Apollo Global Management Investor Day Presentation Deck

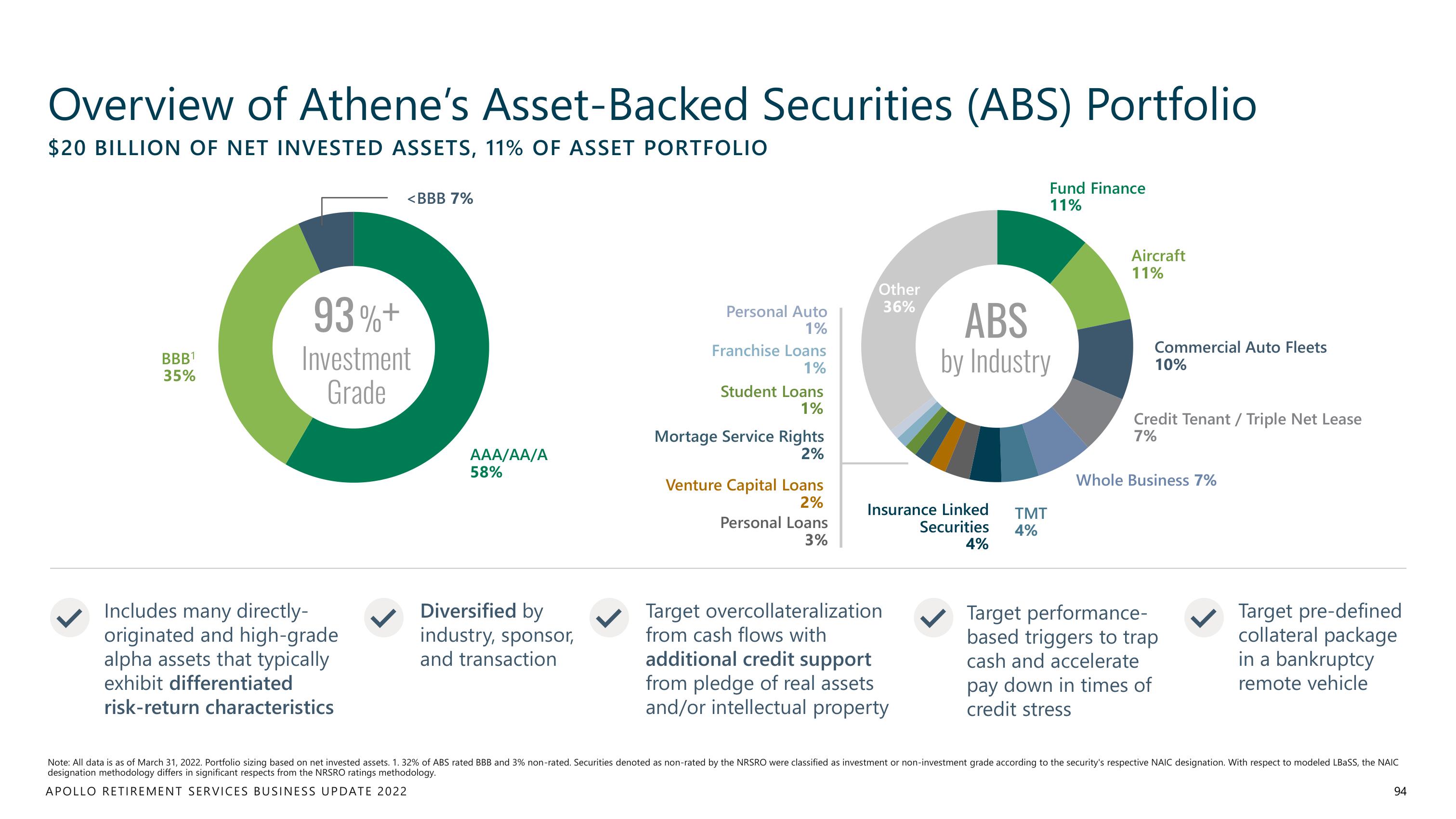

Overview of Athene's Asset-Backed Securities (ABS) Portfolio

$20 BILLION OF NET INVESTED ASSETS, 11% OF ASSET PORTFOLIO

BBB¹1

35%

<BBB 7%

93%+

Investment

Grade

Includes many directly-

originated and high-grade

alpha assets that typically

exhibit differentiated

risk-return characteristics

AAA/AA/A

58%

Diversified by

industry, sponsor,

and transaction

Personal Auto

1%

Franchise Loans

1%

Student Loans

1%

Mortage Service Rights

2%

Venture Capital Loans

2%

Personal Loans

3%

Other

36%

Insurance Linked TMT

Securities

4%

4%

Target overcollateralization

from cash flows with

additional credit support

from pledge of real assets

and/or intellectual property

Fund Finance

11%

ABS

by Industry

Aircraft

11%

Commercial Auto Fleets

10%

Credit Tenant / Triple Net Lease

7%

Whole Business 7%

Target performance-

based triggers to trap

cash and accelerate

pay down in times of

credit stress

Target pre-defined

collateral package

in a bankruptcy

remote vehicle

Note: All data is as of March 31, 2022. Portfolio sizing based on net invested assets. 1. 32% of ABS rated BBB and 3% non-rated. Securities denoted as non-rated by the NRSRO were classified as investment or non-investment grade according to the security's respective NAIC designation. With respect to modeled LBaSS, the NAIC

designation methodology differs in significant respects from the NRSRO ratings methodology.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

94View entire presentation