TPG Investor Presentation Deck

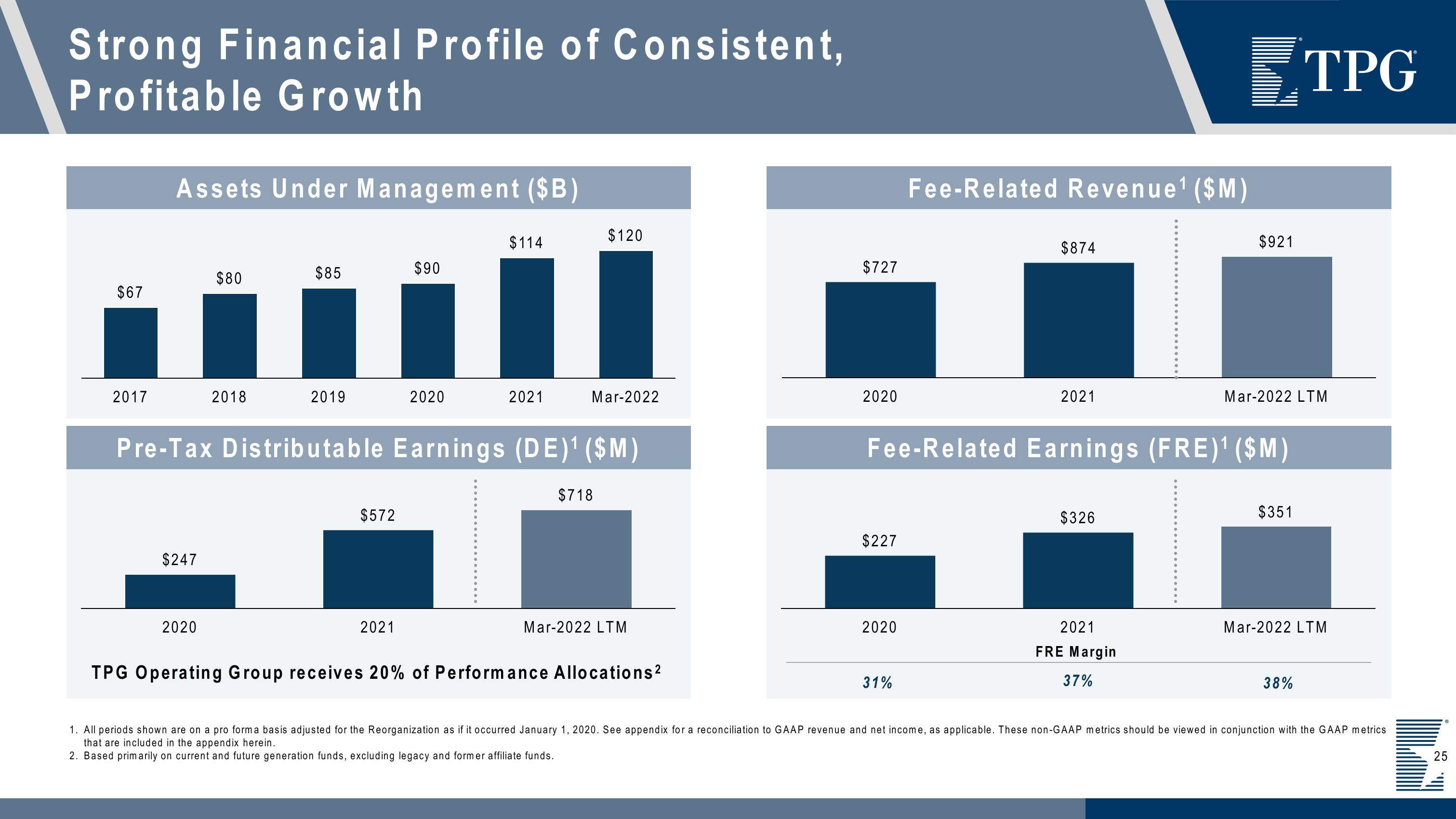

Strong Financial Profile of Consistent,

Profitable Growth

$67

2017

Assets Under Management ($B)

$247

$80

2020

2018

$85

2019

$572

$90

2021

2020

$114

Pre-Tax Distributable Earnings (DE)¹ ($M)

2021

$120

Mar-2022

$718

Mar-2022 LTM

TPG Operating Group receives 20% of Performance Allocations ²

$727

2020

$227

2020

Fee-Related Revenue ¹ ($M)

31%

$874

2021

Fee-Related Earnings (FRE)¹ ($M)

$326

$921

2021

FRE Margin

37%

Mar-2022 LTM

$351

TPG

Mar-2022 LTM

38%

1. All periods shown are on a pro form a basis adjusted for the Reorganization as if it occurred January 1, 2020. See appendix for a reconciliation to GAAP revenue and net income, as applicable. These non-GAAP metrics should be viewed in conjunction with the GAAP metrics

that are included in the appendix herein.

2. Based primarily on current and future generation funds, excluding legacy and former affiliate funds.

25View entire presentation