Morgan Stanley Investment Banking Pitch Book

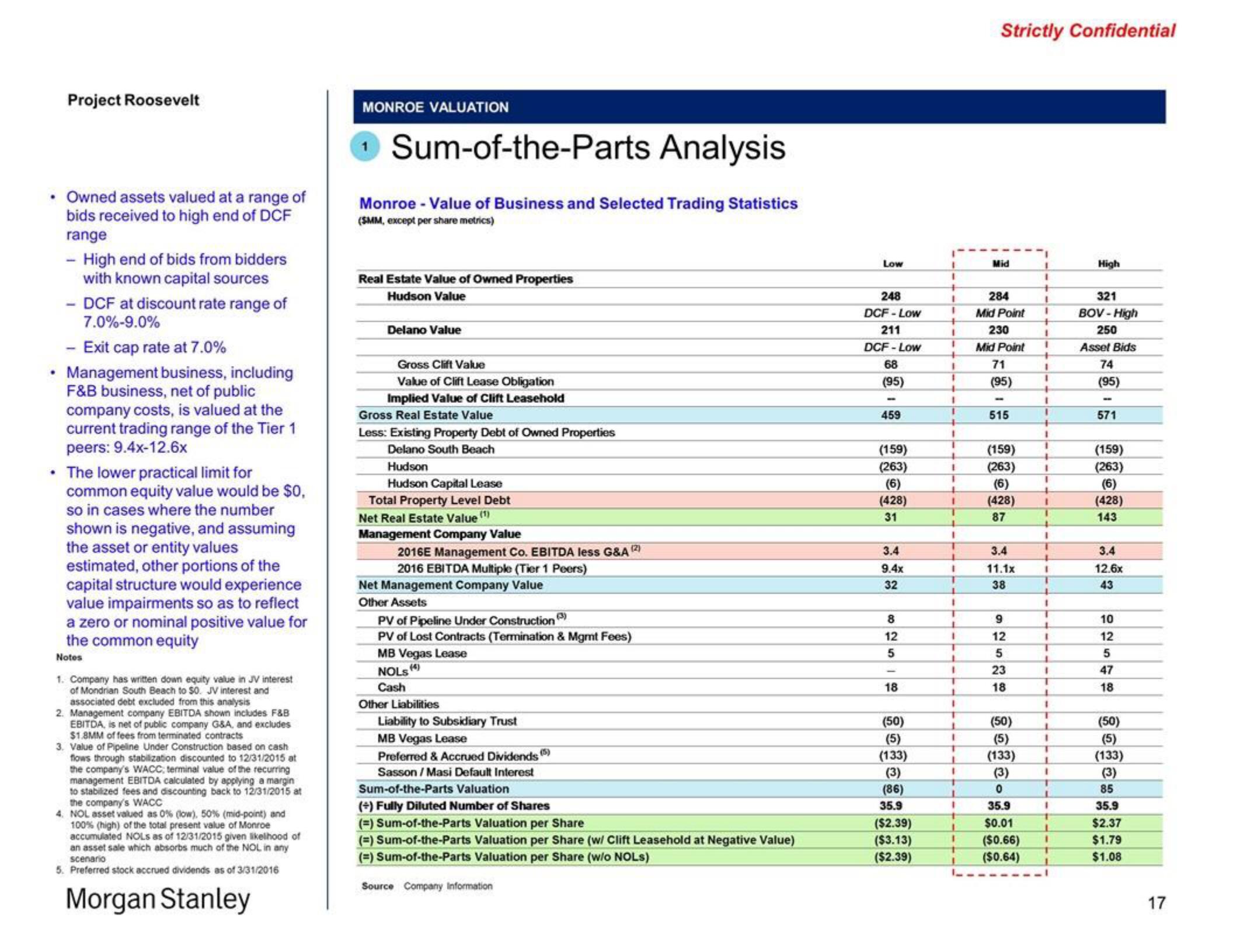

• Owned assets valued at a range of

bids received to high end of DCF

range

.

Project Roosevelt

.

- High end of bids from bidders

with known capital sources

- DCF at discount rate range of

7.0%-9.0%

- Exit cap rate at 7.0%

Management business, including

F&B business, net of public

company costs, is valued at the

current trading range of the Tier 1

peers: 9.4x-12.6x

The lower practical limit for

common equity value would be $0,

so in cases where the number

shown is negative, and assuming

the asset or entity values

estimated, other portions of the

capital structure would experience

value impairments so as to reflect

a zero or nominal positive value for

the common equity

Notes

1. Company has written down equity value in JV interest

of Mondrian South Beach to S0. JV interest and

associated debt excluded from this analysis

2. Management company EBITDA shown includes F&B

EBITDA, is net of public company G&A, and excludes

$1.8MM of fees from terminated contracts

3. Value of Pipeline Under Construction based on cash

flows through stabilization discounted to 12/31/2015 at

the company's WACC; terminal value of the recurring

management EBITDA calculated by applying a margin

to stabilized fees and discounting back to 12/31/2015 at

the company's WACC

4. NOL asset valued as 0% (low), 50% (mid-point) and

100% (high) of the total present value of Monroe

accumulated NOLS as of 12/31/2015 given likelihood of

an asset sale which absorbs much of the NOL in any

scenario

5. Preferred stock accrued dividends as of 3/31/2016

Morgan Stanley

MONROE VALUATION

Sum-of-the-Parts Analysis

Monroe - Value of Business and Selected Trading Statistics

(SMM, except per share metrics)

Real Estate Value of Owned Properties

Hudson Value

Delano Value

Gross Clift Value

Value of Clift Lease Obligation

Implied Value of Clift Leasehold

Gross Real Estate Value

Less: Existing Property Debt of Owned Properties

Delano South Beach

Hudson

Hudson Capital Lease

Total Property Level Debt

Net Real Estate Value (¹)

Management Company Value

2016E Management Co. EBITDA less G&A (2)

2016 EBITDA Multiple (Tier 1 Peers)

Net Management Company Value

Other Assets

PV of Pipeline Under Construction (3)

PV of Lost Contracts (Termination & Mgmt Fees)

MB Vegas Lease

NOLS (4)

Cash

Other Liabilities

Liability to Subsidiary Trust

MB Vegas Lease

Preferred & Accrued Dividends (5)

Sasson / Masi Default Interest

Sum-of-the-Parts Valuation

(+) Fully Diluted Number of Shares

(=) Sum-of-the-Parts Valuation per Share

(=) Sum-of-the-Parts Valuation per Share (w/ Clift Leasehold at Negative Value)

(-) Sum-of-the-Parts Valuation per Share (w/o NOLs)

Source Company Information

Low

248

DCF-Low

211

DCF-Low

68

(95)

459

(159)

(263)

(6)

(428)

31

3.4

9.4x

32

8

12

5

18

(50)

(5)

(133)

(3)

(86)

35.9

($2.39)

($3.13)

($2.39)

1

+

I

1

+

1

1

+

I

1

4

I

1

+

1

T

4

I

T

4

1

T

1

T

1

I

T

1

1

T

1

1

T

1

1

T

1

1

T

1

I

T

1

I

T

L

I

t

1

1

t

I

Strictly Confidential

Mid

284

Mid Point

230

Mid Point

71

(95)

515

(159)

(263)

(6)

(428)

87

3.4

11.1x

38

9

12

5

23

18

(50)

(5)

(133)

(3)

0

35.9

$0.01

($0.66)

($0.64)

I

I

I

I

1

+

1

1

+

1

1

+

I

1

1

1

+

I

1

+

I

T

1

T

4

T

4

I

T

J

I

T

L

1

T

1

1

T

1

I

T

L

I

1

I

1

High

321

BOV-High

250

Asset Bids

74

(95)

571

(159)

(263)

(6)

(428)

143

3.4

12.6x

43

10

12

5

47

18

(50)

(5)

(133)

(3)

85

35.9

$2.37

$1.79

$1.08

17View entire presentation