Mesirow Private Equity

Mesirow Financial Private Equity Fund VIII-B, L.P.

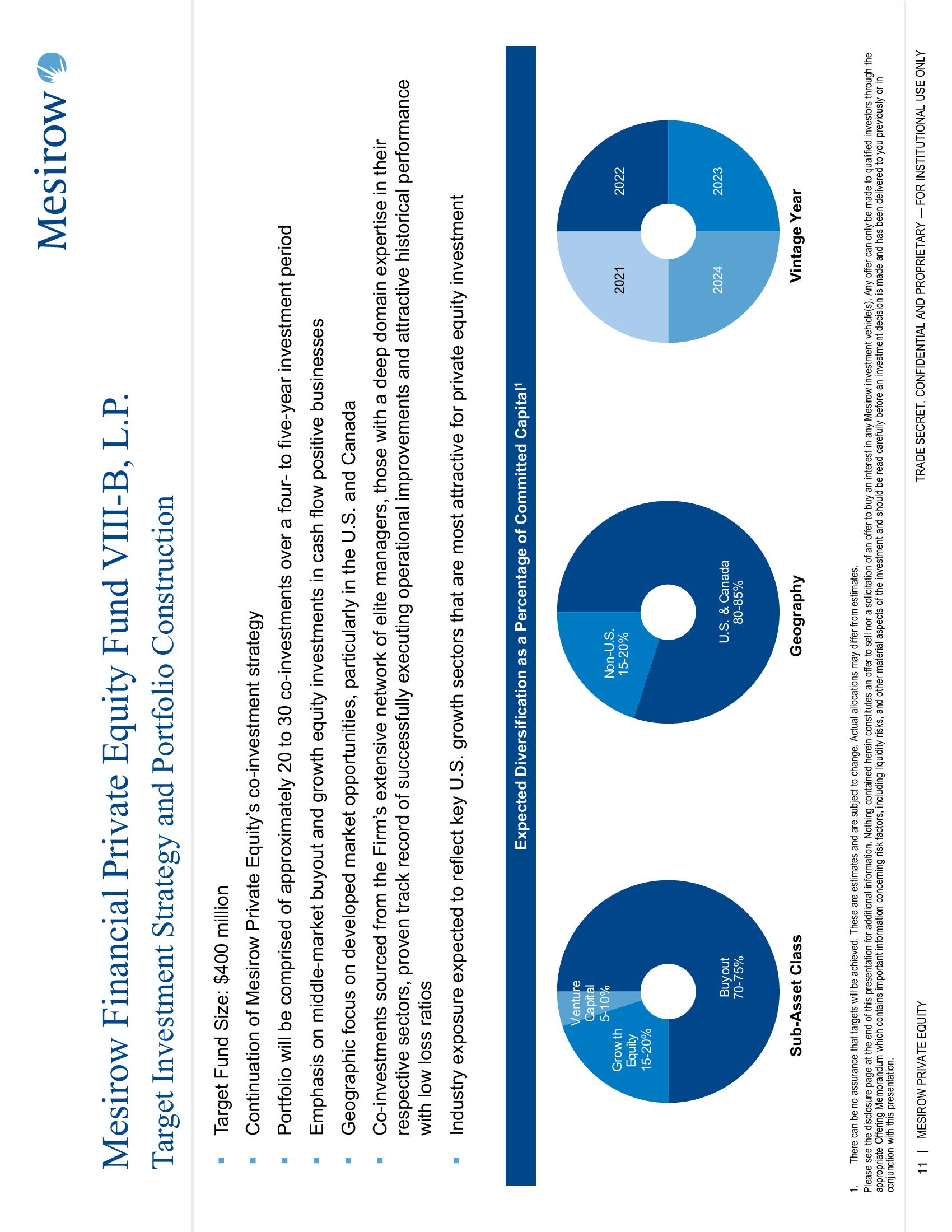

Target Investment Strategy and Portfolio Construction

I

■

Target Fund Size: $400 million

Continuation of Mesirow Private Equity's co-investment strategy

Portfolio will be comprised of approximately 20 to 30 co-investments over a four- to five-year investment period

Emphasis on middle-market buyout and growth equity investments in cash flow positive businesses

Geographic focus on developed market opportunities, particularly in the U.S. and Canada

Co-investments sourced from the Firm's extensive network of elite managers, those with a deep domain expertise in their

respective sectors, proven track record of successfully executing operational improvements and attractive historical performance

with low loss ratios

Industry exposure expected to reflect key U.S. growth sectors that are most attractive for private equity investment

Grow th

Equity

15-20%

Venture

Capital

5-10%

Buyout

70-75%

Sub-Asset Class

Expected Diversification as a Percentage of Committed Capital¹

Non-U.S.

15-20%

U.S. & Canada

80-85%

Geography

Mesirow

2021

2024

2022

2023

Vintage Year

1. There can be no assurance that targets will be achieved. These are estimates and are subject to change. Actual allocations may differ from estimates.

Please see the disclosure page at the end of this presentation for additional information. Nothing contained herein constitutes an offer to sell nor a solicitation of an offer to buy an interest in any Mesirow investment vehicle(s). Any offer can only be made to qualified investors through the

appropriate Offering Memorandum which contains important information concerning risk factors, including liquidity risks, and other material aspects of the investment and should be read carefully before an investment decision is made and has been delivered to you previously or in

conjunction with this presentation.

11 | MESIROW PRIVATE EQUITY

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation