OppFi Investor Presentation Deck

31

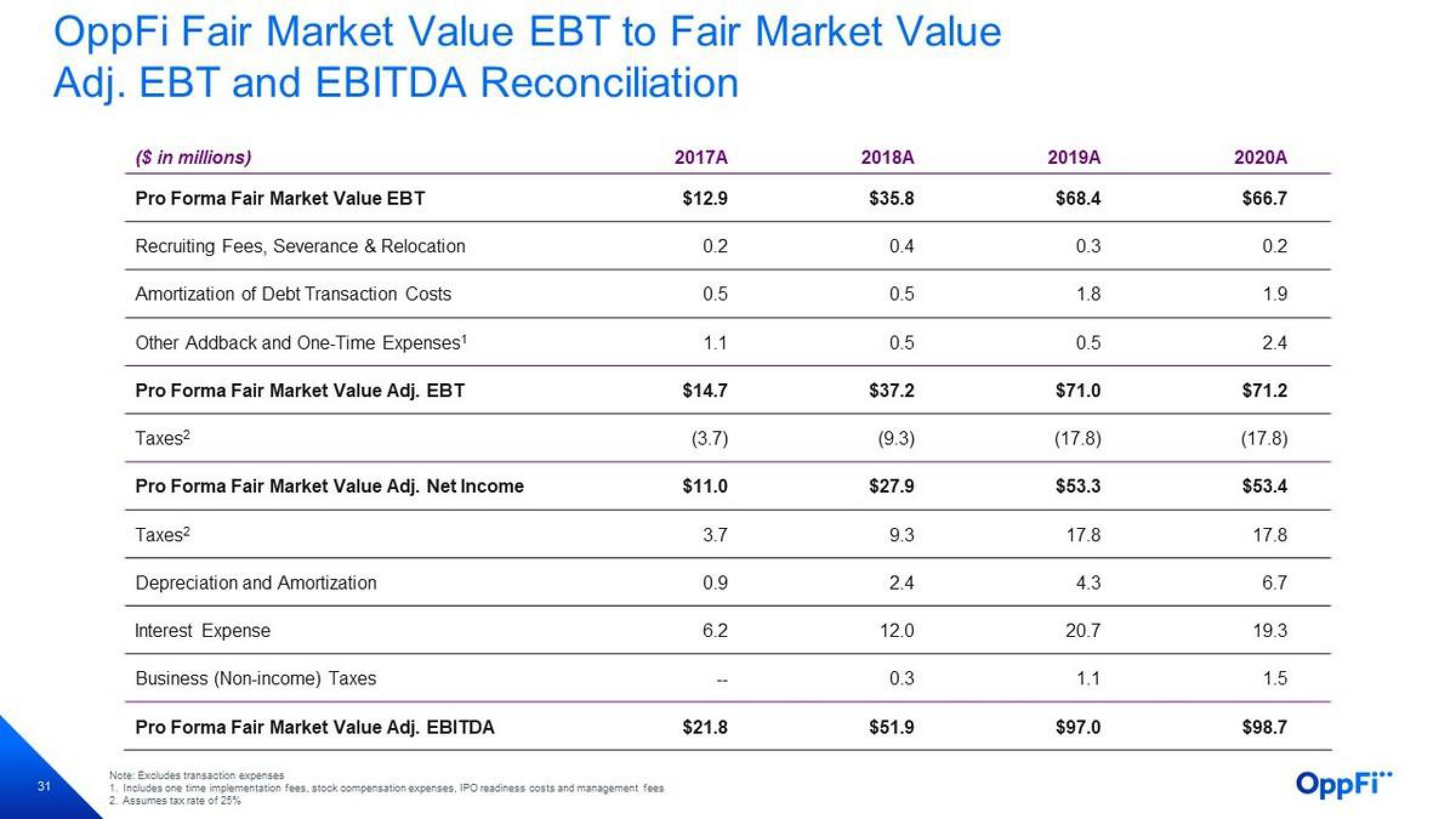

OppFi Fair Market Value EBT to Fair Market Value

Adj. EBT and EBITDA Reconciliation

($ in millions)

Pro Forma Fair Market Value EBT

Recruiting Fees, Severance & Relocation

Amortization of Debt Transaction Costs

Other Addback and One-Time Expenses¹

Pro Forma Fair Market Value Adj. EBT

Taxes²

Pro Forma Fair Market Value Adj. Net Income

Taxes²

Depreciation and Amortization

Interest Expense

Business (Non-income) Taxes

Pro Forma Fair Market Value Adj. EBITDA

Note: Excludes transaction expenses

1. Includes one time implementation fees, stock compensation expenses, IPO readiness costs and management fees

2. Assumes tax rate of 25%

2017A

$12.9

0.2

0.5

1.1

$14.7

(3.7)

$11.0

3.7

0.9

6.2

$21.8

2018A

$35.8

0.4

0.5

0.5

$37.2

(9.3)

$27.9

9.3

2.4

12.0

0.3

$51.9

2019A

$68.4

0.3

1.8

0.5

$71.0

(17.8)

$53.3

17.8

4.3

20.7

1.1

$97.0

2020A

$66.7

0.2

1.9

2.4

$71.2

(17.8)

$53.4

17.8

6.7

19.3

1.5

$98.7

OppFi"View entire presentation