Credit Suisse Results Presentation Deck

Notes

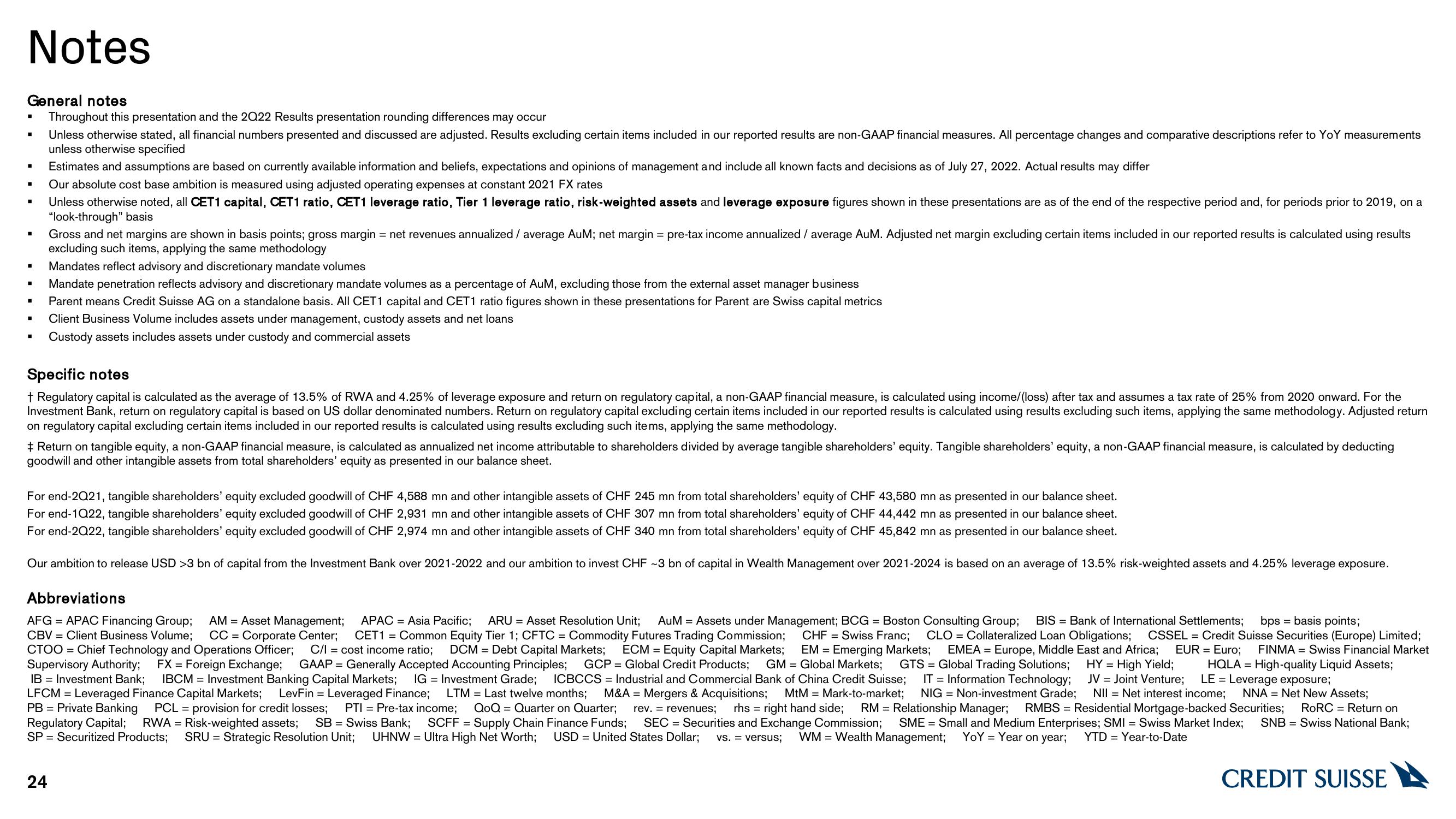

General notes

Throughout this presentation and the 2Q22 Results presentation rounding differences may occur

Unless otherwise stated, all financial numbers presented and discussed are adjusted. Results excluding certain items included in our reported results are non-GAAP financial measures. All percentage changes and comparative descriptions refer to YoY measurements

unless otherwise specified

■

■

■

■

■

I

I

■

Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of July 27, 2022. Actual results may differ

Our absolute cost base ambition is measured using adjusted operating expenses at constant 2021 FX rates

Unless otherwise noted, all CET1 capital, CET1 ratio, CET1 leverage ratio, Tier 1 leverage ratio, risk-weighted assets and leverage exposure figures shown in these presentations are as of the end of the respective period and, for periods prior to 2019, on a

"look-through" basis

Gross and net margins are shown in basis points; gross margin = net revenues annualized / average AuM; net margin = pre-tax income annualized / average AuM. Adjusted net margin excluding certain items included in our reported results is calculated using results

excluding such items, applying the same methodology

Mandates reflect advisory and discretionary mandate volumes

Mandate penetration reflects advisory and discretionary mandate volumes as a percentage of AuM, excluding those from the external asset manager business

Parent means Credit Suisse AG on a standalone basis. All CET1 capital and CET1 ratio figures shown in these presentations for Parent are Swiss capital metrics

Client Business Volume includes assets under management, custody assets and net loans

Custody assets includes assets under custody and commercial assets

Specific notes

+ Regulatory capital is calculated as the average of 13.5% of RWA and 4.25% of leverage exposure and return on regulatory capital, a non-GAAP financial measure, is calculated using income/(loss) after tax and assumes a tax rate of 25% from 2020 onward. For the

Investment Bank, return on regulatory capital is based on US dollar denominated numbers. Return on regulatory capital excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology. Adjusted return

on regulatory capital excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology.

‡ Return on tangible equity, a non-GAAP financial measure, is calculated as annualized net income attributable to shareholders divided by average tangible shareholders' equity. Tangible shareholders' equity, a non-GAAP financial measure, is calculated by deducting

goodwill and other intangible assets from total shareholders' equity as presented in our balance sheet.

For end-2Q21, tangible shareholders' equity excluded goodwill of CHF 4,588 mn and other intangible assets of CHF 245 mn from total shareholders' equity of CHF 43,580 mn as presented in our balance sheet.

For end-1Q22, tangible shareholders' equity excluded goodwill of CHF 2,931 mn and other intangible assets of CHF 307 mn from total shareholders' equity of CHF 44,442 mn as presented in our balance sheet.

For end-2Q22, tangible shareholders' equity excluded goodwill of CHF 2,974 mn and other intangible assets of CHF 340 mn from total shareholders' equity of CHF 45,842 mn as presented in our balance sheet.

Our ambition to release USD >3 bn of capital from the Investment Bank over 2021-2022 and our ambition to invest CHF ~3 bn of capital in Wealth Management over 2021-2024 is based on an average of 13.5% risk-weighted assets and 4.25% leverage exposure.

Abbreviations

AFG = APAC Financing Group; AM = Asset Management; APAC = Asia Pacific; ARU = Asset Resolution Unit; AuM = Assets under Management; BCG = Boston Consulting Group; BIS = Bank of International Settlements; bps = basis points;

CBV Client Business Volume; CC = Corporate Center; CET1 = Common Equity Tier 1; CFTC = Commodity Futures Trading Commission; CHF Swiss Franc; CLO Collateralized Loan Obligations; CSSEL = Credit Suisse Securities (Europe) Limited;

CTOO = Chief Technology and Operations Officer; C/I= cost income ratio; DCM = Debt Capital Markets; ECM = Equity Capital Markets; EM = Emerging Markets; EMEA = Europe, Middle East and Africa; EUR = Euro; FINMA Swiss Financial Market

Supervisory Authority; FX = Foreign Exchange; GAAP = Generally Accepted Accounting Principles; GCP Global Credit Products; GM Global Markets; GTS Global Trading Solutions; HY = High Yield; HQLA = High-quality Liquid Assets;

IB Investment Bank; IBCM = Investment Banking Capital Markets; IG Investment Grade; ICBCCS = Industrial and Commercial Bank of China Credit Suisse; IT = Information Technology; JV Joint Venture; LE = Leverage exposure;

LFCM = Leveraged Finance Capital Markets; LevFin = Leveraged Finance; LTM = Last twelve months; M&A = Mergers & Acquisitions; MtM = Mark-to-market; NIG Non-investment Grade; NII Net interest income; NNA = Net New Assets;

PTI = Pre-tax income; QoQ = Quarter on Quarter; rev. = revenues; rhs = right hand side; RM = Relationship Manager; RMBS = Residential Mortgage-backed Securities; RoRC Return on

Swiss Bank; SCFF = Supply Chain Finance Funds; SEC = Securities and Exchange Commission; SME = Small and Medium Enterprises; SMI = Swiss Market Index; SNB Swiss National Bank;

PB = Private Banking

Regulatory Capital;

SP = Securitized Products;

PCL = provision for credit losses;

RWA = Risk-weighted assets; SB

SRU = Strategic Resolution Unit;

UHNW = Ultra High Net Worth; USD = United States Dollar; vs. versus; WM = Wealth Management; YoY Year on year; YTD = Year-to-Date

24

CREDIT SUISSEView entire presentation