●

●

●

●

●

23

Gateway terminals volumes declined 4.7% (declined 1.7% like-

for-like), mainly due to extraordinary high volumes in Q4 2018

related to frontloading of transpacific volumes prior to tariffs

being imposed.

Volumes from external customers grew by 1.1% (2.3% like-for-

like), while volumes from Ocean decreased 14% (declined 8.8%

like-for-like) due to general lower volumes in the North

American terminals and divestment of Izmir and Kobe.

Utilisation decreased 2%-points due to lower volumes.

Revenue per move was mainly driven by exit from Izmir.

Cost per move was driven by lower concession costs in Los

Angeles and the additional cost in Q4 2018 due to congestion.

In Towage the Harbour towage activities driven by increased

activity in the Americas and the Asia, Middle East & Africa

region.

Annual Report 2019

Like-for-like throughput declined

1.7% (+2.3% from external

customers and -8.8% from

Ocean)

Revenue per move increased by

0.7% to USD 265 (USD 263), adj.

for FX it increased by 0.8%

Harbour towage activities grew by

2.9%

Utilisation declined by 2.0%-points

78% (80%)

Cost per move decreased by 5.4%

USD 207 (USD 219), adj. for FX it

decreased by 3.7%

Terminal towage annualised

EBITDA per tug increased 15%

MAERSKView entire presentation