Owens&Minor Investor Day Presentation Deck

90

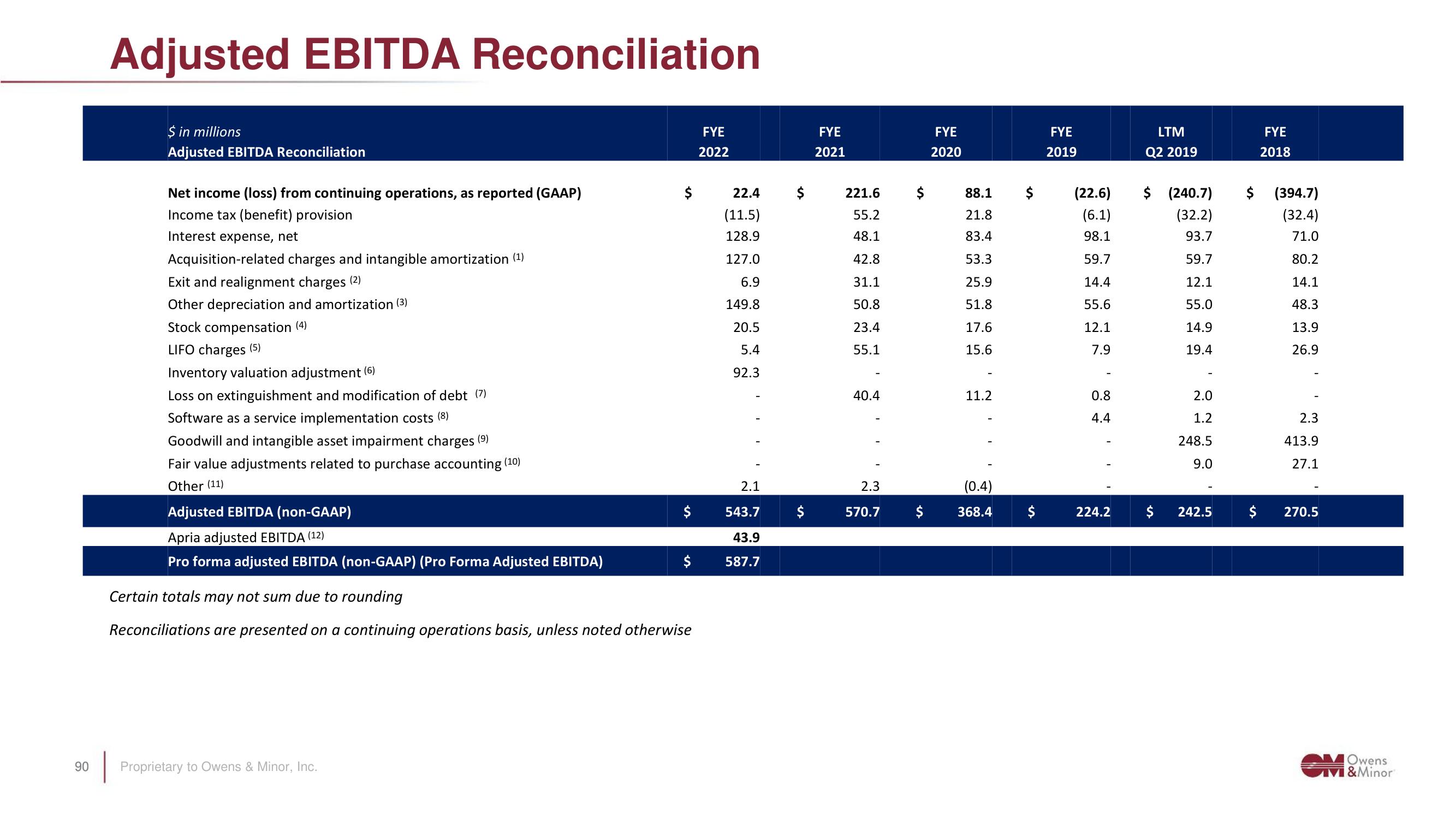

Adjusted EBITDA Reconciliation

$ in millions

Adjusted EBITDA Reconciliation

Net income (loss) from continuing operations, as reported (GAAP)

Income tax (benefit) provision

Interest expense, net

Acquisition-related charges and intangible amortization (¹)

Exit and realignment charges (2)

Other depreciation and amortization (3)

Stock compensation (4)

LIFO charges (5)

Inventory valuation adjustment (6)

Loss on extinguishment and modification of debt (7)

Software as a service implementation costs (8)

Goodwill and intangible asset impairment charges (9)

Fair value adjustments related to purchase accounting (10)

Other (11)

Adjusted EBITDA (non-GAAP)

Apria adjusted EBITDA (12)

Pro forma adjusted EBITDA (non-GAAP) (Pro Forma Adjusted EBITDA)

$

Proprietary to Owens & Minor, Inc.

$

Certain totals may not sum due to rounding

Reconciliations are presented on a continuing operations basis, unless noted otherwise

FYE

2022

22.4

(11.5)

128.9

127.0

6.9

149.8

20.5

5.4

92.3

2.1

543.7

43.9

587.7

FYE

2021

221.6

55.2

48.1

42.8

31.1

50.8

23.4

55.1

40.4

2.3

570.7

FYE

2020

88.1

21.8

83.4

53.3

25.9

51.8

17.6

15.6

11.2

(0.4)

368.4

FYE

2019

(22.6)

(6.1)

98.1

59.7

14.4

55.6

12.1

7.9

0.8

4.4

224.2

LTM

Q2 2019

$ (240.7)

(32.2)

93.7

59.7

12.1

55.0

14.9

19.4

2.0

1.2

248.5

9.0

242.5

FYE

2018

(394.7)

(32.4)

71.0

80.2

14.1

48.3

13.9

26.9

2.3

413.9

27.1

270.5

MOwens

M&MinorView entire presentation