Topps SPAC Presentation Deck

18

2D

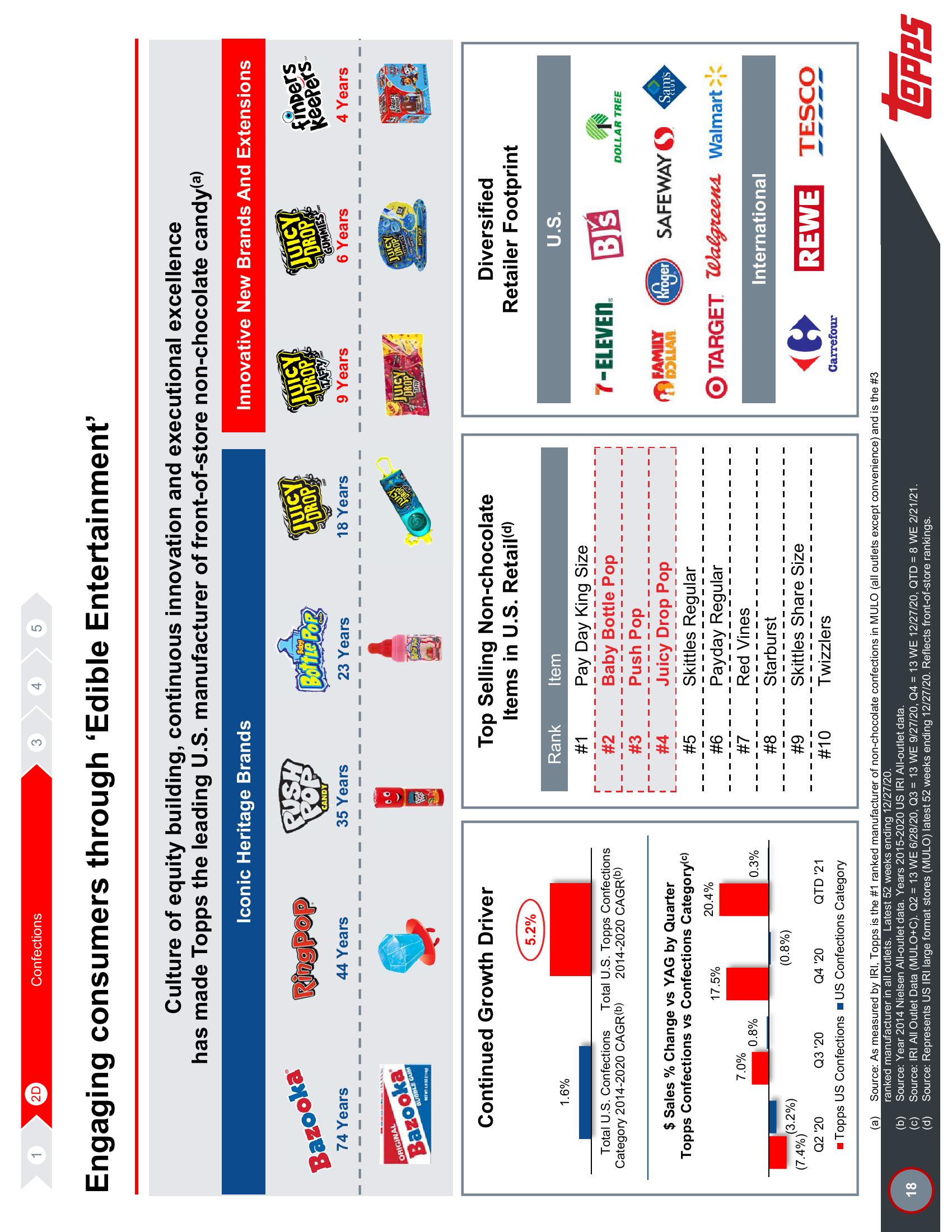

Engaging consumers through 'Edible Entertainment'

Bazooka

74 Years

ORIGINAL

Bazooka

BUBBLE GUM

NETT

1.6%

Confections

Continued Growth Driver

(a)

(b)

(c)

(d)

Culture of equity building, continuous innovation and executional excellence

has made Topps the leading U.S. manufacturer of front-of-store non-chocolate candy(a)

Iconic Heritage Brands

Ringpop

44 Years

Total U.S. Confections Total U.S. Topps Confections

Category 2014-2020 CAGR (b) 2014-2020 CAGR(b)

7.0%

$ Sales % Change vs YAG by Quarter

Topps Confections vs Confections Category(c)

20.4%

0.8%

5.2%

17.5%

(0.8%)

0.3%

(3.2%)

(7.4%)

Q2 '20

Q3 '20

Q4 '20

QTD '21

■Topps US Confections US Confections Category

5

CANDY

35 Years

Rank

#1

#2

#3

#4

#5

#6

#7

#8

#9

#10

Baby !!!!

23 Years

Item

Pay Day King Size

Baby Bottle Pop

Push Pop

JUICY

DROP

18 Years

Top Selling Non-chocolate

Items in U.S. Retail(d)

Juicy Drop Pop

Skittles Regular

Payday Regular

Red Vines

3

Starburst

Skittles Share Size

Twizzlers

JUICY

I

Source: IRI All Outlet Data (MULO+C). Q2 = 13 WE 6/28/20, Q3 = 13 WE 9/27/20, Q4 = 13 WE 12/27/20, QTD = 8 WE 2/21/21.

Source: Represents US IRI large format stores (MULO) latest 52 weeks ending 12/27/20. Reflects front-of-store rankings.

T

Innovative New Brands And Extensions

JUICY

DROP

9 Years

JUICY

DROP

TIFF

JUICY

DROP

GUMMIES

6 Years

Source: As measured by IRI, Topps is the #1 ranked manufacturer of non-chocolate confections in MULO (all outlets except convenience) and is the #3

ranked manufacturer in all outlets. Latest 52 weeks ending 12/27/20.

Source: Year 2014 Nielsen All-outlet data. Years 2015-2020 US IRI All-outlet data.

JUICY

DROP

CUMMIES

Diversified

e

Carrefour

Retailer Footprint

7-ELEVEN. BJ's

U.S.

finders

keepers

4 Years

Fintek

FAMILY

DOLLAR Kroger SAFEWAY Sams

DOLLAR TREE

O TARGET Walgreens Walmart

International

REWE TESCO

LOPPSView entire presentation