Volta SPAC Presentation Deck

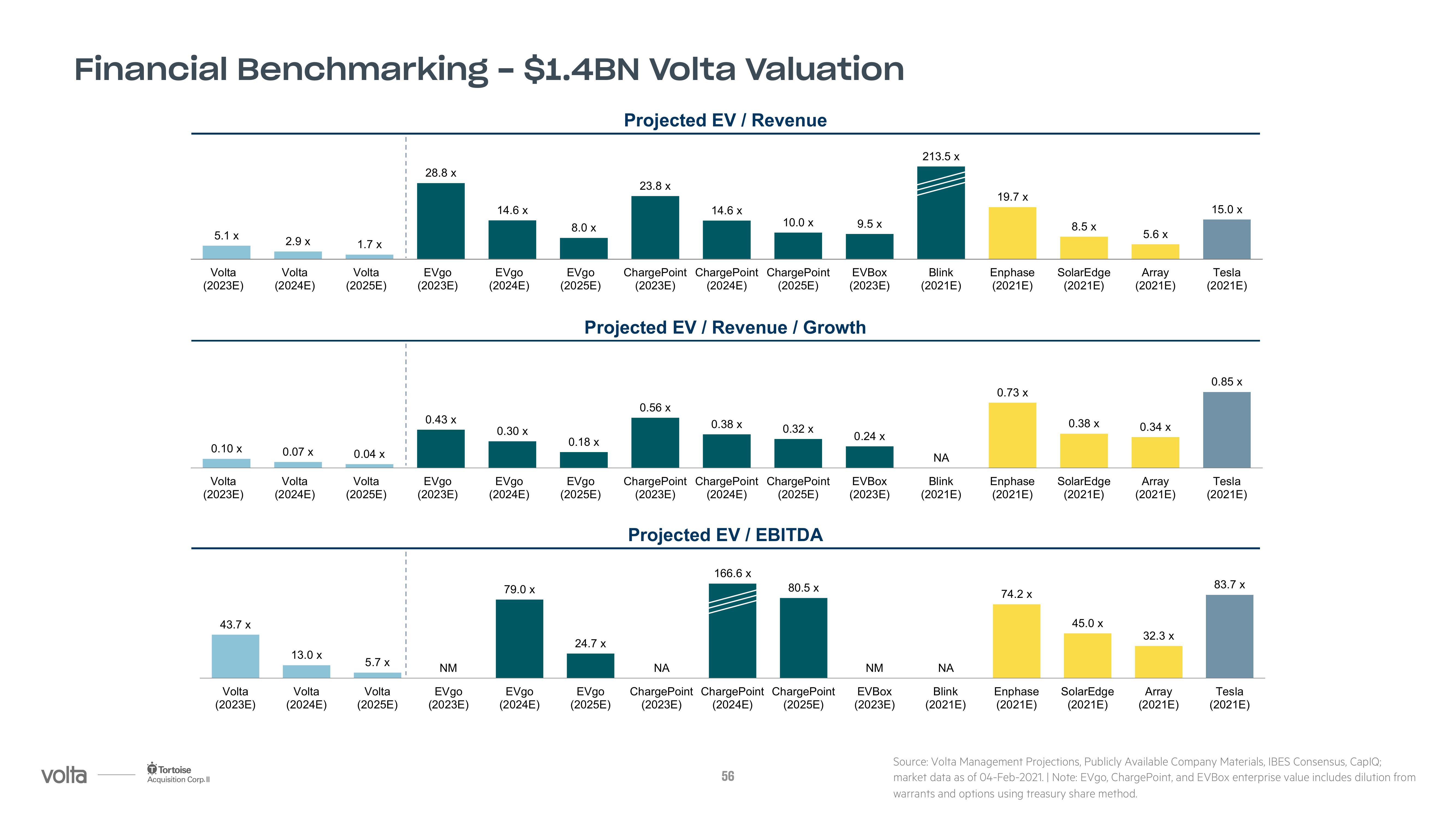

Financial Benchmarking - $1.4BN Volta Valuation

volta

5.1 x

Volta

(2023E)

0.10 x

Volta

(2023E)

Tortoise

Acquisition Corp.ll

43.7 x

Volta

(2023E)

2.9 x

Volta

(2024E)

0.07 x

Volta

(2024E)

13.0 x

Volta

(2024E)

1.7 x

Volta

(2025E)

0.04 x

Volta

(2025E)

5.7 x

Volta

(2025E)

28.8 x

EVgo

(2023E)

0.43 x

14.6 x

EVgo

(2024E)

0.30 x

79.0 x

8.0 x

NM

EVgo

EVgo

(2023E) (2024E)

EVgo

(2025E)

EVgo

EVgo

EVgo

(2023E) (2024E) (2025E)

0.18 x

24.7 x

Projected EV / Revenue

ChargePoint ChargePoint ChargePoint

(2023E) (2024E) (2025E)

Projected EV / Revenue / Growth

EVgo

(2025E)

23.8 x

14.6 x

0.56 x

0.38 x

10.0 x

166.6 x

ChargePoint ChargePoint ChargePoint

(2023E) (2024E) (2025E)

Projected EV / EBITDA

0.32 x

56

80.5 x

ΝΑ

ChargePoint ChargePoint ChargePoint

(2023E) (2024E) (2025E)

9.5 x

EVBox

(2023E)

0.24 x

213.5 x

NM

EVBOX

(2023E)

Blink

(2021E)

ΝΑ

EVBox

Blink

(2023E) (2021E)

19.7 x

Enphase

(2021E)

0.73 x

Enphase

(2021E)

74.2 x

8.5 x

SolarEdge

(2021E)

0.38 x

SolarEdge

(2021E)

45.0 x

5.6 x

Array

(2021E)

0.34 x

Array

(2021E)

32.3 x

ΝΑ

Blink

Enphase SolarEdge Array

(2021E) (2021E) (2021E) (2021E)

15.0 x

Tesla

(2021E)

0.85 x

Tesla

(2021E)

83.7 x

Tesla

(2021E)

Source: Volta Management Projections, Publicly Available Company Materials, IBES Consensus, CaplQ;

market data as of 04-Feb-2021. | Note: EVgo, ChargePoint, and EVBox enterprise value includes dilution from

warrants and options using treasury share method.View entire presentation