LionTree Investment Banking Pitch Book

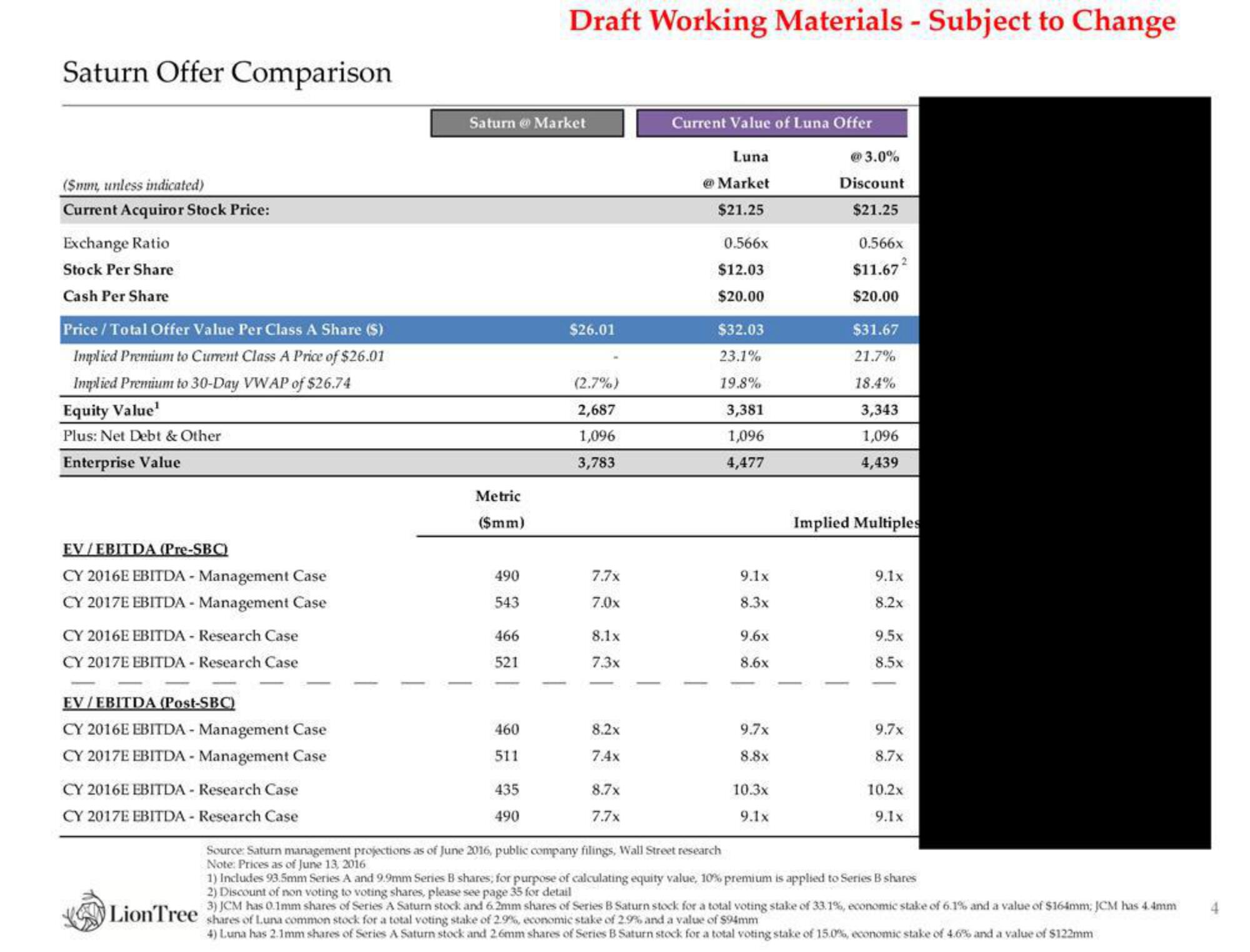

Saturn Offer Comparison

($mm, unless indicated)

Current Acquiror Stock Price:

Exchange Ratio

Stock Per Share

Cash Per Share

Price / Total Offer Value Per Class A Share ($)

Implied Premium to Current Class A Price of $26.01

Implied Premium to 30-Day VWAP of $26.74

Equity Value¹

Plus: Net Debt & Other

Enterprise Value

EV/EBITDA (Pre-SBC)

CY 2016E EBITDA- Management Case

CY 2017E EBITDA - Management Case

CY 2016E EBITDA - Research Case

CY 2017E EBITDA- Research Case

EV/EBITDA (Post-SBC)

CY 2016E EBITDA - Management Case

CY 2017E EBITDA - Management Case

CY 2016E EBITDA - Research Case

CY 2017E EBITDA- Research Case

Saturn Market

Metric

($mm)

490

543

466

521

460

511

Draft Working Materials - Subject to Change

435

490

$26.01

(2.7%)

2,687

1,096

3,783

7.7x

7.0x

8.1x

7.3x

8.2x

7.4x

8.7x

7.7x

Current Value of Luna Offer

Luna

@Market

$21.25

0.566x

$12.03

$20.00

$32.03

23.1%

19.8%

3,381

1,096

4,477

Source: Saturn management projections as of June 2016, public company filings, Wall Street research

Note: Prices as of June 13, 2016

9.1x

8.3x

9.6x

8.6x

9.7x

8.8x

10.3x

9.1x

@3.0%

Discount

$21.25

LionTree shares of Luna common stock for a total voting stake of 2.9%, economic stake of 2.9% and a value of $94mm

0.566x

$11.67²

$20.00

$31.67

21.7%

18.4%

3,343

1,096

4,439

Implied Multiples

9.1x

8.2x

9.5x

8.5x

9.7x

8.7x

10.2x

9.1x

1) Includes 93.5mm Series A and 9.9mm Series B shares; for purpose of calculating equity value, 10% premium is applied to Series B shares

2) Discount of non voting to voting shares, please see page 35 for detail

3) JCM has 0.1mm shares of Series A Saturn stock and 6.2mm shares of Series B Saturn stock for a total voting stake of 33.1%, economic stake of 6.1% and a value of $164mm; JCM has 4.4mm

4) Luna has 2.1mm shares of Series A Saturn stock and 2.6mm shares of Series B Saturn stock for a total voting stake of 15.0%, economic stake of 4.6% and a value of $122mmView entire presentation