Xos SPAC Presentation Deck

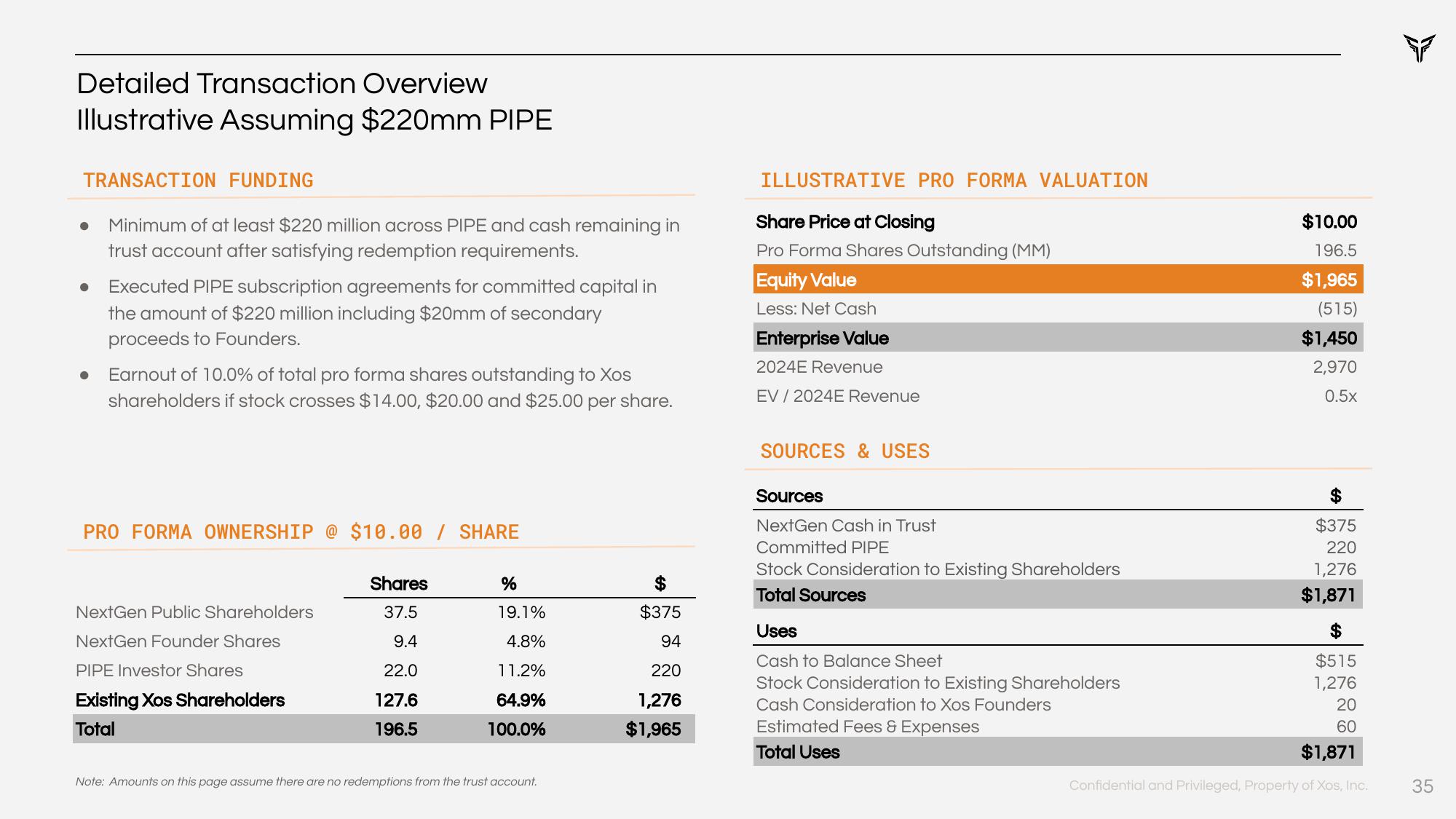

Detailed Transaction Overview

Illustrative Assuming $220mm PIPE

TRANSACTION FUNDING

● Minimum of at least $220 million across PIPE and cash remaining in

trust account after satisfying redemption requirements.

●

●

Executed PIPE subscription agreements for committed capital in

the amount of $220 million including $20mm of secondary

proceeds to Founders.

Earnout of 10.0% of total pro forma shares outstanding to Xos

shareholders if stock crosses $14.00, $20.00 and $25.00 per share.

PRO FORMA OWNERSHIP @ $10.00 / SHARE

NextGen Public Shareholders

NextGen Founder Shares

PIPE Investor Shares

Existing Xos Shareholders

Total

Shares

37.5

9.4

22.0

127.6

196.5

%

19.1%

4.8%

11.2%

64.9%

100.0%

Note: Amounts on this page assume there are no redemptions from the trust account.

$375

94

220

1,276

$1,965

ILLUSTRATIVE PRO FORMA VALUATION

Share Price at Closing

Pro Forma Shares Outstanding (MM)

Equity Value

Less: Net Cash

Enterprise Value

2024E Revenue

EV/ 2024E Revenue

SOURCES & USES

Sources

NextGen Cash in Trust

Committed PIPE

Stock Consideration to Existing Shareholders

Total Sources

Uses

Cash to Balance Sheet

Stock Consideration to Existing Shareholders

Cash Consideration to Xos Founders

Estimated Fees & Expenses

Total Uses

$10.00

196.5

$1,965

(515)

$1,450

2,970

0.5x

$

$375

220

1,276

$1,871

$

$515

1,276

20

60

$1,871

Confidential and Privileged, Property of Xos, Inc.

35View entire presentation