MoneyLion Results Presentation Deck

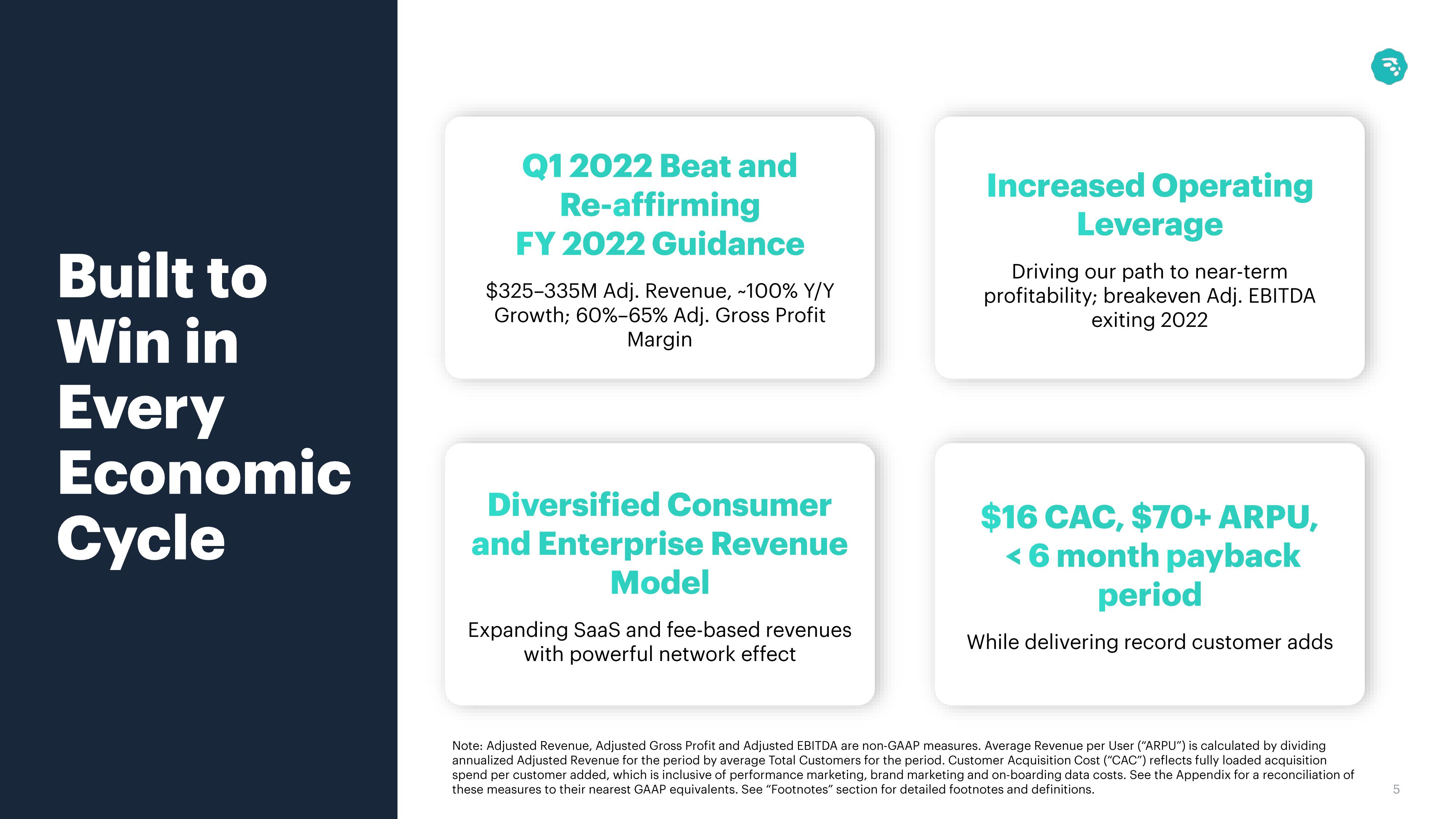

Built to

Win in

Every

Economic

Cycle

Q1 2022 Beat and

Re-affirming

FY 2022 Guidance

$325-335M Adj. Revenue, ~100% Y/Y

Growth; 60%-65% Adj. Gross Profit

Margin

Diversified Consumer

and Enterprise Revenue

Model

Expanding SaaS and fee-based revenues

with powerful network effect

Increased Operating

Leverage

Driving our path to near-term

profitability; breakeven Adj. EBITDA

exiting 2022

$16 CAC, $70+ ARPU,

< 6 month payback

period

While delivering record customer adds

Note: Adjusted Revenue, Adjusted Gross Profit and Adjusted EBITDA are non-GAAP measures. Average Revenue per User ("ARPU") is calculated by dividing

annualized Adjusted Revenue for the period by average Total Customers for the period. Customer Acquisition Cost ("CAC") reflects fully loaded acquisition

spend per customer added, which is inclusive of performance marketing, brand marketing and on-boarding data costs. See the Appendix for a reconciliation of

these measures to their nearest GAAP equivalents. See "Footnotes" section for detailed footnotes and definitions.

50⁰

5View entire presentation