Carlyle Investor Day Presentation Deck

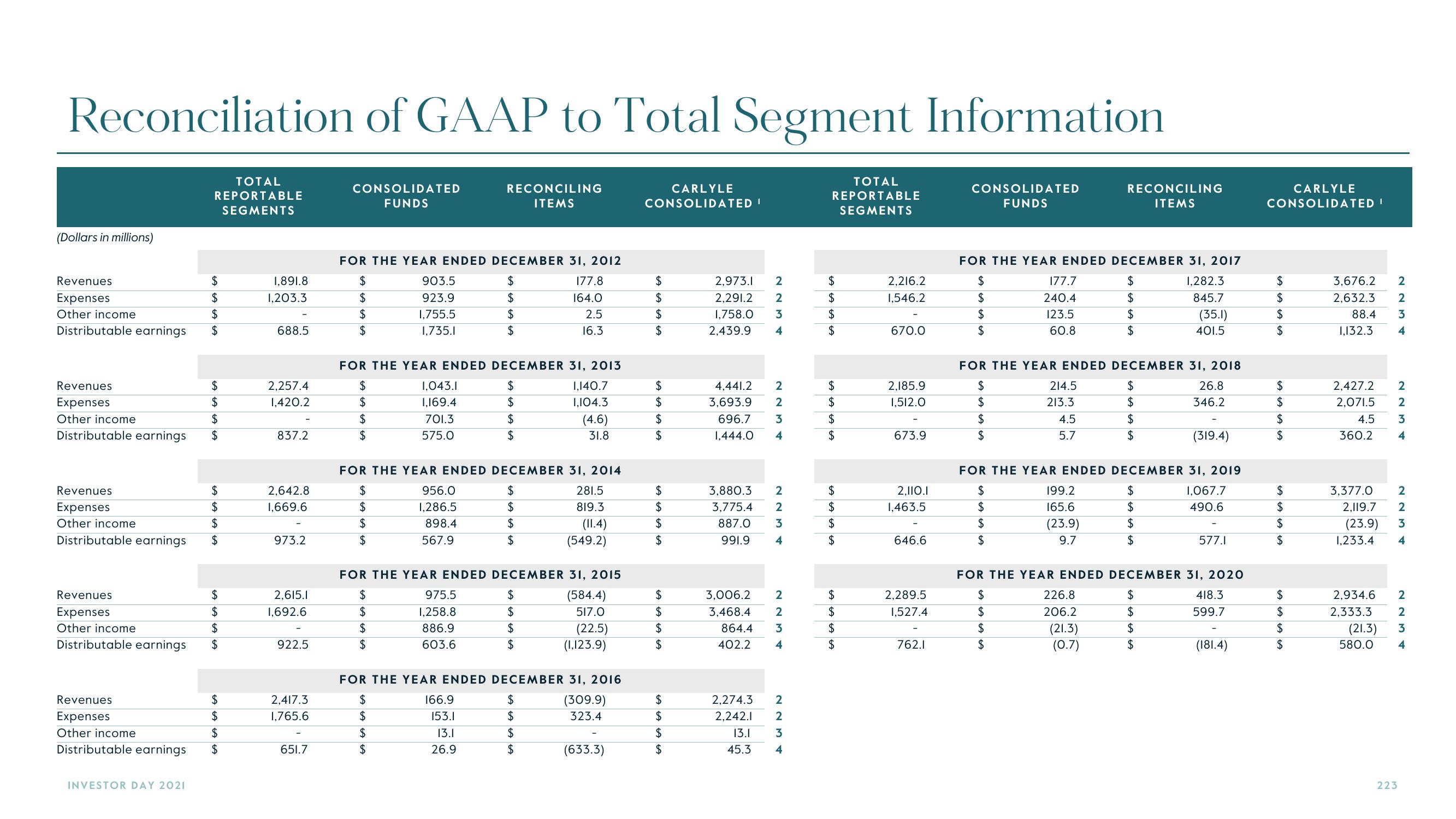

Reconciliation of GAAP to Total Segment Information

CONSOLIDATED

FUNDS

RECONCILING

ITEMS

CONSOLIDATED

FUNDS

(Dollars in millions)

Revenues

Expenses

Other income

Distributable earnings

Revenues

Expenses

Other income

Distributable earnings

Revenues

Expenses

Other income

Distributable earnings

Revenues

Expenses

Other income

Distributable earnings

Revenues

Expenses

Other income

Distributable earnings

INVESTOR DAY 2021

TOTAL

REPORTABLE

SEGMENTS

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

1,891.8

1,203.3

688.5

2,257.4

1,420.2

837.2

2,642.8

1,669.6

973.2

2,615.1

1,692.6

922.5

2,417.3

1,765.6

651.7

FOR THE YEAR ENDED DECEMBER 31, 2012

$

$

$

$

903.5

923.9

1,755.5

1,735.1

1,043.1

1,169.4

701.3

575.0

FOR THE YEAR ENDED DECEMBER 31, 2013

$

1,140.7

$

1,104.3

(4.6)

$

$

31.8

956.0

1,286.5

898.4

567.9

$

$

$

$

975.5

1,258.8

886.9

603.6

$

$

FOR THE YEAR ENDED DECEMBER 31, 2014

$

$

$

$

$

$

166.9

153.1

13.1

26.9

$

$

$

$

177.8

164.0

2.5

16.3

FOR THE YEAR ENDED DECEMBER 31, 2015

$

(584.4)

$

517.0

$

$

$

$

$

$

281.5

819.3

$

$

$

$

(11.4)

(549.2)

FOR THE YEAR ENDED DECEMBER 31, 2016

$

(309.9)

$

323.4

$

$

(22.5)

(1,123.9)

(633.3)

CARLYLE

CONSOLIDATED!

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

2,973.1 2

2,291.2 2

1,758.0 3

2,439.9 4

4,441.2

3,693.9

696.7

1,444.0 4

223

3,880.3 2

3,775.4 2

887.0 3

991.9

4

2

3,006.2 2

3,468.4

864.4

402.2

3

4

2,274.3

2,242.1

13.1

45.3

22

3

4

TOTAL

REPORTABLE

SEGMENTS

$

$

$

$

$

LA LA LA LA

$

$

$

$

$

$

$

LA LA LA LA

$

$

$

$

2,216.2

1,546.2

670.0

2,185.9

1,512.0

673.9

2,110.1

1,463.5

646.6

2,289.5

1,527.4

762.1

FOR THE YEAR ENDED DECEMBER 31, 2017

$

$

$

$

1,282.3

845.7

(35.1)

401.5

177.7

240.4

123.5

60.8

214.5

213.3

FOR THE YEAR ENDED DECEMBER 31, 2018

$

$

$

$

4.5

5.7

RECONCILING

ITEMS

199.2

165.6

(23.9)

9.7

$

$

$

$

226.8

206.2

(21.3)

(0.7)

$

$

$

$

FOR THE YEAR ENDED DECEMBER 31, 2019

$

1,067.7

490.6

$

$

$

$

$

$

$

26.8

346.2

(319.4)

$

$

$

$

FOR THE YEAR ENDED DECEMBER 31, 2020

$

$

$

$

577.1

418.3

599.7

(181.4)

CARLYLE

CONSOLIDATED!

$

$

$

$

$

$

$

$

$

$

$

$

LA LA LA LA

$

$

$

$

3,676.2

2,632.3

88.4

1,132.3

2,427.2

2,071.5

4.5

360.2

3,377.0

2,119.7

(23.9)

1,233.4

2,934.6

2,333.3

(21.3)

580.0

2234

2234

2234

223+

4

223View entire presentation