Paysafe SPAC Presentation Deck

Bill Foley's value creation playbook

Foley will bring a team

of board members to

oversee transformation

■

■

William P. Foley II

Founder

Long history of value creation across multiple

public company platforms

Foley has led five separate multi-billion dollar

public market platforms with 100+ acquisitions

across them

Founder, former CEO and now Chairman of

Fidelity National Financial ("FNF") - built the

largest title insurance company, growing equity

value from $3mm to $11bn

Through FNF, Foley was also able to acquire

and spin-out FIS(1) (current market

capitalization of $91bn) Black Knight (current

market capitalization of $14bn) and Cannae

Investments (current market capitalization of

$4bn)

Foley also led the take private of Dun &

Bradstreet (current market capitalization of

$11bn) and the subsequent IPO - current

market

■ Team knows how to drive

revenue growth and margin

expansion in payments

■

■

Experts in payments and

processing

Drove value creation at FIS -

$2.5bn to $91bn

Experts in cloud migration /

SaaS transformation

At Ceridian, drove 7x+

increase in value during

tenure to date

Experts in cost synergy

realization

Realized $225m of synergies

at DNB

Deep strategic M&A expertise in

payments

- Team has consummated

hundreds of financial

technology M&A transactions

for tens of billions in

transaction value

Synergy bonus pool to align

incentive and drive performance

Source: Cannae Holdings Investor Presentation, Dun & Bradstreet materials, public company filings. Market cap data from Factset as of 12/4/2020.

(1) Bill Foley currently owns no equity in FIS.

(2)

Achievement on-going.

(3)

Synergy projection and realization data provided by FNF.

MFIDELITY

NATIONAL FINANCIAL

Acquiror

Cannae

FNF

FIS

FNF

FIS

FIS

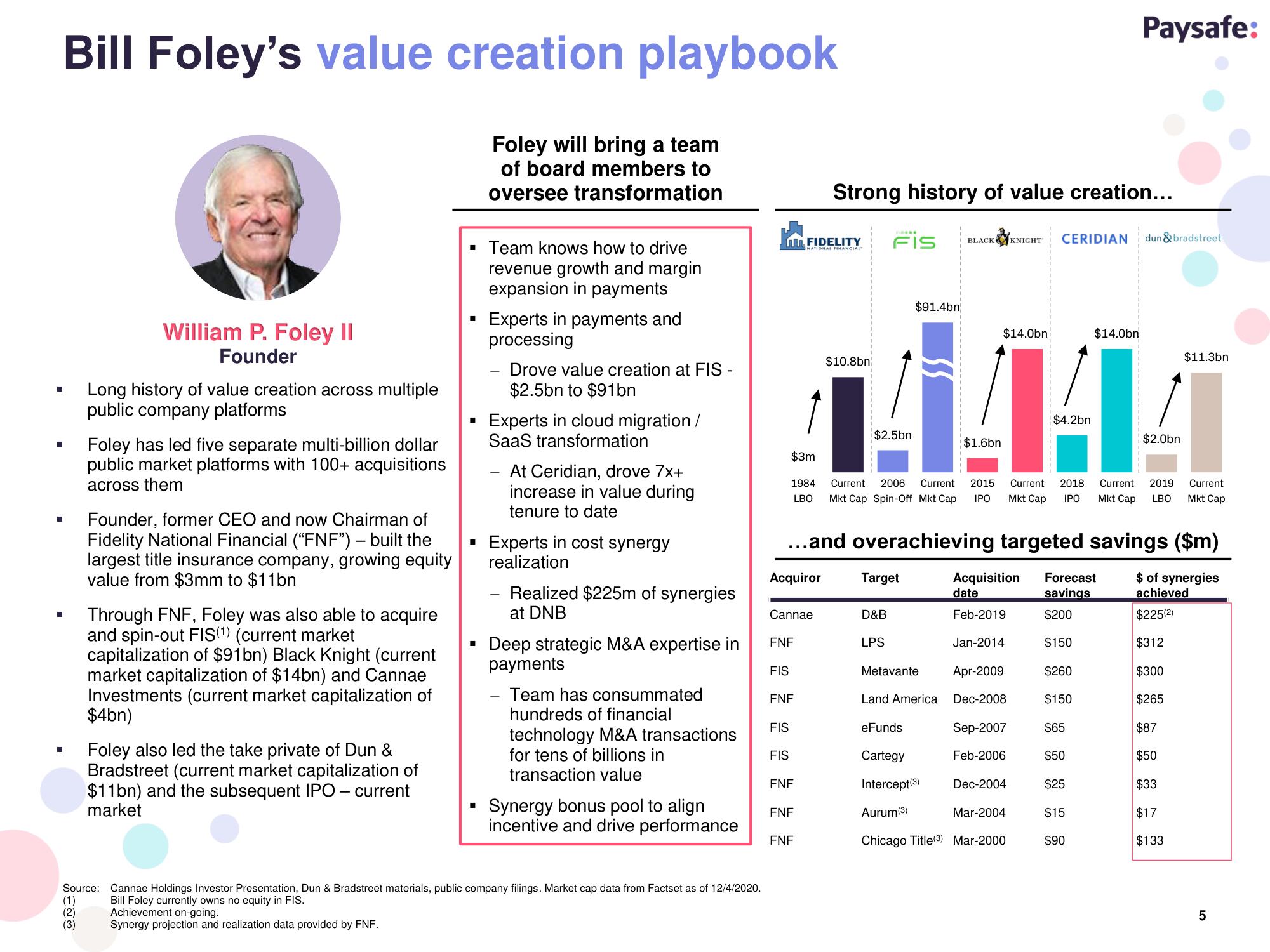

Strong history of value creation...

FNF

FNF

$10.8bn

FNF

$2.5bn

Fis

$3m

1984 Current 2006 Current 2015 Current 2018

LBO Mkt Cap Spin-Off Mkt Cap IPO

Mkt Cap IPO

Target

D&B

$91.4bn

LPS

BLACK KNIGHT

$1.6bn

...and overachieving targeted savings ($m)

$ of synergies

achieved

$225(2)

$312

$300

$265

$87

$50

$33

$17

$133

$14.0bn

Jan-2014

Metavante Apr-2009

Land America Dec-2008

Sep-2007

Feb-2006

Acquisition Forecast

date

savings

Feb-2019 $200

$150

$260

$150

$65

$50

$25

$15

$90

eFunds

Cartegy

Intercept(3)

Aurum (3)

Chicago Title(3) Mar-2000

CERIDIAN dun & bradstreet

$4.2bn

Dec-2004

Mar-2004

Paysafe:

$14.0bn

$2.0bn

$11.3bn

Current. 2019 Current

Mkt Cap LBO Mkt Cap

01

5View entire presentation