J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

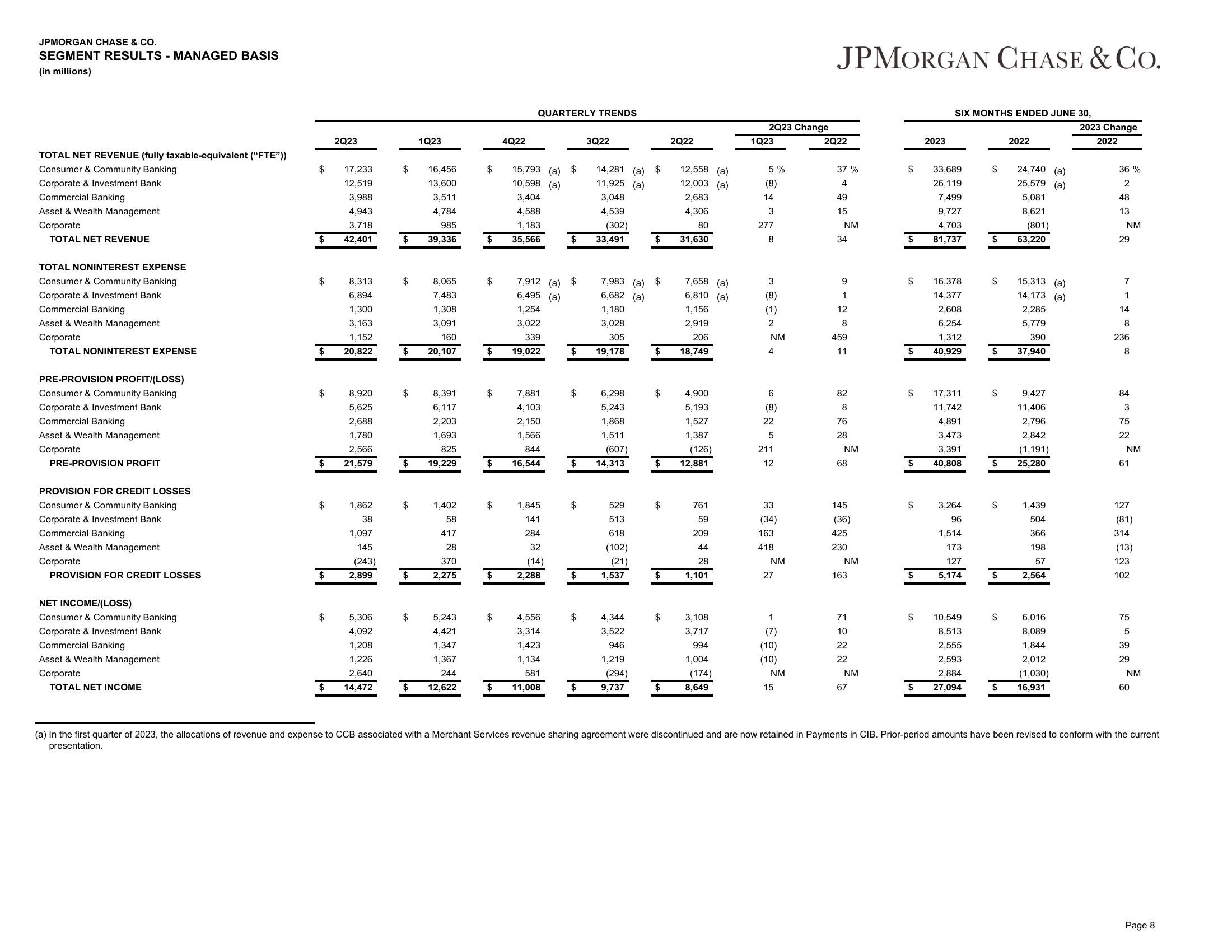

SEGMENT RESULTS - MANAGED BASIS

(in millions)

TOTAL NET REVENUE (fully taxable-equivalent ("FTE"))

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NET REVENUE

TOTAL NONINTEREST EXPENSE

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NONINTEREST EXPENSE

PRE-PROVISION PROFIT/(LOSS)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

PRE-PROVISION PROFIT

PROVISION FOR CREDIT LOSSES

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

PROVISION FOR CREDIT LOSSES

NET INCOME/(LOSS)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NET INCOME

$

$

$

$

$

$

8,920

5,625

2,688

1,780

2,566

$ 21,579

$

$

2Q23

$

17,233

12,519

3,988

4,943

3,718

42,401

8,313

6,894

1,300

3,163

1,152

20,822

1,862

38

1,097

145

(243)

2,899

5,306

4,092

1,208

1,226

2,640

14,472

$

$

$

8,065

7,483

1,308

3,091

160

$ 20,107

$

1Q23

8,391

6,117

2,203

1,693

825

$ 19,229

$

16,456

13,600

3,511

4,784

985

39,336

$

1,402

58

417

28

370

2,275

5,243

4,421

1,347

1,367

244

$ 12,622

15,793 (a)

10,598 (a)

3,404

4,588

1,183

$ 35,566

$

$

4Q22

QUARTERLY TRENDS

7,912 (a) $

6,495 (a)

1,254

3,022

339

$ 19,022

$

7,881

4,103

2,150

1,566

844

$ 16,544

$

1,845

141

284

32

(14)

2,288

$

4,556

3,314

1,423

1,134

581

$ 11,008

$

$

$

$

$

3Q22

(607)

$ 14,313

$

14,281 (a)

11,925 (a)

3,048

4,539

(302)

33,491

7,983 (a)

6,682 (a)

1,180

3,028

305

19,178

6,298

5,243

1,868

1,511

529

513

618

(102)

(21)

1,537

4,344

3,522

946

1,219

(294)

9,737

$

$

$

$

$

$

$

$

$

$

2Q22

12,558 (a)

12,003 (a)

2,683

4,306

80

31,630

7,658 (a)

6,810 (a)

1,156

2,919

206

18,749

4,900

5,193

1,527

1,387

(126)

12,881

761

59

209

44

28

1,101

3,108

3,717

994

1,004

(174)

8,649

2Q23 Change

1Q23

5%

(8)

14

3

277

8

3

(8)

(1)

2

NM

4

6

(8)

22

5

211

12

33

(34)

163

418

NM

27

1

(7)

(10)

(10)

NM

15

JPMORGAN CHASE & Co.

2Q22

37 %

4

49

15

NM

34

9

1

12

8

459

11

82

8

76

28

NM

68

145

(36)

425

230

NM

163

71

10

22

22

NM

67

$

$

$

$

$

$

$

$

$

$

2023

SIX MONTHS ENDED JUNE 30,

33,689

26,119

7,499

9,727

4,703

81,737

16,378

14,377

2,608

6,254

1,312

40,929

17,311

11,742

4,891

3,473

3,391

40,808

3,264

96

1,514

173

127

5,174

10,549

8,513

2,555

2,593

2,884

27,094

$

$

$

$

$

$

$

$

$

2022

24,740 (a)

25,579 (a)

5,081

8,621

(801)

63,220

15,313 (a)

14,173 (a)

2,285

5,779

390

37,940

9,427

11,406

2,796

2,842

(1,191)

25,280

1,439

504

366

198

57

2,564

6,016

8,089

1,844

2,012

(1,030)

16,931

2023 Change

2022

36 %

2

48

13

NM

29

7

1

14

8

236

8

84

3

75

22

NM

61

127

(81)

314

(13)

123

102

75

5

39

29

NM

60

(a) In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current

presentation.

Page 8View entire presentation