Masterworks Investor Presentation Deck

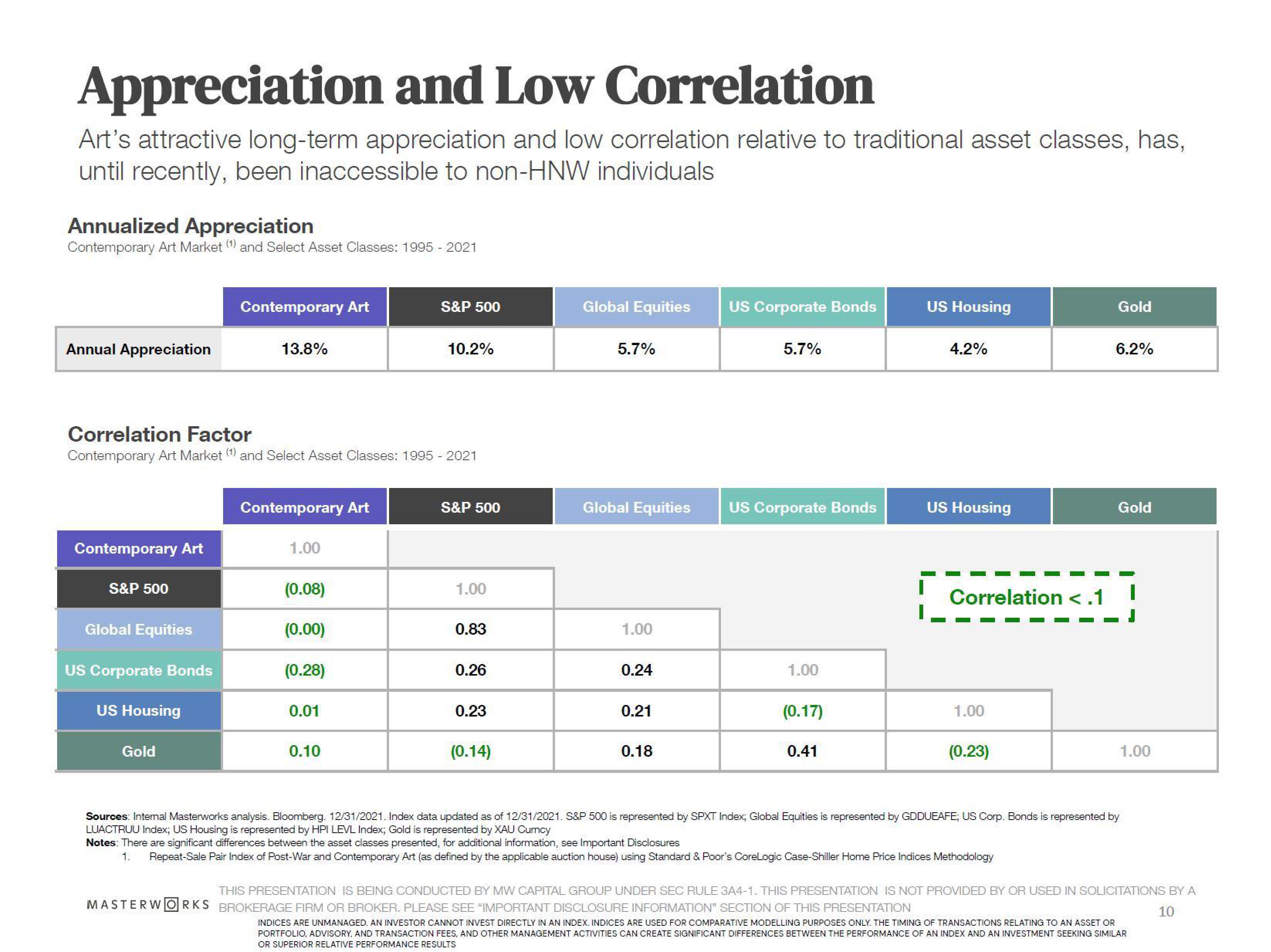

Appreciation and Low Correlation

Art's attractive long-term appreciation and low correlation relative to traditional asset classes, has,

until recently, been inaccessible to non-HNW individuals

Annualized Appreciation

Contemporary Art Market (¹) and Select Asset Classes: 1995 - 2021

Annual Appreciation

Contemporary Art

S&P 500

Global Equities

Correlation Factor

Contemporary Art Market (1) and Select Asset Classes: 1995 - 2021

US Corporate Bonds

US Housing

Contemporary Art

Gold

13.8%

Contemporary Art

1.00

(0.08)

(0.00)

(0.28)

0.01

S&P 500

0.10

10.2%

S&P 500

1.00

0.83

0.26

0.23

(0.14)

Global Equities

5.7%

Global Equities

1.00

0.24

0.21

0.18

US Corporate Bonds

5.7%

US Corporate Bonds

1.00

(0.17)

0.41

US Housing

4.2%

MASTERWORKS BROKERAGE FIRM OR BROKER. PLEASE SEE "IMPORTANT DISCLOSURE INFORMATION" SECTION OF THIS PRESENTATION

US Housing

Correlation <.1

1.00

(0.23)

Gold

6.2%

Gold

Sources: Internal Masterworks analysis. Bloomberg. 12/31/2021. Index data updated as of 12/31/2021. S&P 500 is represented by SPXT Index, Global Equities is represented by GDDUEAFE; US Corp. Bonds is represented by

LUACTRUU Index; US Housing is represented by HPI LEVL Index; Gold is represented by XAU Curncy

Notes: There are significant differences between the asset classes presented, for additional information, see Important Disclosures

1. Repeat-Sale Pair Index of Post-War and Contemporary Art (as defined by the applicable auction house) using Standard & Poor's CoreLogic Case-Shiller Home Price Indices Methodology

1.00

THIS PRESENTATION IS BEING CONDUCTED BY MW CAPITAL GROUP UNDER SEC RULE 3A4-1. THIS PRESENTATION IS NOT PROVIDED BY OR USED IN SOLICITATIONS BY A

10

INDICES ARE UNMANAGED. AN INVESTOR CANNOT INVEST DIRECTLY IN AN INDEX. INDICES ARE USED FOR COMPARATIVE MODELLING PURPOSES ONLY. THE TIMING OF TRANSACTIONS RELATING TO AN ASSET OR

PORTFOLIO, ADVISORY, AND TRANSACTION FEES, AND OTHER MANAGEMENT ACTIVITIES CAN CREATE SIGNIFICANT DIFFERENCES BETWEEN THE PERFORMANCE OF AN INDEX AND AN INVESTMENT SEEKING SIMILAR

OR SUPERIOR RELATIVE PERFORMANCE RESULTSView entire presentation