WeWork Restructuring Presentation Deck

Executive Summary

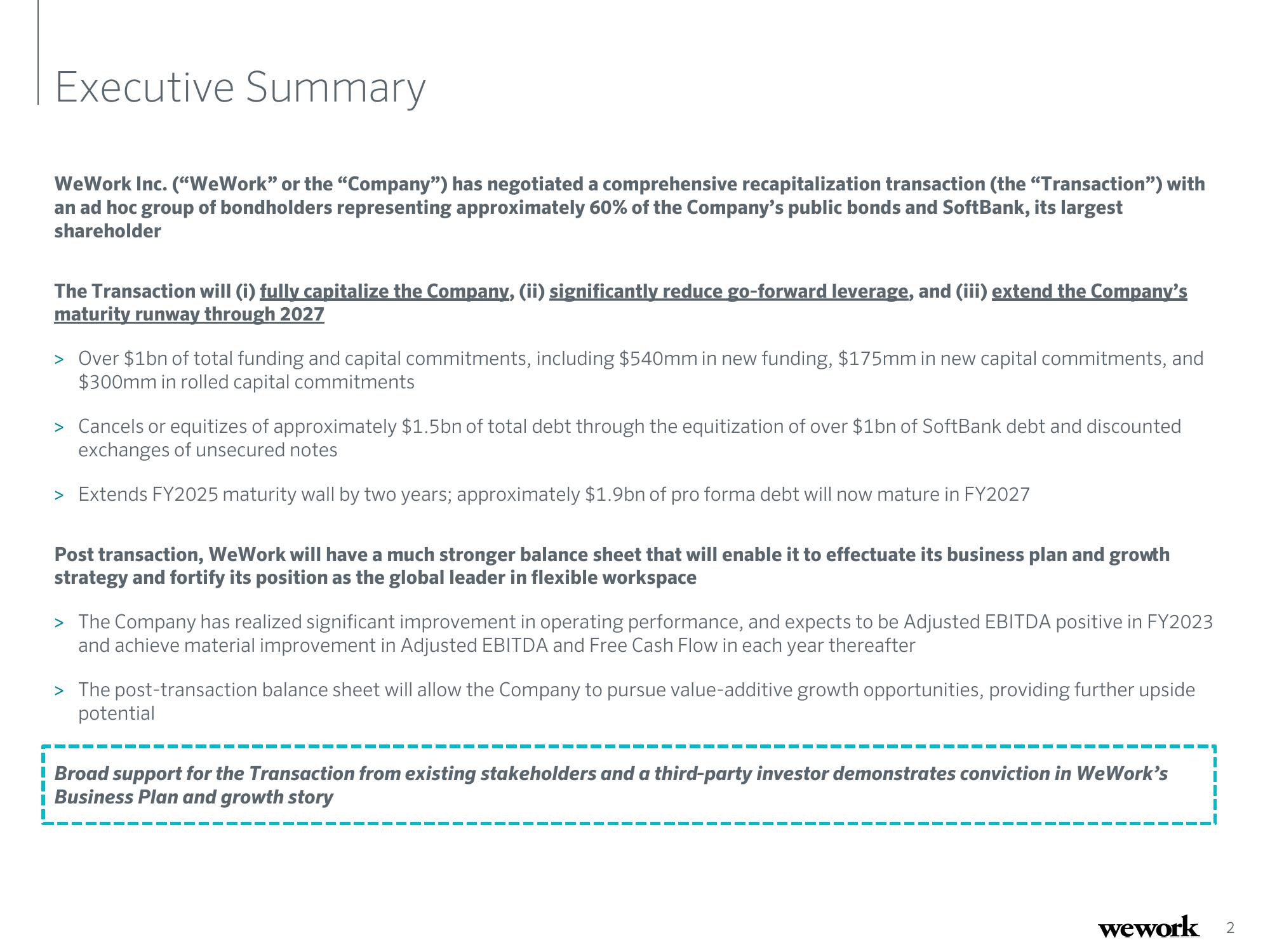

WeWork Inc. ("WeWork" or the "Company") has negotiated a comprehensive recapitalization transaction (the "Transaction") with

an ad hoc group of bondholders representing approximately 60% of the Company's public bonds and SoftBank, its largest

shareholder

The Transaction will (i) fully capitalize the Company, (ii) significantly reduce go-forward leverage, and (iii) extend the Company's

maturity runway through 2027

> Over $1bn of total funding and capital commitments, including $540mm in new funding, $175mm in new capital commitments, and

$300mm in rolled capital commitments

> Cancels or equitizes of approximately $1.5bn of total debt through the equitization of over $1bn of SoftBank debt and discounted

exchanges of unsecured notes

> Extends FY2025 maturity wall by two years; approximately $1.9bn of pro forma debt will now mature in FY2027

Post transaction, WeWork will have a much stronger balance sheet that will enable it to effectuate its business plan and growth

strategy and fortify its position as the global leader in flexible workspace

> The Company has realized significant improvement in operating performance, and expects to be Adjusted EBITDA positive in FY2023

and achieve material improvement in Adjusted EBITDA and Free Cash Flow in each year thereafter

> The post-transaction balance sheet will allow the Company to pursue value-additive growth opportunities, providing further upside

potential

! Broad support for the Transaction from existing stakeholders and a third-party investor demonstrates conviction in WeWork's

i Business Plan and growth story

I

wework 2View entire presentation