Main Street Capital Fixed Income Presentation Deck

Stable, Long-Term Leverage - Significant Unused Capacity

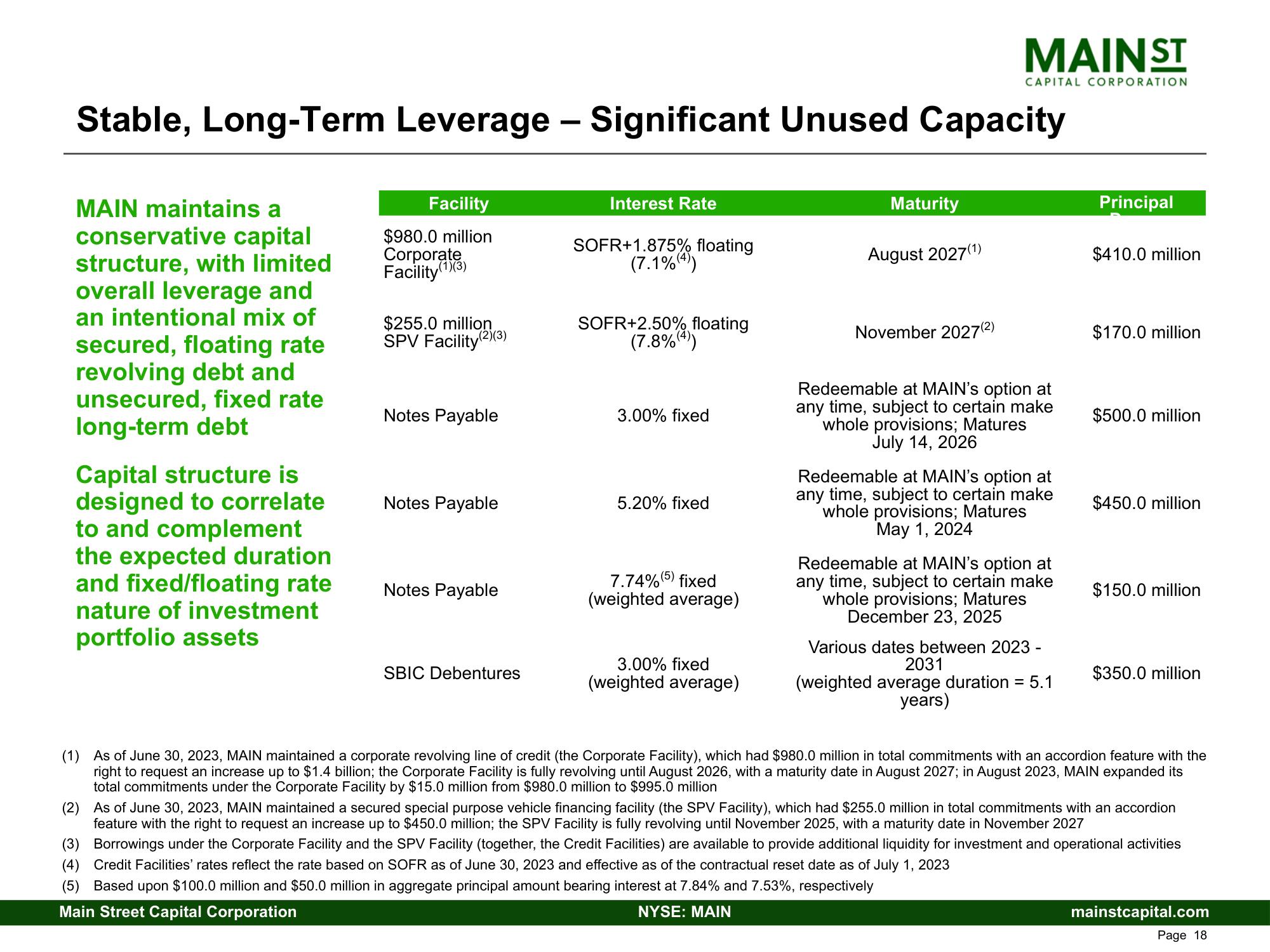

MAIN maintains a

conservative capital

structure, with limited

overall leverage and

an intentional mix of

secured, floating rate

revolving debt and

unsecured, fixed rate

long-term debt

Capital structure is

designed to correlate

to and complement

the expected duration

and fixed/floating rate

nature of investment

portfolio assets

Facility

$980.0 million

Corporate

Facility (1)(3)

$255.0 million

SPV Facility(2)(3)

Notes Payable

Notes Payable

Notes Payable

SBIC Debentures

Interest Rate

SOFR+1.875% floating

(7.1%(4))

SOFR+2.50% floating

(7.8% (4))

3.00% fixed

5.20% fixed

7.74% (5) fixed

(weighted average)

3.00% fixed

(weighted average)

Maturity

August 2027(1)

MAIN ST

CAPITAL CORPORATION

November 2027(²)

Redeemable at MAIN's option at

any time, subject to certain make

whole provisions; Matures

July 14, 2026

Redeemable at MAIN's option at

any time, subject to certain make

whole provisions; Matures

May 1, 2024

Redeemable at MAIN's option at

any time, subject to certain make

whole provisions; Matures

December 23, 2025

Various dates between 2023 -

2031

(weighted average duration = 5.1

years)

Principal

$410.0 million

$170.0 million

$500.0 million

$450.0 million

$150.0 million

$350.0 million

(1) As of June 30, 2023, MAIN maintained a corporate revolving line of credit (the Corporate Facility), which had $980.0 million in total commitments with an accordion feature with the

right to request an increase up to $1.4 billion; the Corporate Facility is fully revolving until August 2026, with a maturity date in August 2027; in August 2023, MAIN expanded its

total commitments under the Corporate Facility by $15.0 million from $980.0 million to $995.0 million

(2)

As of June 30, 2023, MAIN maintained a secured special purpose vehicle financing facility (the SPV Facility), which had $255.0 million in total commitments with an accordion

feature with the right to request an increase up to $450.0 million; the SPV Facility is fully revolving until November 2025, with a maturity date in November 2027

(3) Borrowings under the Corporate Facility and the SPV Facility (together, the Credit Facilities) are available to provide additional liquidity for investment and operational activities

(4) Credit Facilities' rates reflect the rate based on SOFR as of June 30, 2023 and effective as of the contractual reset date as of July 1, 2023

(5) Based upon $100.0 million and $50.0 million in aggregate principal amount bearing interest at 7.84% and 7.53%, respectively

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

Page 18View entire presentation