SoftBank Results Presentation Deck

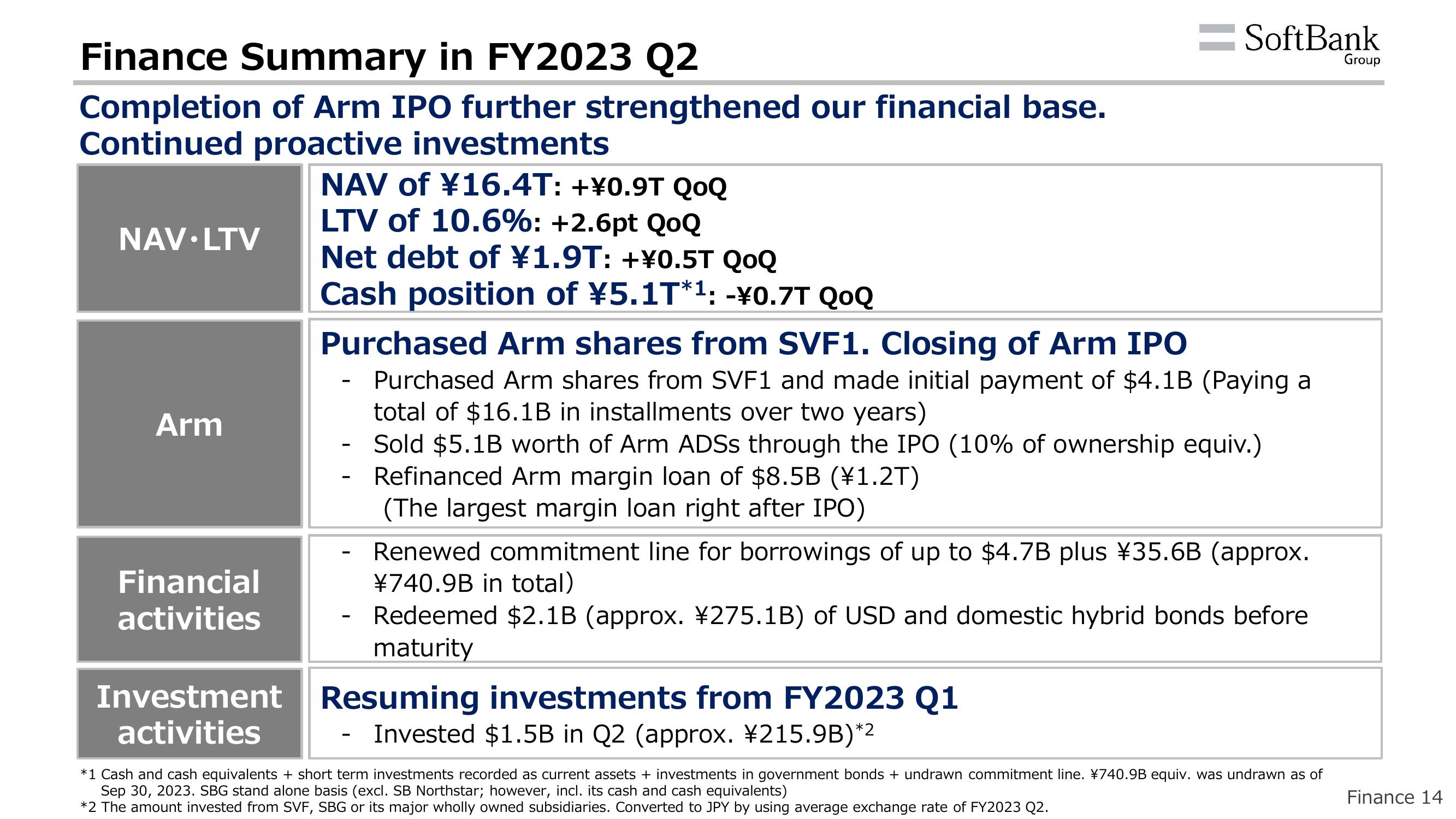

Finance Summary in FY2023 Q2

Completion of Arm IPO further strengthened our financial base.

Continued proactive investments

NAV.LTV

Arm

Financial

activities

Investment

activities

NAV of ¥16.4T: +¥0.9T QOQ

LTV of 10.6%: +2.6pt QoQ

Net debt of ¥1.9T: +¥0.5T QOQ

Cash position of ¥5.1T*¹: -¥0.7T QOQ

Purchased Arm shares from SVF1. Closing of Arm IPO

Purchased Arm shares from SVF1 and made initial payment of $4.1B (Paying a

total of $16.1B in installments over two years)

Sold $5.1B worth of Arm ADSS through the IPO (10% of ownership equiv.)

Refinanced Arm margin loan of $8.5B (¥1.2T)

(The largest margin loan right after IPO)

-

-

-

-

= SoftBank

Resuming investments from FY2023 Q1

Invested $1.5B in Q2 (approx. ¥215.9B)*²

-

Renewed commitment line for borrowings of up to $4.7B plus ¥35.6B (approx.

¥740.9B in total)

Redeemed $2.1B (approx. ¥275.1B) of USD and domestic hybrid bonds before

maturity

*1 Cash and cash equivalents + short term investments recorded as current assets + investments in government bonds + undrawn commitment line. ¥740.9B equiv. was undrawn as of

Sep 30, 2023. SBG stand alone basis (excl. SB Northstar; however, incl. its cash and cash equivalents)

*2 The amount invested from SVF, SBG or its major wholly owned subsidiaries. Converted to JPY by using average exchange rate of FY2023 Q2.

Group

Finance 14View entire presentation