Maersk Investor Presentation Deck

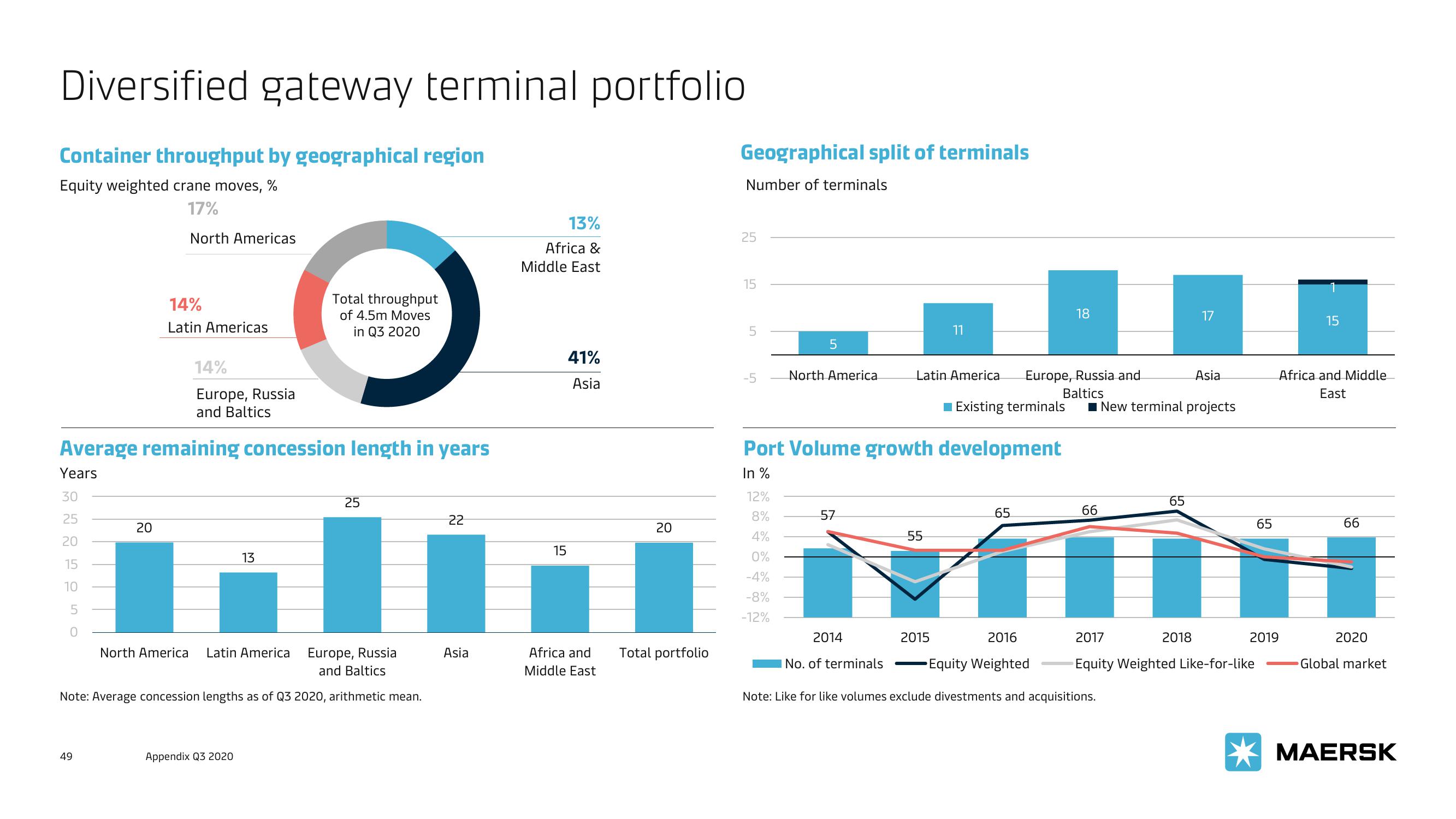

Diversified gateway terminal portfolio

Container throughput by geographical region

Equity weighted crane moves, %

17%

North Americas

SHOEDSO

30

Average remaining concession length in years

Years

25

20

15

10

5

0

14%

Latin Americas

20

49

14%

Europe, Russia

and Baltics

Total throughput

of 4.5m Moves

in Q3 2020

13

Appendix Q3 2020

North America Latin America Europe, Russia

and Baltics

Note: Average concession lengths as of Q3 2020, arithmetic mean.

25

22

Asia

13%

Africa &

Middle East

15

41%

Asia

Africa and

Middle East

20

Total portfolio

Geographical split of terminals

Number of terminals

25

15

5

-5

5

12%

8%

4%

0%

-4%

-8%

-12%

North America

Port Volume growth development

In %

57

2014

I No. of terminals

11

55

Latin America Europe, Russia and

Baltics

Existing terminals ■New terminal projects

2015

65

18

2016

Equity Weighted

66

65

Note: Like for like volumes exclude divestments and acquisitions.

17

2018

2017

Equity Weighted Like-for-like

Asia

65

2019

15

Africa and Middle

East

66

2020

Global market

MAERSKView entire presentation