Sixth Street Lending Partners, Inc. Presentation to State of Connecticut

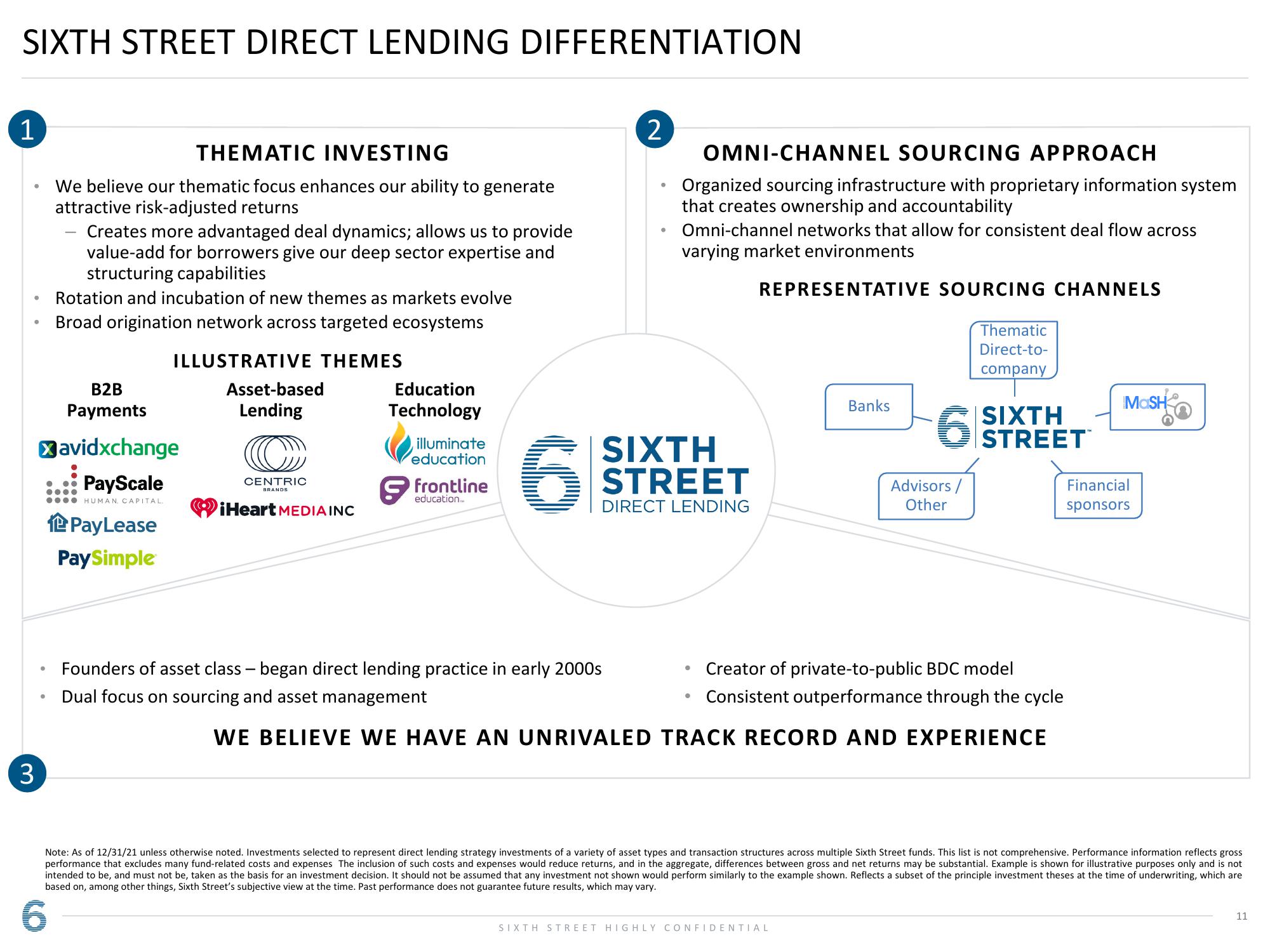

SIXTH STREET DIRECT LENDING DIFFERENTIATION

1

3

THEMATIC INVESTING

We believe our thematic focus enhances our ability to generate

attractive risk-adjusted returns

●

Creates more advantaged deal dynamics; allows us to provide

value-add for borrowers give our deep sector expertise and

structuring capabilities

Rotation and incubation of new themes as markets evolve

Broad origination network across targeted ecosystems

ILLUSTRATIVE THEMES

B2B

Payments

Xavidxchange

PayScale

HUMAN CAPITAL.

PayLease

Pay Simple

Asset-based

Lending

CENTRIC

BRANDS

iHeart MEDIA INC

Education

Technology

illuminate

education

education...

6

2

Founders of asset class - began direct lending practice in early 2000s

Dual focus on sourcing and asset management

OMNI-CHANNEL SOURCING APPROACH

Organized sourcing infrastructure with proprietary information system

that creates ownership and accountability

Omni-channel networks that allow for consistent deal flow across

varying market environments

REPRESENTATIVE SOURCING CHANNELS

SIXTH

STREET

DIRECT LENDING

Banks

6

Advisors

Other

SIXTH STREET HIGHLY CONFIDENTIAL

Thematic

Direct-to-

company

STREET

Creator of private-to-public BDC model

Consistent outperformance through the cycle

WE BELIEVE WE HAVE AN UNRIVALED TRACK RECORD AND EXPERIENCE

MASH

Financial

sponsors

Note: As of 12/31/21 unless otherwise noted. Investments selected to represent direct lending strategy investments of a variety of asset types and transaction structures across multiple Sixth Street funds. This list is not comprehensive. Performance information reflects gross

performance that excludes many fund-related costs and expenses The inclusion of such costs and expenses would reduce returns, and in the aggregate, differences between gross and net returns may be substantial. Example shown for illustrative purposes only and is not

intended to be, and must not be, taken as the basis for an investment decision. It should not be assumed that any investment not shown would perform similarly to the example shown. Reflects a subset of the principle investment theses at the time of underwriting, which are

based on, among other things, Sixth Street's subjective view at the time. Past performance does not guarantee future results, which may vary.

6

11View entire presentation