Rhode Island Employees’ Retirement System

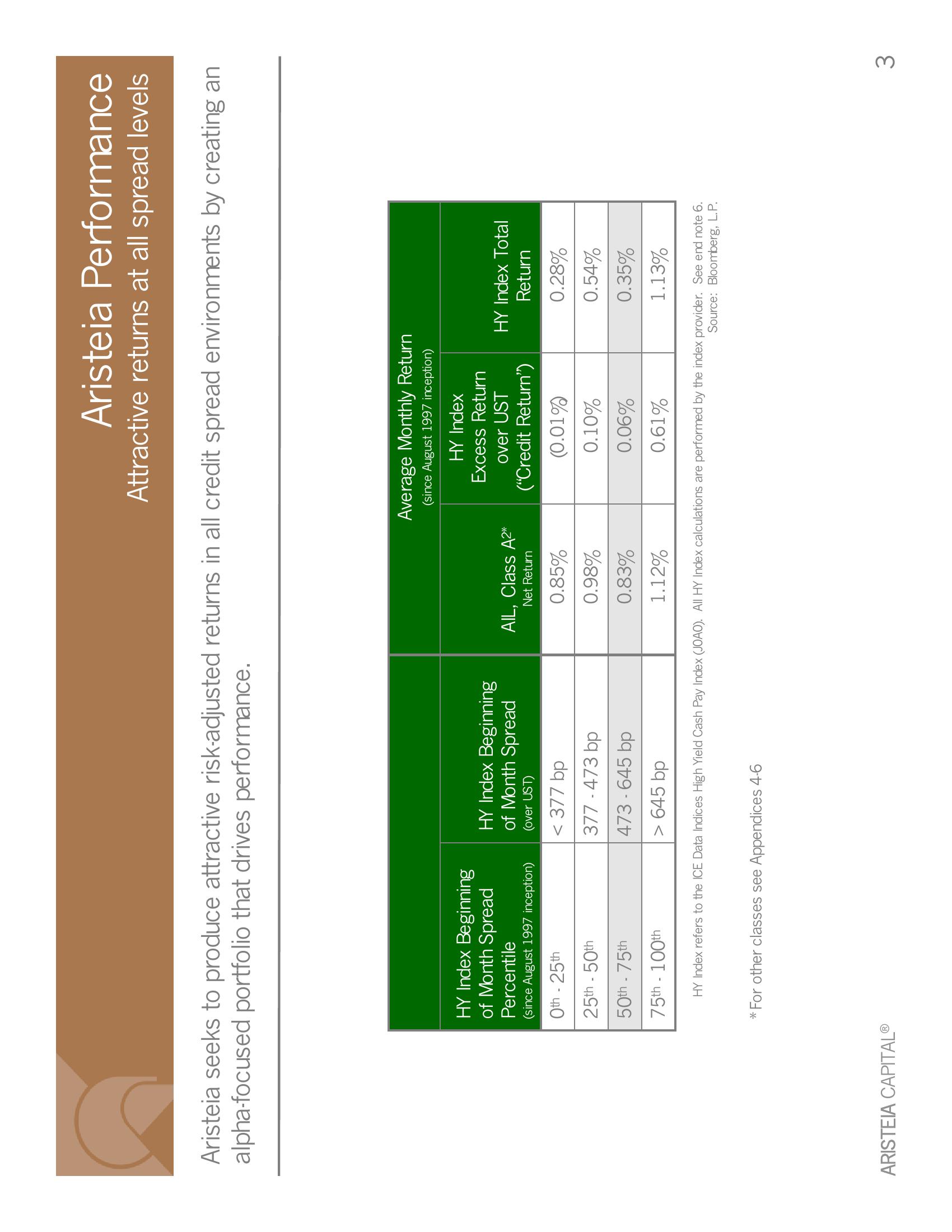

Aristeia seeks to produce attractive risk-adjusted returns in all credit spread environments by creating an

alpha-focused portfolio that drives performance.

ARISTEIA CAPITALⓇ

HY Index Beginning

of Month Spread

Percentile

(since August 1997 inception)

0th - 25th

25th - 50th

50th - 75th

75th - 100th

HY Index Beginning

of Month Spread

(over UST)

< 377 bp

377-473 bp

473-645 bp

> 645 bp

AIL, Class A²*

Net Return

*For other classes see Appendices 4-6

Aristeia Performance

Attractive returns at all spread levels

0.85%

0.98%

0.83%

1.12%

Average Monthly Return

(since August 1997 inception)

HY Index

Excess Return

over UST

("Credit Return")

(0.01%)

0.10%

0.06%

0.61%

HY Index Total

Return

0.28%

0.54%

0.35%

1.13%

HY Index refers to the ICE Data Indices High Yield Cash Pay Index (JOAO). All HY Index calculations are performed by the index provider. See end note 6.

Source: Bloomberg, L.P.

3View entire presentation