eToro SPAC Presentation Deck

08

бетого

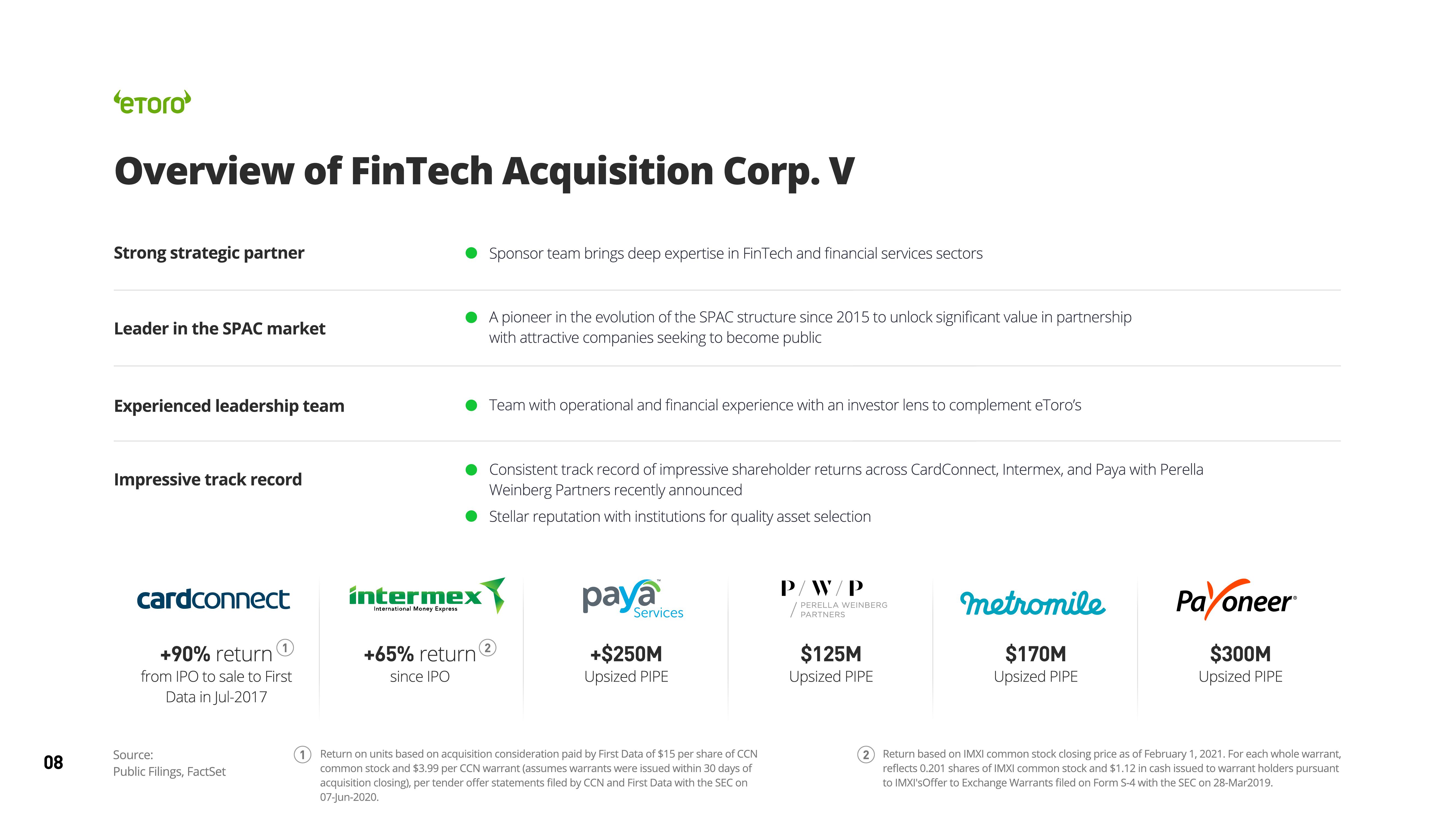

Overview of FinTech Acquisition Corp. V

Strong strategic partner

Leader in the SPAC market

Experienced leadership team

Impressive track record

cardconnect

+90% return

from IPO to sale to First

Data in Jul-2017

Source:

Public Filings, FactSet

1

intermex

International Money Express

+65% return

since IPO

Sponsor team brings deep expertise in FinTech and financial services sectors

A pioneer in the evolution of the SPAC structure since 2015 to unlock significant value in partnership

with attractive companies seeking to become public

Team with operational and financial experience with an investor lens to complement eToro's

Consistent track record of impressive shareholder returns across CardConnect, Intermex, and Paya with Perella

Weinberg Partners recently announced

Stellar reputation with institutions for quality asset selection

(2)

paya

Services

+$250M

Upsized PIPE

Return on units based on acquisition consideration paid by First Data of $15 per share of CCN

common stock and $3.99 per CCN warrant (assumes warrants were issued within 30 days of

acquisition closing), per tender offer statements filed by CCN and First Data with the SEC on

07-Jun-2020.

P/W/P

PERELLA WEINBERG

PARTNERS

$125M

Upsized PIPE

metromile

$170M

Upsized PIPE

Payon

oneer

$300M

Upsized PIPE

(2) Return based on IMXI common stock closing price as of February 1, 2021. For each whole warrant,

reflects 0.201 shares of IMXI common stock and $1.12 in cash issued to warrant holders pursuant

to IMXI'sOffer to Exchange Warrants filed on Form S-4 with the SEC on 28-Mar2019.View entire presentation