Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION (cont'd)

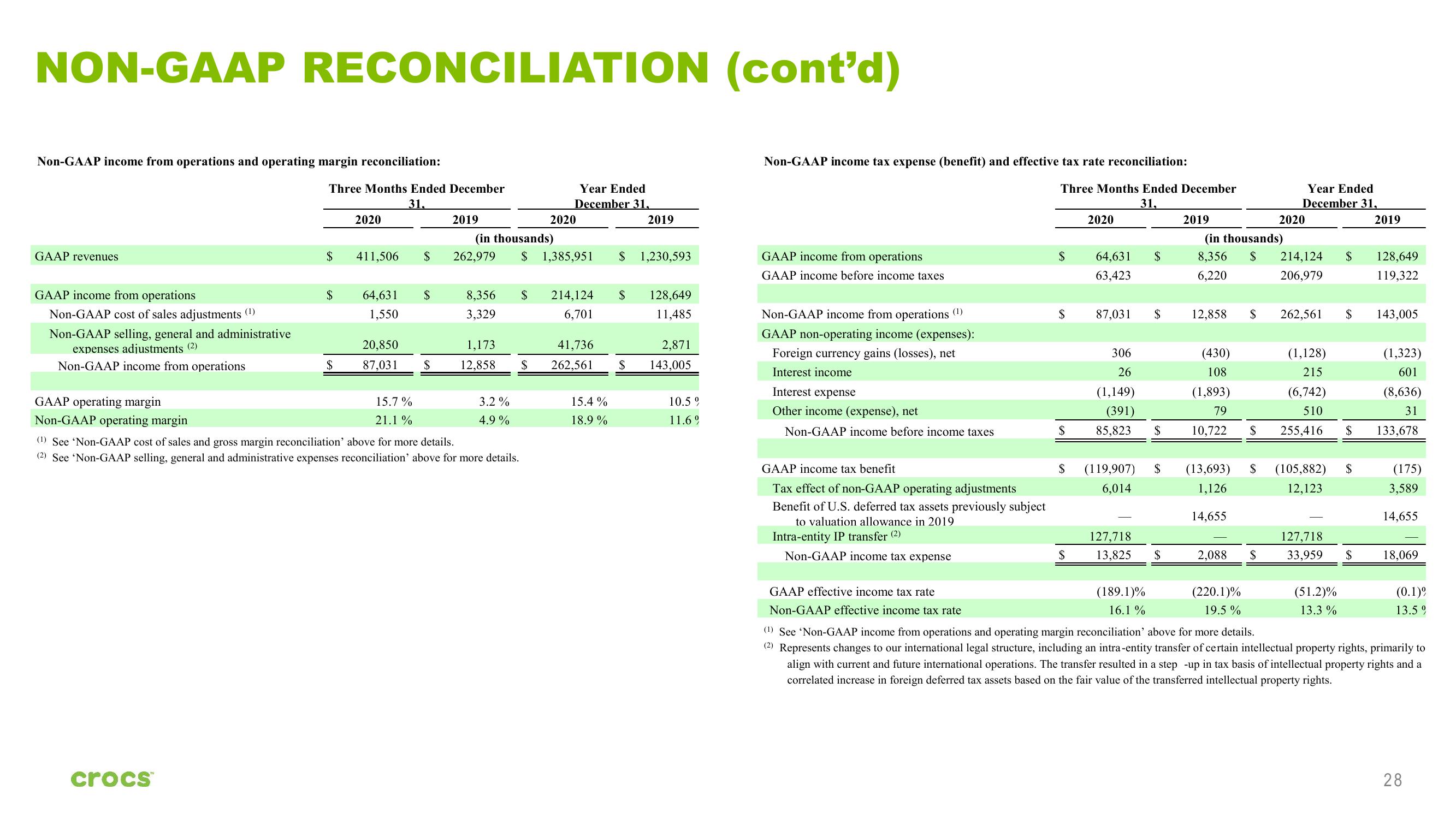

Non-GAAP income from operations and operating margin reconciliation:

GAAP revenues

GAAP income from operations

Non-GAAP cost of sales adjustments (1)

Non-GAAP selling, general and administrative

expenses adjustments (2)

Non-GAAP income from operations

Three Months Ended December

31.

crocs™

$

$

$

2020

411,506

64,631 $

1,550

20,850

87,031

$

15.7%

21.1%

2019

8,356

3,329

GAAP operating margin

Non-GAAP operating margin

(1) See 'Non-GAAP cost of sales and gross margin reconciliation' above for more details.

(2) See 'Non-GAAP selling, general and administrative expenses reconciliation' above for more details.

1,173

$ 12,858

(in thousands)

262,979 $ 1,385,951 $ 1,230,593

3.2%

4.9%

$

Year Ended

December 31,

$

2020

214,124 $

6,701

41,736

262,561

2019

15.4%

18.9%

128,649

11,485

2,871

$ 143,005

10.5 9

11.6%

Non-GAAP income tax expense (benefit) and effective tax rate reconciliation:

GAAP income from operations

GAAP income before income taxes

Non-GAAP income from operations (¹)

GAAP non-operating income (expenses):

Foreign currency gains (losses), net

Interest income

Interest expense

Other income (expense), net

Non-GAAP income before income taxes

GAAP income tax benefit

Tax effect of non-GAAP operating adjustments

Benefit of U.S. deferred tax assets previously subject

to valuation allowance in 2019

Intra-entity IP transfer (2)

Non-GAAP income tax expense

GAAP effective income tax rate

Non-GAAP effective income tax rate

Three Months Ended December

31,

$

$

$

2020

64,631 $

63,423

87,031

306

26

(1,149)

(391)

85,823

(119,907)

6,014

127,718

13,825

(189.1)%

16.1%

$

$

$

$

2019

12,858

(in thousands)

8,356 $ 214,124 $

6,220

206,979

(430)

108

(1,893)

79

10,722

2,088

$

(13,693) $

1,126

14,655

(220.1)%

19.5%

Year Ended

December 31,

2019

2020

$

262,561

(1,128)

215

(6,742)

510

$ 255,416 $

(105,882)

12,123

127,718

33,959

$

(51.2)%

13.3%

$

$

128,649

119,322

143,005

(1,323)

601

(8,636)

31

133,678

(175)

3,589

14,655

18,069

(0.1)⁰

13.5 9

(¹) See 'Non-GAAP income from operations and operating margin reconciliation' above for more details.

(2) Represents changes to our international legal structure, including an intra-entity transfer of certain intellectual property rights, primarily to

align with current and future international operations. The transfer resulted in a step-up in tax basis of intellectual property rights and a

correlated increase in foreign deferred tax assets based on the fair value of the transferred intellectual property rights.

28View entire presentation