Bed Bath & Beyond Results Presentation Deck

Q2 2020 FINANCIAL RESULTS

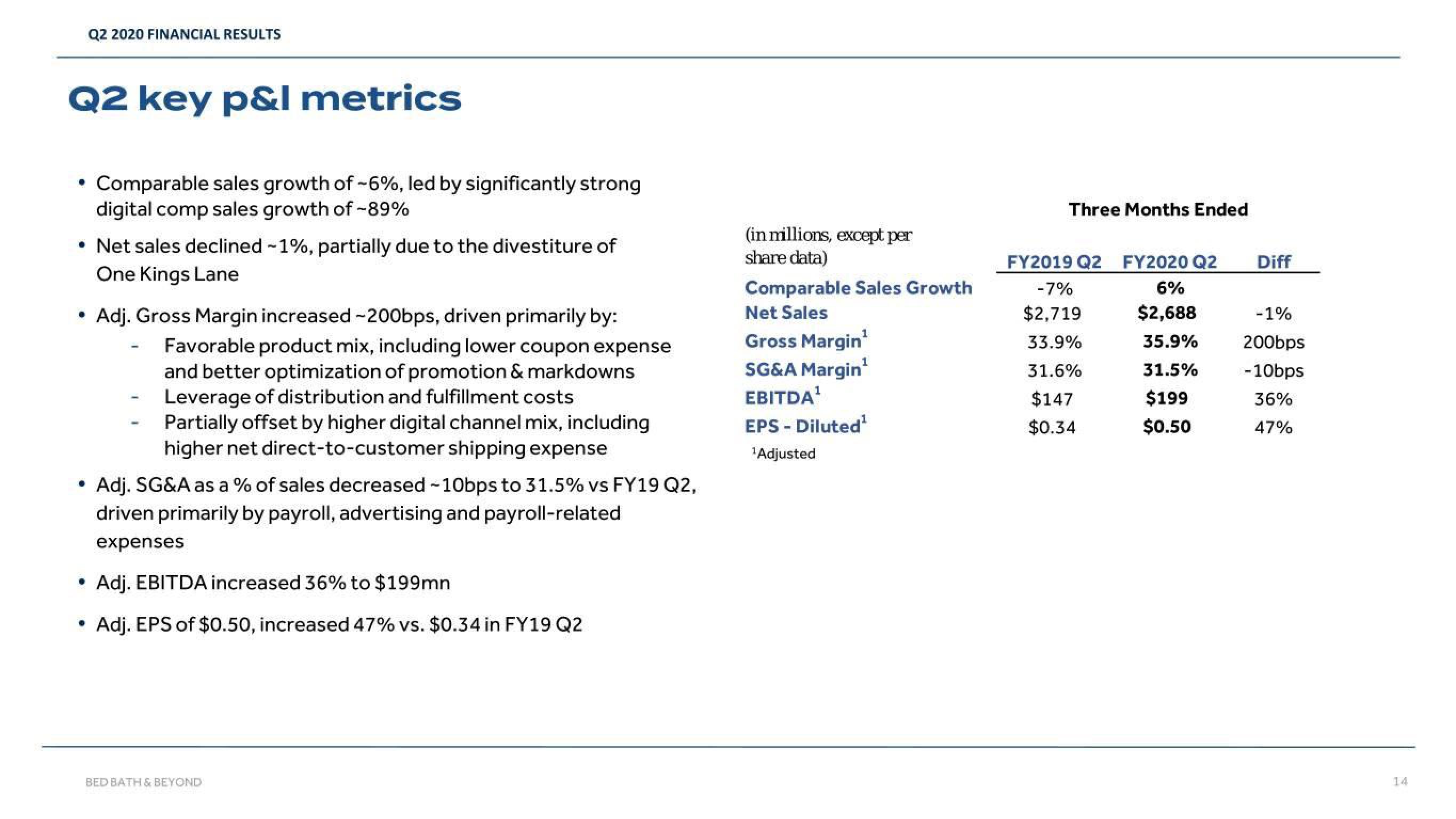

Q2 key p&l metrics

• Comparable sales growth of -6%, led by significantly strong

digital comp sales growth of -89%

• Net sales declined -1%, partially due to the divestiture of

One Kings Lane

.

Adj. Gross Margin increased ~200bps, driven primarily by:

Favorable product mix, including lower coupon expense

and better optimization of promotion & markdowns

Leverage of distribution and fulfillment costs

Partially offset by higher digital channel mix, including

higher net direct-to-customer shipping expense

-

Adj. SG&A as a % of sales decreased ~10bps to 31.5% vs FY19 Q2,

driven primarily by payroll, advertising and payroll-related

expenses

Adj. EBITDA increased 36% to $199mn

Adj. EPS of $0.50, increased 47% vs. $0.34 in FY19 Q2

BED BATH & BEYOND

(in millions, except per

share data)

Comparable Sales Growth

Net Sales

Gross Margin¹

SG&A Margin¹

EBITDA¹

EPS - Diluted¹

¹Adjusted

Three Months Ended

FY2019 Q2 FY2020 Q2

-7%

6%

$2,719 $2,688

33.9%

35.9%

31.6%

$147

$0.34

31.5%

$199

$0.50

Diff

-1%

200bps

- 10bps

36%

47%

14View entire presentation